Investing in royalties can be a unique and exciting way to diversify your investment portfolio. However, with the increasing popularity of online platforms offering royalty investments, it is important to carefully consider the legitimacy of these platforms. One such platform that has gained attention is Royalty Exchange.

In this article, we will explore what Royalty Exchange is, how it works, and evaluate its legitimacy as an investment platform.

What is Royalty Exchange?

Royalty Exchange is a marketplace where investors can buy or sell the rights to royalty streams from creative industries such as music, film, and television. Artists and creators have the option to sell their future earnings in exchange for an upfront payment.

The platform acts as an intermediary, allowing investors to browse through auctions and bid on the rights to receive future royalties. This provides artists with immediate funds and investors with opportunities to diversify their portfolios while supporting talented individuals in the entertainment world.

Buying or Selling the Rights to a Royalty Stream

Investing in royalties or selling the rights to a royalty stream can be lucrative and flexible. On Royalty Exchange, investors can choose from various asset types like music catalogs and publishing rights. Creators can sell their royalty streams for immediate capital.

The process involves listing an asset for auction, conducting due diligence, and participating in bidding. The highest bidder secures the rights to the royalty stream. Royalty Exchange offers a transparent marketplace for buyers and sellers, unlocking value from intellectual property assets and providing investment opportunities.

Auction Format for Investments

The auction format for investments, employed by Royalty Exchange, is designed to provide a transparent and competitive environment for investors. By utilizing this format, interested parties can assess the market value of royalty investments by analyzing bidding patterns and competing offers.

Not only does it allow for a fair evaluation of assets, but it also ensures that sellers receive fair market prices for their royalty streams.

One of the key benefits of the auction format is that it creates a level playing field for all participants, regardless of their investment size or experience. Unlike traditional methods, auctions offer equal opportunities to both small and large investors, enabling them to compete on an equal footing.

Additionally, auctions provide an opportunity for price discovery, allowing investors to potentially acquire assets at a lower cost compared to alternative investment methods.

However, it’s important to note that auctions can be highly competitive in nature. This competitiveness can drive up prices as investors vie against each other to secure valuable assets.

While this may benefit sellers who are looking to maximize their returns, it may limit opportunities for some investors who are unable or unwilling to engage in bidding wars.

In summary, the auction format for investments offered by Royalty Exchange brings transparency and competitiveness to the market. It allows participants to assess market value through bidding patterns and competing offers while ensuring fair prices for sellers.

Although auctions present opportunities for price discovery and equal participation, they can also lead to increased competition and potentially limited opportunities for certain investors.

Legitimacy of Royalty Exchange

When it comes to evaluating the legitimacy of any investment platform, there are several key factors that investors should consider. These factors play a crucial role in determining whether a platform is trustworthy and reliable. In the case of Royalty Exchange, it is evident that they meet these criteria for legitimacy.

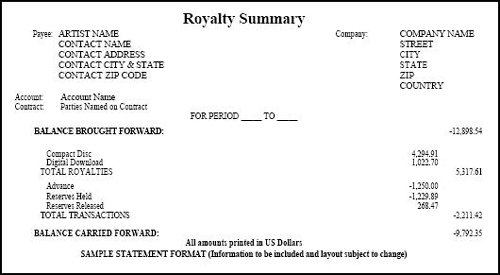

One essential factor is the transparency of operations and financials. Legitimate platforms should provide clear and detailed information about how they operate and their financial performance. Fortunately, Royalty Exchange does just that.

They offer comprehensive information about their operations, including details about their auction format and how royalties are bought and sold on their platform. Additionally, they provide transparent insights into their financials, giving investors confidence in their stability.

Another crucial aspect of legitimacy is legal compliance and regulatory oversight. Investors need to ensure that the platform they choose operates within the boundaries set by relevant laws and regulations. Royalty Exchange demonstrates its commitment to legality by complying with industry regulations and operating within legal frameworks.

This adherence adds credibility to the platform and assures investors that their investments are protected.

Positive user experiences and testimonials also contribute to a platform’s legitimacy. The feedback from buyers and sellers who have successfully transacted on Royalty Exchange speaks volumes about its credibility and reliability as an investment platform.

With numerous positive reviews, it becomes evident that users have had positive experiences with the platform, further solidifying its legitimacy.

In summary, Royalty Exchange proves itself to be a legitimate investment platform through its transparency in operations and financials, adherence to legal compliance and regulatory oversight, as well as positive user experiences highlighted through testimonials.

By meeting these key factors for legitimacy, Royalty Exchange establishes itself as a trustworthy option for investors seeking opportunities in royalty investments.

The Potential Benefits of Investing in Royalties through Royalty Exchange

Investing in royalties through Royalty Exchange offers diversification opportunities beyond traditional assets. It provides a chance to gain exposure to popular songs or artists, potentially earning passive income over time.

Previously limited to industry insiders and large institutions, Royalty Exchange democratizes access to exclusive investment opportunities, allowing individuals to participate in this once-restricted asset class.

Explore the enticing world of music royalties with diversification, passive income potential, and newfound accessibility through Royalty Exchange.

VI Risks Associated with Royalty Exchange Investments

Investing in royalty exchange platforms comes with certain risks that investors should be aware of and manage effectively. These risks include:

-

Counterparty Risk: There is a possibility that creators may not generate expected royalties or face financial difficulties, which can impact the investor’s returns.

-

Market Risk: Changes in consumer preferences or technological advancements can affect the value of royalty streams, potentially reducing investment earnings.

-

Timing Risk: The timing of royalty payments may not align with an investor’s short-term liquidity needs, requiring careful planning to meet financial obligations.

-

Liquidity Risk: Selling royalty assets may take time and could result in delays or limitations on accessing capital when needed, requiring investors to consider their liquidity requirements carefully.

-

Legal Risks: Intellectual property disputes or changes in copyright laws can impact the value of royalty streams, necessitating ongoing monitoring and legal guidance.

To mitigate these risks, investors should conduct thorough due diligence on creators, stay informed about market trends, diversify their portfolios, manage liquidity needs prudently, and stay updated on legal developments.

By taking proactive steps to address these risks, investors can protect their investment capital in the realm of royalty exchange investments.

VII Tips for Successful Investing in Royalties through Royalty Exchange

Investing in royalties through platforms like Royalty Exchange requires careful research, diversification, and realistic expectations. Here are seven tips to help you succeed:

- Thoroughly research potential assets before investing.

- Diversify your portfolio to mitigate risks.

- Set realistic expectations for returns and understand the long-term nature of these investments.

- Stay informed about industry trends that may impact royalty values.

- Seek professional advice if needed, especially if you’re new to royalty investing.

- Monitor and evaluate your investments regularly to identify underperforming assets or growth opportunities.

- Stay patient and committed for long-term success.

By following these tips, you can navigate the world of royalty investments with confidence and increase your chances of achieving successful outcomes through platforms like Royalty Exchange. Remember to stay informed, adapt your strategies as needed, and focus on your long-term goals for continued growth and prosperity.

Conclusion

In conclusion, Royalty Exchange is a legitimate platform for buying and selling royalty streams. It offers transparent operations, regulatory compliance, and positive user experiences, making it an attractive option for investors looking to explore the world of royalties as a unique investment avenue.

Investing in royalties through Royalty Exchange provides potential benefits such as diversification, passive income opportunities, and access to exclusive assets.

However, it is crucial for investors to carefully assess the associated risks by conducting thorough research, diversifying their portfolios, and setting realistic expectations for returns.

[lyte id=’11VKLgmTRLo’]