Investing in the stock market is always filled with opportunities and risks. However, one sector that has been gaining significant attention in recent years is ion battery stocks. These stocks have experienced a remarkable surge in popularity, attracting investors from all walks of life.

In this article, we will explore the reasons behind the success of ion battery stocks, understand their significance in various industries, and discuss how investing in this sector can potentially lead to long-term growth.

Introduction to the Growing Popularity of Ion Battery Stocks

The demand for ion batteries has surged due to the global shift towards environmental sustainability and renewable energy sources. Ion batteries, which utilize ions to generate electrical energy, offer advantages such as high energy density, longer lifespan, and eco-friendliness.

Their popularity is driven by their role in powering electric vehicles and storing renewable energy. As the world prioritizes clean energy solutions, ion battery stocks present a compelling investment opportunity.

Understanding Ion Batteries and Their Significance

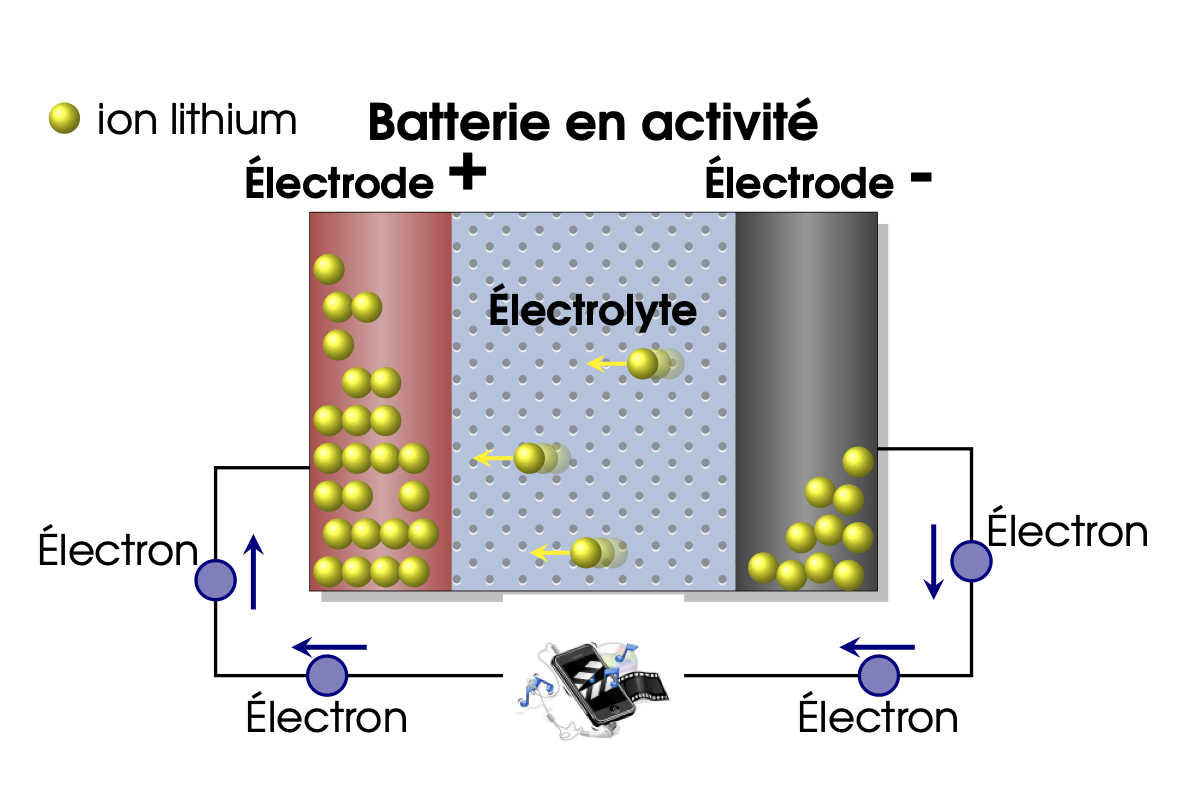

Ion batteries are highly sought after by investors due to their exceptional capabilities and diverse applications. These batteries consist of a cathode, an anode, and an electrolyte solution. During charging, ions move from the cathode to the anode, storing electrical energy. When discharging, this process reverses, releasing stored energy.

The significance of ion batteries extends beyond powering electronic devices. They play a crucial role in renewable energy storage systems, electric vehicles (EVs), portable electronics, and grid stabilization technologies.

Ion batteries enable the efficient storage of excess energy in renewables, power EVs for extended ranges, ensure long-lasting performance in portable electronics, and stabilize electrical grids.

In summary, ion batteries are essential components in various industries due to their ability to store and release electrical energy efficiently. From renewable energy to EVs and portable electronics, these batteries contribute to a sustainable and reliable future.

