Investing in leveraged oil services ETFs can be an exciting opportunity for those looking to maximize their returns in the oil services sector. But before diving into this investment strategy, it’s important to understand the basics of ETFs, leveraged ETFs, and the oil services industry itself.

Definition and Explanation of ETFs

An Exchange-Traded Fund (ETF) is an investment fund that trades on stock exchanges, offering a unique combination of convenience and flexibility. Unlike traditional mutual funds, ETFs are designed to track the performance of a specific index or sector while providing investors with the ability to trade them like individual stocks.

One of the key benefits of investing in ETFs is their diversification. By holding a basket of securities, such as stocks, bonds, or commodities, ETFs offer exposure to a wide range of assets within a single investment. This diversification helps to reduce risk by spreading it across multiple holdings.

In addition to diversification, ETFs are also known for their cost-effectiveness. Compared to actively managed mutual funds, which tend to have higher expense ratios due to the expertise required for stock selection and management, ETFs typically have lower fees.

This is because they passively track an index’s performance rather than relying on active management.

Transparency is another advantage offered by ETFs. The underlying holdings and their weightings are disclosed daily, allowing investors to have a clear understanding of what they own. This transparency enables investors to make informed decisions based on the composition and performance of the ETF.

Furthermore, ETFs provide liquidity by trading on stock exchanges throughout the trading day. Investors can buy or sell shares at market prices during regular trading hours, unlike mutual funds that are priced at the end of each business day.

Overall, ETFs combine the benefits of diversification, cost-effectiveness, transparency, and liquidity into one investment vehicle.

Whether you are looking for broad market exposure or targeting specific sectors or asset classes, ETFs offer a convenient way to achieve your investment goals while enjoying the flexibility and advantages associated with trading individual stocks.

Explanation of leveraged ETFs

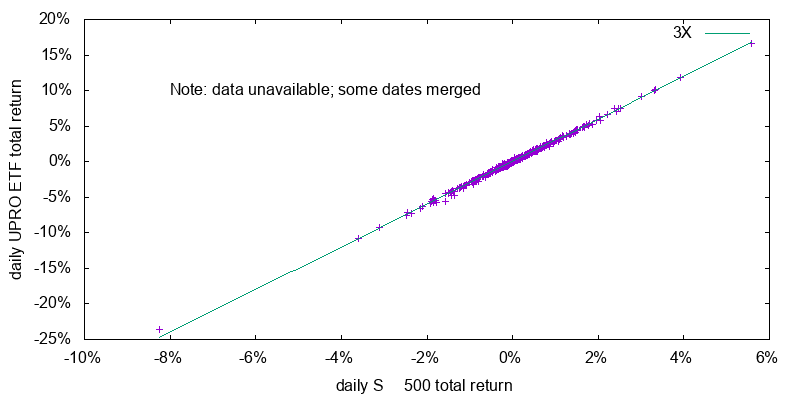

Leveraged ETFs use financial derivatives and debt to amplify the returns of an underlying index or sector. For example, a leveraged oil services ETF may aim to deliver twice the daily return of an oil services index. While this amplification can lead to higher returns, it also comes with increased risks and volatility.

Investors need to carefully evaluate their risk tolerance before considering these complex financial instruments. Thorough research and understanding are crucial for effectively managing the potential downsides associated with leveraged ETFs.

Introduction to the Oil Services Sector

The oil services sector is crucial for supporting oil and gas exploration, production, and transportation. It includes companies that provide services like drilling, maintenance, equipment rentals, and infrastructure development. Investing in this sector offers growth potential and diversification within the broader market.

Leveraged oil services ETFs provide attractive options for investors seeking higher returns and industry diversification. They amplify investment returns relative to an underlying index or benchmark. However, they also come with risks due to their complex nature and reliance on derivatives.

In summary, the oil services sector plays a vital role in the energy industry. Investing in it offers growth potential and diversification opportunities. Leveraged ETFs can provide amplified returns but require careful consideration of associated risks.

| Benefits of Investing in Leveraged Oil Services ETFs |

|---|

| – Amplified returns during positive market performance |

| – Exposure to price movements within the sector |

| – Diversification opportunities within the industry |

| – Potential for higher profits compared to traditional investments |

Higher Potential Returns Compared to Traditional Investments

Leveraged ETFs offer the potential for higher returns compared to traditional investments. By leveraging exposure to an underlying index or sector, these funds can generate amplified returns that are attractive to investors seeking quick gains or wanting to capitalize on short-term market trends.

This flexibility allows investors to take advantage of market volatility and make adjustments as needed. However, it’s important to note that with higher potential returns also come increased risks and volatility, so thorough research and risk assessment are essential before investing in leveraged ETFs.

Diversification Benefits within the Oil Services Industry

Investing in a leveraged oil services ETF allows investors to gain exposure to a diversified portfolio of companies operating within the industry. This diversification reduces the risk associated with investing in individual stocks by spreading investments across multiple companies and sub-sectors.

By avoiding overexposure to a single company or sector, investors can better navigate market fluctuations and take advantage of various growth opportunities. Additionally, diversification helps investors benefit from broader market trends and economic cycles, enhancing overall investment returns while minimizing volatility.

Exposure to the Growth Potential of the Oil Services Sector

Investing in a leveraged oil services ETF offers the opportunity to benefit from the growth potential of the oil services sector. As economies grow and energy consumption increases, the demand for exploration and production services rises.

