Investing in the stock market can be a complex and daunting task, especially when it comes to choosing the right stocks. With so many options available, it’s important to carefully evaluate each opportunity before making a decision. One industry that has gained significant attention in recent years is natural gas.

But is natural gas a good stock to buy? In this article, we will explore the natural gas market, discuss its investment potential, and provide insights on finding top natural gas stocks.

Overview of the Natural Gas Market

The natural gas market is a crucial part of the global energy landscape, offering a cleaner alternative to coal and oil. It is used for heating, electricity generation, and in various industries like petrochemicals. The market’s dynamics are shaped by supply and demand, geopolitics, and environmental concerns.

As countries shift towards cleaner energy sources, the demand for natural gas continues to grow, creating investment opportunities.

One trend in the industry is the rise of liquefied natural gas (LNG), which makes transportation easier and more cost-effective. This opens up new markets for exporters and investment prospects in infrastructure development and LNG shipping. Technological advancements like hydraulic fracturing have also unlocked previously inaccessible reserves.

In summary, the natural gas market offers attractive prospects due to its lower carbon emissions and increasing demand. The shift towards LNG and technological advancements further contribute to its growth potential.

What is Liquefied Natural Gas (LNG)?

Liquefied Natural Gas (LNG) refers to natural gas that has undergone a cooling process, transforming it into a liquid state. This conversion reduces its volume, making it more convenient for storage and transportation purposes. Unlike traditional pipeline transportation, LNG offers the advantage of flexible global trade.

The significance of LNG lies in its ability to meet the increasing demand for natural gas in regions without direct access to gas reserves or pipelines. By diversifying energy sources and reducing reliance on more polluting fuels, countries can address their energy needs sustainably.

Consequently, LNG has become an indispensable component of the global energy mix.

As we look ahead, the demand for LNG is projected to continue rising in the coming years. Several factors contribute to this growth, including population expansion, urbanization, and industrial development which drive up energy consumption worldwide.

Moreover, governments across the globe are implementing policies aimed at reducing carbon emissions, leading to a greater emphasis on cleaner energy alternatives such as natural gas.

Emerging economies with rapidly growing populations and increasing energy demands present particularly attractive investment opportunities within the LNG sector. As these nations strive to meet their energy needs sustainably, they will require significant infrastructure investments and partnerships with established industry players.

In summary, Liquefied Natural Gas (LNG) plays a vital role in addressing the growing demand for natural gas globally. Its transformation into a liquid state enables efficient storage and transportation while offering advantages over traditional pipeline systems.

With rising demand driven by factors like population growth and environmental concerns, investing in LNG presents promising opportunities for both countries seeking sustainable energy solutions and industry players looking to expand their presence in emerging economies.

Is Natural Gas a Good Investment?

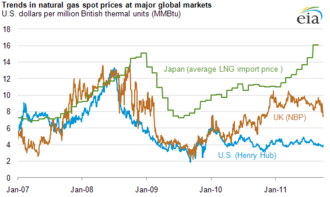

When considering the investment potential of natural gas, it’s important to analyze key factors that can impact its performance. Natural gas prices have experienced volatility due to weather patterns, geopolitical events, and shifts in supply and demand dynamics.

However, many experts believe that natural gas will play a significant role in the transition towards cleaner energy sources. Investing in natural gas stocks can provide exposure to this evolving industry and potentially offer attractive returns.

Factors to consider include supply and demand dynamics, geopolitical factors, environmental considerations, and technological advancements. By evaluating these factors, investors can make informed decisions about the investment potential of natural gas.

The Secret to Finding Top Natural Gas Stocks

To find top-performing natural gas stocks, it is crucial to conduct thorough research and analysis. Here are key strategies:

-

Fundamental Analysis: Evaluate financial health, growth prospects, and competitive advantages of natural gas companies. Look for strong balance sheets, solid management teams, and a track record of delivering value to shareholders.

-

Technical Analysis: Use chart patterns, trends, and indicators to identify buying or selling opportunities in natural gas stocks based on short-term price movements.

-

Industry Research: Stay updated with industry trends, news, and events that may impact the performance of natural gas stocks by following reputable sources.

Consider these factors when selecting investments:

-

Diversification: Spread investments across different types of natural gas assets like exploration & production companies, pipeline operators, or LNG exporters to mitigate risks associated with specific companies or segments.

-

Risk Tolerance: Assess your risk tolerance and align your portfolio accordingly as natural gas stocks can be volatile.

-

Long-Term Outlook: Consider the long-term demand for natural gas and its role in the global energy transition. Focus on companies positioned to adapt to changing market dynamics for sustainable returns.

By employing these strategies and considering key factors, investors can increase their chances of finding top-performing natural gas stocks that align with their investment objectives.

Natural Gas Stocks FAQ

Investing in natural gas stocks can be attractive for those interested in the energy sector. Here are some common questions and concerns:

Are natural gas stocks affected by oil prices?

While there is a correlation between oil and natural gas prices, they are influenced by different factors. Natural gas prices** depend on supply and demand dynamics within the market itself.

What impact does environmental regulation have on natural gas stocks?

Environmental regulations can both positively and negatively affect natural gas stocks**. Favorable regulations can increase demand, while stricter regulations may raise compliance costs for companies.

Here is some expert advice for potential investors:

Should I invest in individual natural gas stocks or ETFs?

This depends on your strategy and risk tolerance**. Individual stocks offer higher returns but carry higher risks. ETFs provide diversification but may limit upside potential.

**2.

How can I stay informed about developments in the natural gas industry? **

Stay updated through financial news outlets, industry publications, analyst reports, and company filings. Consider joining investor forums or attending energy sector conferences.

[lyte id=’_rKGW9T1FQM’]