The demand for clean and sustainable energy sources is driving the growth of renewable energy technologies. As countries aim to reduce carbon emissions, efficient energy storage solutions become crucial. This is where ion batteries excel.

Ion batteries can store excess energy generated by solar and wind power, providing a reliable method for use during low generation or high demand periods. By overcoming the intermittent nature of renewable sources, ion batteries offer a viable alternative to conventional energy production methods.

Investing in ion battery stocks presents an opportunity in the energy sector. With governments worldwide supporting renewable energy adoption, there is a growing market for battery technologies. Companies specializing in ion battery manufacturing are experiencing increased demand, leading to potential stock value growth.

Ion Batteries and Electric Vehicles: A Perfect Match

The global shift to electric vehicles (EVs) has been significant, with ion batteries playing a pivotal role. EVs rely on ion batteries for power storage, emitting zero greenhouse gases.

Ion batteries offer advantages over traditional engines. They provide higher energy density, longer driving ranges, and faster charging capabilities. Additionally, they reduce air pollution and fossil fuel dependence. As governments encourage EV adoption, the demand for ion battery stocks soars.

With their technical benefits and environmental impact, ion batteries are a perfect match for EVs. Advancements in battery technology will further drive EV adoption, creating a cleaner transportation future.

Investing in Ion Battery Stocks for Long-Term Growth

Investing in ion battery stocks presents a lucrative opportunity for long-term growth. As the world shifts towards sustainable energy solutions, the demand for these batteries has surged across various sectors.

Key players in the industry include Tesla Inc., known for its electric vehicles and advanced lithium-ion battery production; Panasonic Corporation, with its strategic partnership with Tesla; Samsung SDI Co., Ltd., a leading manufacturer of lithium-ion batteries; BYD Co., Ltd., specializing in electric vehicles and energy storage solutions; Albemarle Corporation, a global producer of lithium; and QuantumScape Corporation, an innovative solid-state battery technology company.

Analyzing factors like revenue growth, market share, R&D efforts, and partnerships can help investors make informed decisions about investing in this promising sector.

| Company Name | Key Highlights |

|---|---|

| Tesla Inc. | Leader in electric vehicles and clean energy solutions |

| Panasonic Corporation | Partnered with Tesla for battery cell supply |

| Samsung SDI Co., Ltd. | Leading manufacturer of advanced lithium-ion batteries |

| BYD Co., Ltd. | Chinese manufacturer focused on EVs and energy storage |

| Albemarle Corporation | Global specialty chemicals company producing lithium |

| QuantumScape Corporation | American solid-state battery technology company focused on advanced energy storage |

Risks and Challenges Associated with Ion Battery Stocks

Investing in ion battery stocks comes with risks and challenges. Market volatility can impact stock prices, especially in emerging industries like ion batteries. Competition among manufacturers leads to pricing pressures and reduced profit margins.

Regulatory challenges arise as governments implement policies related to environmental standards and safety requirements. Technological advancements may render current battery technologies obsolete. Supply chain disruptions and macroeconomic factors can also affect ion battery stocks.

Tips for Investing in Ion Battery Stocks Wisely

Investing in ion battery stocks requires careful consideration. Here are some tips to help you make wise investment decisions:

Research the company’s track record in innovation, product quality, and customer satisfaction. Look for partnerships with established EV manufacturers or renewable energy companies.

Understand the potential risks and rewards. Be prepared for market fluctuations and competition, despite significant growth potential.

Analyze the current demand for ion batteries across industries like automotive and energy storage. Consider the future outlook of ion batteries, including research advancements.

Diversify your investment portfolio by including other renewable energy or EV-related companies. Seek professional guidance from financial advisors familiar with the ion battery market.

By following these tips, you can invest wisely in ion battery stocks and contribute to sustainable energy solutions.

Expert Insights on Ion Battery Stock Investments

Investing in ion battery stocks presents promising opportunities within the growing sector. We interviewed an industry expert who shared valuable insights into the future prospects, technological advancements, and potential investment opportunities in this field.

The expert emphasized the rising demand for ion batteries due to the global shift towards sustainable energy solutions. Factors such as government initiatives, technological advancements, and increasing consumer awareness contribute to this demand surge.

Technological advancements play a significant role in improving ion battery performance and efficiency. Constant innovations in battery chemistry and manufacturing processes result in longer-lasting batteries with higher energy densities.

Investors should consider both established companies and innovative startups when exploring investment opportunities. Established players offer stability, while startups bring disruptive technologies that can revolutionize the industry.

Key indicators to consider include research and development efforts, partnerships with major manufacturers or automakers, regulatory support from governments, and market trends.

By staying informed and analyzing investment opportunities within the ion battery market, investors can position themselves to benefit from its growth.

[lyte id=’msPIWuxKKUg’]