By investing in a leveraged ETF, investors can capture a portion of this growth potential and take advantage of positive market dynamics. However, it’s important to carefully consider the risks involved, as leveraged ETFs can be volatile and may not be suitable for all investors.

Overall, exposure to the oil services sector through a leveraged ETF can be an attractive option for those seeking opportunities in the energy industry.

Volatility and Market Risks Associated with Leveraged Investments

Leveraged exchange-traded funds (ETFs) are financial instruments designed to deliver amplified returns on a daily basis. While they may seem attractive to investors seeking higher potential gains, it’s important to understand the inherent risks associated with these investments.

One key aspect of leveraged ETFs is their susceptibility to larger price swings and increased volatility compared to traditional investments. This means that even small fluctuations in the underlying assets can have a magnified impact on the fund’s performance.

As a result, investors must be prepared for potentially significant losses as well as gains.

Market conditions play a crucial role in determining the performance of leveraged ETFs. Economic downturns, for example, can lead to increased market volatility and uncertainty. During such periods, leveraged funds can experience even greater price swings due to heightened investor emotions and reactions.

Similarly, fluctuations in the price of commodities like oil can significantly impact these funds’ returns.

It’s essential for investors to carefully consider their risk tolerance before venturing into leveraged ETFs. These investments are not suitable for everyone and should only be considered by those who have a thorough understanding of the underlying assets and are willing to accept the potential downside risks.

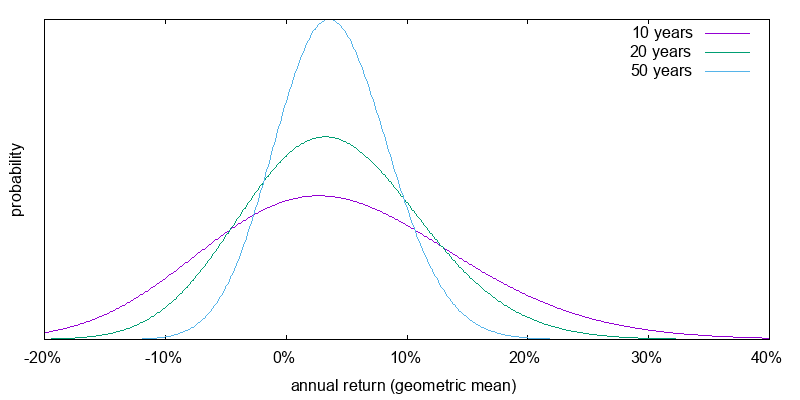

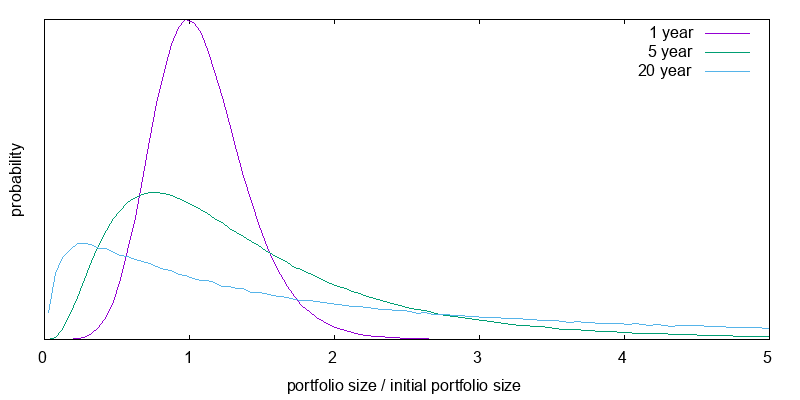

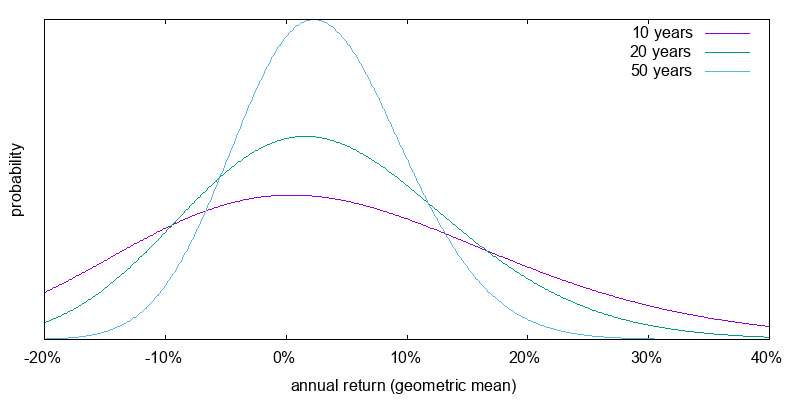

Decay and Compounding Effects on Long-Term Performance

Leveraged ETFs can experience decay over time due to their daily rebalancing mechanism. This decay is caused by the compounding effect, which leads to deviations from expected returns, especially in volatile markets or when asset prices frequently reverse direction.

While these effects can impact long-term performance, it’s important for investors to closely monitor their positions and consider their risk tolerance before investing in leveraged ETFs. Consulting with a financial advisor is advisable to make informed decisions based on individual circumstances.

[lyte id=’n4sxTkXkQIc’]