Real estate has long been considered a lucrative investment option, offering the potential for stability and high returns. While traditional real estate investment methods have prevailed for years, a new player has emerged on the scene – real estate private equity firms.

These firms have gained significant popularity and are reshaping the industry with their innovative approaches. In this article, we will explore the rise of real estate private equity firms, understand why investors choose them, and delve into their operation and key players.

Whether you’re an experienced investor or just starting to learn about investing, this article will provide valuable insights into this exciting avenue.

What Are Real Estate Private Equity Firms?

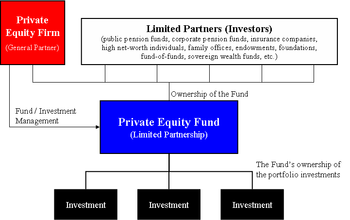

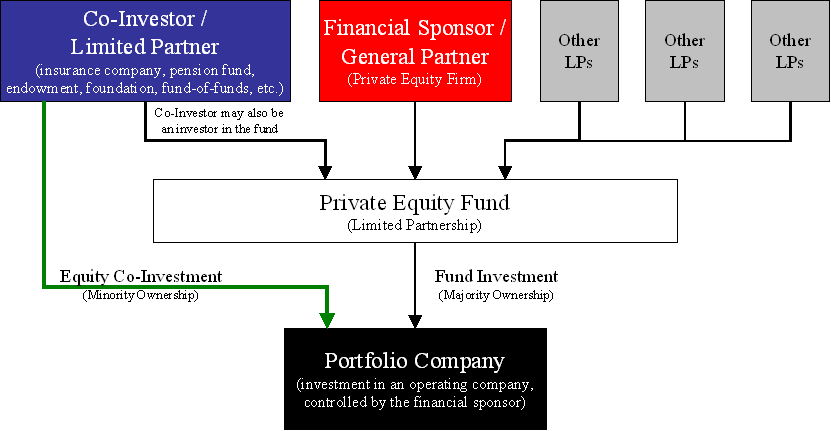

Real estate private equity firms are investment entities that pool capital from high-net-worth individuals, institutional investors, and other sources to invest in a variety of real estate properties.

Acting as intermediaries, these firms manage funds on behalf of investors, offering a more accessible way to diversify portfolios without the hassle of property ownership or day-to-day operations.

They play a crucial role in urban revitalization efforts and job creation by providing capital for property acquisition, development, and improvement projects within the real estate industry.

The Rise of Real Estate Private Equity Firms

Private equity investments in real estate have gained prominence due to increased institutional investor appetite for alternative investments, favorable economic conditions, and changing market dynamics.

Historically, the real estate industry was dominated by individual investors or small groups. However, the entrance of institutional investors, such as pension funds and insurance companies, has transformed the landscape of real estate private equity.

Several factors contribute to the growth and popularity of these firms:

-

Economic conditions and market trends: Favorable interest rates, stable economic growth, and increasing property values make real estate an attractive investment option. Private equity firms leverage their expertise to identify undervalued assets and unlock their potential value.

-

Increased demand for alternative investments: Traditional options like stocks and bonds have become more volatile and less reliable. Investors seek alternatives that offer higher potential returns and diversification. Real estate private equity firms provide access to a distinct asset class with unique risk-return characteristics.

-

Expertise in navigating complex markets: Private equity firms specializing in real estate possess deep knowledge and experience in identifying lucrative opportunities within dynamic markets. Their thorough due diligence, risk assessment, and successful investment strategies attract investors.

-

Enhanced access and diversification: Real estate private equity firms offer investors access to a wide range of assets across geographies, property types, and risk profiles. This diversification helps mitigate risks while benefiting from potential portfolio upside.

Why Investors Choose Real Estate Private Equity Firms

Investors choose real estate private equity firms for several reasons. These firms offer diversification and risk management by carefully selecting assets across different sectors and geographies, reducing exposure to market fluctuations.

