When it comes to investing, finding reliable sources for stock picks can be a game-changer. With so many options available, it’s important to weigh the pros and cons of each platform before making a decision. Two popular choices in the investing world are Zacks and The Motley Fool.

In this article, we will dive deep into their offerings and compare them head-to-head to help you determine if Zacks stock picks are good.

Overview: Zacks vs. Stock Advisor

When it comes to investment research platforms, Zacks and The Motley Fool’s Stock Advisor are two well-known names in the industry. These platforms cater to individual investors seeking expert insights to make informed decisions and identify potential market opportunities.

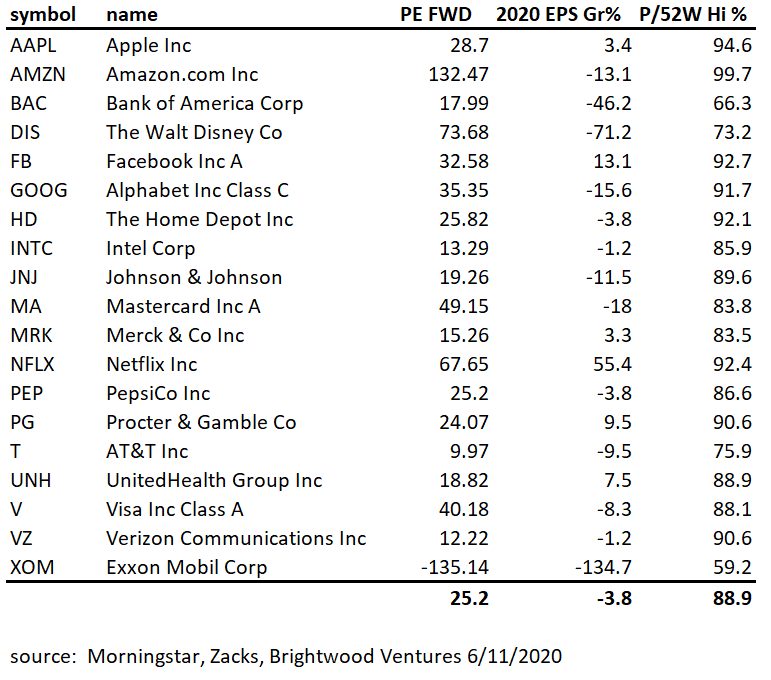

Zacks differentiates itself by focusing primarily on quantitative analysis, utilizing its proprietary rating system called the Zacks Rank. This system evaluates stocks based on a range of factors, including earnings surprises, analyst revisions, and other fundamental metrics.

By employing this approach, Zacks aims to pinpoint stocks that have the potential to outperform the overall market.

On the other hand, The Motley Fool’s Stock Advisor takes a distinct route by emphasizing qualitative analysis and long-term investing strategies. Their team of knowledgeable analysts conducts thorough research on companies and delivers comprehensive reports that highlight why they believe certain stocks possess strong growth potential.

While Zacks relies heavily on numbers and statistical data, The Motley Fool’s Stock Advisor places greater emphasis on understanding the underlying factors driving a company’s success.

By delving into qualitative aspects such as management competence, industry trends, competitive advantage, and growth prospects, this platform provides investors with a deeper understanding of the stocks they recommend.

Both Zacks and The Motley Fool’s Stock Advisor offer valuable resources for investors seeking guidance in their investment decisions. While Zacks’ quantitative approach may appeal to those who prefer a more data-driven analysis, The Motley Fool’s Stock Advisor provides a comprehensive view by considering both quantitative and qualitative factors.

Ultimately, choosing between these two platforms depends on an investor’s preferred style of analysis and investment goals. Some investors may find comfort in relying solely on numerical indicators, while others may appreciate the additional insights provided by delving into qualitative aspects.

About Zacks

Zacks Investment Research, a trusted player in the financial industry since 1978, has earned a commendable reputation for its comprehensive stock research offerings. With over three decades of experience, Zacks equips investors with an extensive range of tools and resources to make well-informed investment decisions.

At the heart of Zacks’ offerings lies their renowned Zacks Rank system. This unique feature assigns a ranking ranging from #1 (Strong Buy) to #5 (Strong Sell) to stocks, based on a thorough analysis of diverse financial metrics. The aim is to identify stocks that exhibit substantial upside potential or downside risk.

In addition to their highly-regarded ranking system, Zacks provides investors with an array of valuable resources. Their research reports offer insightful analysis and recommendations, while their stock screeners enable users to filter through thousands of stocks based on specific criteria.

Furthermore, Zacks offers educational resources designed to help investors navigate the complexities of the investment landscape.

For those seeking even more in-depth insights and features, Zacks Premium is a premium subscription service that provides real-time alerts and access to their top-rated stocks. This additional offering allows subscribers to stay ahead of market trends and make timely investment decisions.

With a steadfast commitment to providing reliable research and empowering investors, Zacks Investment Research continues to be at the forefront of delivering valuable tools and resources for individuals navigating the world of investing.

| Feature | Description |

|---|---|

| Zacks Rank | Assigns rankings (#1-#5) based on comprehensive analysis of financial metrics |

| Research Reports | Provides detailed analysis and recommendations for various stocks |

| Stock Screeners | Enables users to filter through thousands of stocks based on specific criteria |

| Educational Resources | Offers educational materials aimed at helping investors navigate the complexities of investing |

| Zacks Premium | A premium subscription service that provides real-time alerts and access to top-rated stocks |

About the Motley Fool

The Motley Fool, founded in 1993 by brothers David and Tom Gardner, is a well-known financial services company. They are renowned for their emphasis on individual stock picking and long-term investment strategies. Their flagship product, Stock Advisor, provides subscribers with two new stock picks each month, backed by thorough research reports.

The Motley Fool stands out by promoting long-term investing strategies over short-term gains. They encourage investors to think like business owners and hold stocks for extended periods to benefit from compounding returns.

In addition to Stock Advisor, they offer other subscription-based services like Rule Breakers (focusing on high-growth stocks) and Rule Your Retirement (providing retirement planning advice).

Zacks vs. Fool Summary and Conclusion

Is Investing in Motley Fool vs. Zacks Worth It?

When it comes to choosing between Motley Fool and Zacks Investment Research, the real question is whether their stock picks are worth it. While both platforms offer valuable insights and recommendations, investing in the stock market carries inherent risks. No platform can guarantee positive returns or eliminate the possibility of losses.

To make informed investment decisions, it’s crucial to conduct your own research, diversify your portfolio, and consider your individual financial situation. Utilizing services like Motley Fool or Zacks can be helpful tools, but they should not be relied upon solely.

Motley Fool focuses on long-term growth and strategic stock recommendations, while Zacks takes a data-driven approach using quantitative models. Choosing between them depends on personal preference and alignment with your investment goals.

[lyte id=’UrGXPclKTJg’]