Investing is a powerful tool for wealth creation, but what if there was a way to amplify its impact? Enter leveraging credit. In this article, we will delve into the world of leveraging credit and explore how borrowing money can be used strategically to maximize investment returns.

Whether you’re a seasoned investor or just starting your journey, understanding the concept of leveraging credit can help you take your investments to new heights.

Understanding Leveraging Credit

Leveraging credit involves using borrowed money to invest, increasing potential gains. It allows investors to access funds beyond their capital and amplify investment power. By leveraging credit, investors can potentially enhance returns without committing all their own capital upfront.

The concept is simple: using other people’s money (OPM) to generate profits. Investors borrow funds at low rates, aiming for higher returns than the cost of borrowing. This strategy enables them to potentially earn more than if they solely used their own funds.

Benefits include portfolio diversification and risk reduction. However, caution is essential as leveraging credit carries higher risk. Thorough research, analysis, and disciplined financial management are crucial for success.

Understanding how to leverage credit effectively can maximize investment returns. When used prudently with proper risk management strategies, it offers opportunities for increased profitability and portfolio diversification. Approach leveraged investments with caution and conduct thorough analysis to minimize risks and optimize outcomes.

The Benefits and Risks of Leveraging Credit

Leveraging credit in investments has its advantages and risks. By using borrowed funds, investors can enhance potential returns and access larger investment opportunities. However, it also exposes them to the risk of greater losses if investments decline in value. Interest rate fluctuations can impact borrowing costs and profitability.

Careful analysis, risk management planning, and monitoring interest rates are crucial when leveraging credit in investments.

Assessing Your Financial Situation for Leveraging Credit

Before leveraging credit, it’s crucial to evaluate your creditworthiness and understand its importance. Lenders consider factors like credit history, income stability, debt-to-income ratio, and overall financial health when assessing creditworthiness.

A good credit score is significant as it opens doors to favorable borrowing terms and lower interest rates. Additionally, determining your risk tolerance and assessing personal financial stability are essential.

Evaluate comfort levels with debt and consider factors like income stability, financial goals, and ability to manage fluctuations in investment returns. Assess overall financial stability by considering emergency savings, existing debt obligations, and liquidity.

Thoroughly evaluating these aspects will help you make informed decisions about leveraging credit effectively while minimizing risks associated with leverage.

| Factors Considered by Lenders | The Significance of a Good Credit Score |

|---|---|

| Credit history | Opens doors to favorable borrowing terms and lower interest rates |

| Income stability | Demonstrates responsible financial behavior |

| Debt-to-income ratio | Increases chances of securing loans at competitive rates |

| Overall financial health | Shows ability to repay borrowed funds |

Remember to use leverage wisely and consider all aspects before making borrowing decisions.

Choosing the Right Investments for Leveraging Credit

To leverage credit effectively, it is crucial to select the right investments. Thorough research is essential to understand potential opportunities and associated risks. Diversifying across real estate, stocks, bonds, or starting a business helps spread risk.

Carefully evaluate each option’s benefits and risks based on your financial goals and risk tolerance. Seek guidance from financial advisors to navigate this complex landscape and make informed decisions.

In summary, choose investments wisely when leveraging credit. Research thoroughly, diversify across asset classes, and consider your financial goals and risk tolerance. Seek professional advice for informed decision-making.

Taking Advantage of Low-Interest Rates to Leverage Credit

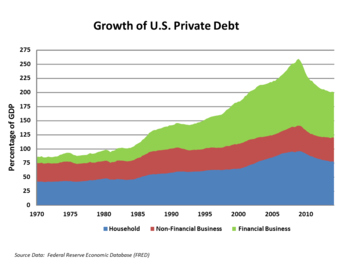

Low-interest rates offer a valuable opportunity to leverage credit effectively. During these periods, borrowing becomes more affordable, allowing investors to access cheap financing options that can potentially generate higher returns on investments.

One of the main benefits of borrowing during low-interest rate periods is the reduced cost of funds. With lower borrowing costs, individuals and businesses can secure loans at attractive rates, leading to decreased interest expenses and greater financial flexibility.

This enables them to allocate funds towards income-generating activities or strategic investments that have the potential for substantial returns.

However, it’s important to be aware of the risks associated with interest rate fluctuations. While taking advantage of low-interest rates is appealing, there is always the possibility that rates could rise unexpectedly. This could increase borrowing costs and impact investment profitability.

To mitigate these risks, strategies such as fixed-rate loans or hedging techniques should be considered. Fixed-rate loans lock in a specific interest rate for the loan term, protecting borrowers from future rate increases.

Hedging techniques involve using financial instruments like derivatives to offset potential losses caused by adverse interest rate movements.

By carefully considering these risks and implementing effective risk management strategies, individuals and businesses can navigate through periods of low-interest rates while leveraging credit wisely. This allows them to take advantage of favorable borrowing conditions and make informed investment decisions aligned with their financial goals.

Managing the Risks Involved in Leveraging Credit

To mitigate risks when leveraging credit, it’s crucial to establish a comprehensive risk management plan. This includes building an emergency fund for unforeseen circumstances and maintaining adequate insurance coverage for protection against potential losses.

Investors must also be aware of margin calls and liquidation risks, maintaining a safe margin level and having contingency plans in place to navigate market volatility successfully. By proactively managing these risks, individuals can minimize negative impacts while maximizing the benefits of leveraging credit.

Tips for Successful Leveraging Credit

When it comes to leveraging credit, there are several key tips that can help you navigate this financial strategy successfully. By starting with small investments and gradually increasing exposure, you can build confidence and gain valuable experience along the way.

This approach allows you to learn from any mistakes made early on and make adjustments as needed.

Regularly monitoring your investments and adapting to market conditions is another crucial aspect of successful leveraging credit. By staying informed about economic trends, industry developments, and changes that may impact your investment portfolio, you can make necessary adjustments to maximize your returns.

This active monitoring ensures that your strategies remain aligned with current market conditions.

Seeking professional advice when needed is highly recommended when it comes to leveraging credit. Given the complexity of this financial strategy, consulting with financial advisors or experts in leveraging credit can provide valuable insights tailored to your specific financial goals and risk tolerance.

They can help you understand the intricacies involved in leveraging credit and guide you towards making informed decisions.

In addition to these tips, it’s important to consider other factors such as maintaining a good credit score, managing debt responsibly, and diversifying your investment portfolio. These elements play a significant role in mitigating risks associated with leveraging credit.

By following these tips for successful leveraging credit, you can navigate this strategy more effectively while minimizing potential pitfalls. Remember, patience and discipline are key when venturing into leveraging credit. With careful planning and thoughtful execution, you can harness the power of leverage to achieve your financial goals.

Examples of Successful Leveraging Credit Strategies

Real-life case studies provide valuable insights into the effectiveness of leveraging credit strategies. Sarah, an investor, used borrowed funds to purchase multiple rental properties, diversifying her portfolio and generating substantial passive income.

Similarly, David, an entrepreneur with limited capital, leveraged credit to fund his startup’s development and marketing initiatives. These examples demonstrate how leveraging credit can create opportunities for growth and wealth accumulation. However, careful analysis and risk management are crucial when utilizing this strategy.

[lyte id=’a1MwAkYtYBE’]