They also provide access to professional expertise and networks, enabling thorough due diligence, favorable negotiations, and efficient property management. Additionally, real estate private equity investments historically deliver attractive risk-adjusted returns due to active asset management and value-add strategies.

Successful investments by these firms, such as renovating underperforming properties for significant profits, showcase their ability to generate substantial returns. Overall, investors are drawn to the potential benefits offered by real estate private equity firms: diversification, expertise, and higher returns compared to other investment options.

How Real Estate Private Equity Firms Operate

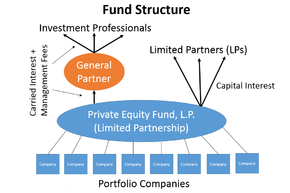

Real estate private equity firms raise funds through limited partnerships, with general partners managing the investments on behalf of passive limited partners. These firms employ different investment strategies based on risk appetite and market conditions.

Core strategies focus on stable income-producing properties, value-add strategies involve enhancing property value through improvements, and opportunistic strategies target distressed assets with potential for high returns. Understanding these processes is crucial for investors navigating the real estate private equity market.

Key Players in the Real Estate Private Equity Industry

Private equity firms play a significant role in real estate, providing capital and expertise to maximize returns. The industry is divided into major global players with diverse portfolios and niche-focused or regional firms specializing in specific sectors or regions.

Success stories of innovative firms inspire investors seeking industry leaders, showcasing their remarkable achievements through strategic investments and innovative approaches. These key players shape the global real estate investment landscape, offering opportunities for investors to align themselves with market-leading firms.

The Risks Associated with Investing in Real Estate Private Equity Firms

Investing in real estate private equity firms involves certain risks that investors should be aware of. These risks can be categorized into two main areas: market risks impacting real estate investments and specific risks associated with private equity funds.

Market risks include economic downturns, which can lead to declining property values and reduced investor returns. Additionally, regulatory changes affecting the real estate industry can impact market dynamics and affect investment profitability.

Specific risks associated with private equity funds include liquidity and lock-up periods. Investments often come with lock-up periods during which investors cannot access their capital. Real estate assets are also illiquid, limiting investors’ ability to sell their shares before the fund’s termination date.

Furthermore, there is performance risk and potential loss of capital. While private equity firms strive for superior returns, investments may underperform due to unforeseen market conditions or misjudgment by the firm’s management team.

To make informed investment decisions, it is important for investors to evaluate these risks carefully and conduct thorough due diligence on the track record and expertise of the private equity firm they are considering. By understanding and mitigating these risks, investors can navigate the complexities of real estate private equity successfully.

How to Evaluate Real Estate Private Equity Firms

When evaluating real estate private equity firms, consider factors such as the track record and experience of the management team, transparency and investor communication, alignment of investment strategy with personal goals, and conducting thorough due diligence.

Assessing past performance, expertise, and tenure of key personnel helps gauge a firm’s ability to deliver consistent returns. Look for transparent firms that provide regular updates on fund performance and investment decisions. Ensure their investment strategy matches your risk tolerance, return expectations, and investment time horizon.

Conducting due diligence allows for a deeper understanding of the risks and potential upside before making an informed investment decision.

| Factors to Consider When Selecting a Firm for Investment |

|---|

| 1. Track record and experience of the management team |

| 2. Transparency and investor communication |

| 3. Investment strategy alignment with personal goals |

| 4. Due diligence process: assessing risks and evaluating opportunities |

Conclusion

Investing in real estate private equity firms allows investors to diversify their portfolios, access professional expertise, and potentially achieve higher returns. However, it’s important to manage the risks involved.

Real estate private equity offers diversification benefits by reducing overall risk and enhancing potential returns. Partnering with experienced firms provides access to industry knowledge and investment opportunities not readily available to individuals. Conducting thorough due diligence is crucial before committing capital.

Caution is necessary when exploring real estate private equity investments due to market fluctuations, interest rate changes, liquidity constraints, regulatory changes, and unforeseen events. Balancing potential rewards with risk management strategies ensures a successful investment journey.

[lyte id=’Vw9zSFBKIyA’]