The world is rapidly evolving, with technology playing a pivotal role in shaping our lives. One of the most exciting developments in recent years has been the rise of the Internet of Things (IoT). This interconnected network of devices and objects is revolutionizing various industries, from healthcare to manufacturing.

As an investor, understanding and capitalizing on this trend can lead to significant opportunities for growth. In this article, we will explore the world of IoT investments and how Exchange-Traded Funds (ETFs) can help you tap into its potential.

Understanding the Internet of Things (IoT)

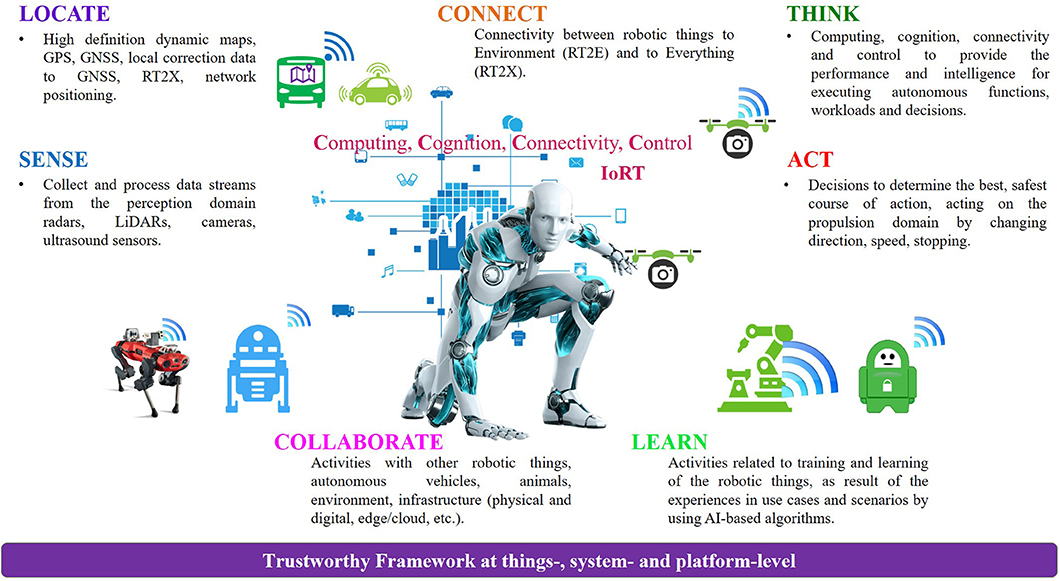

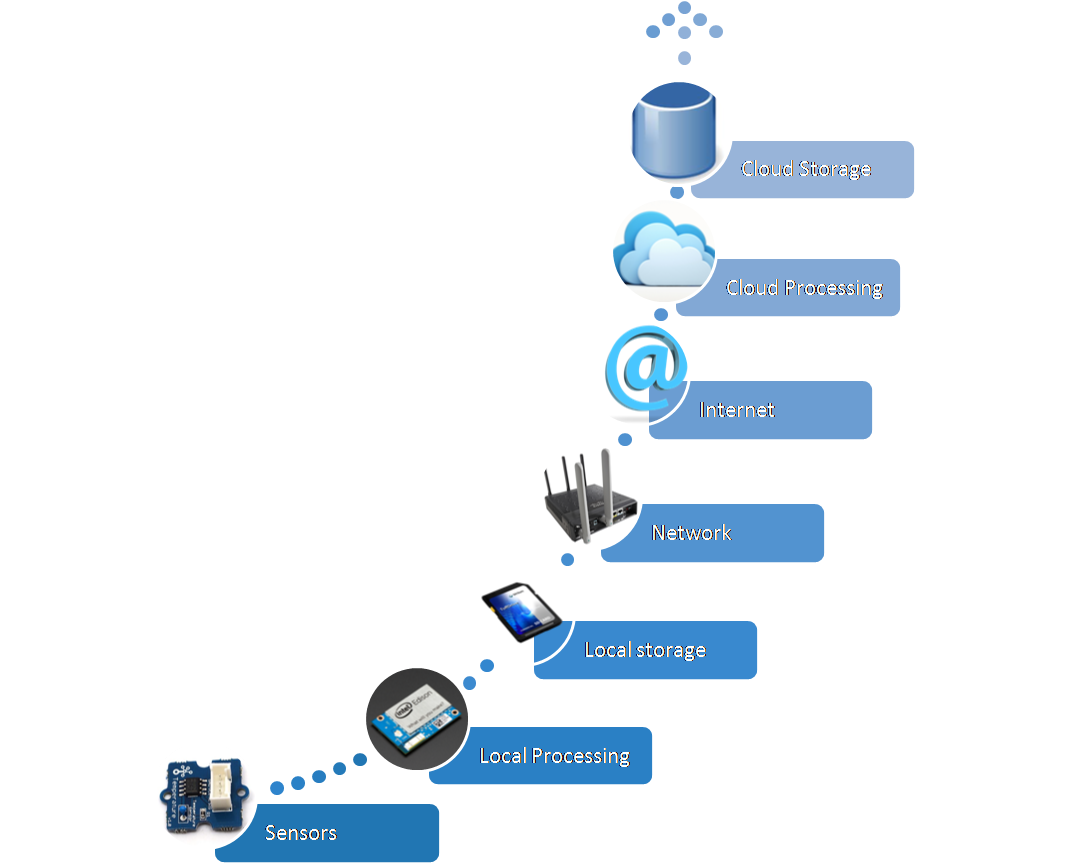

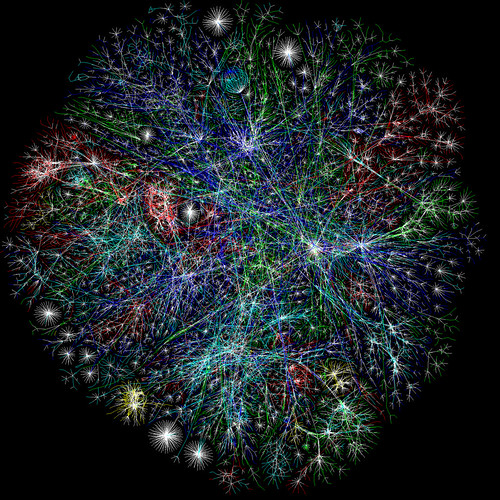

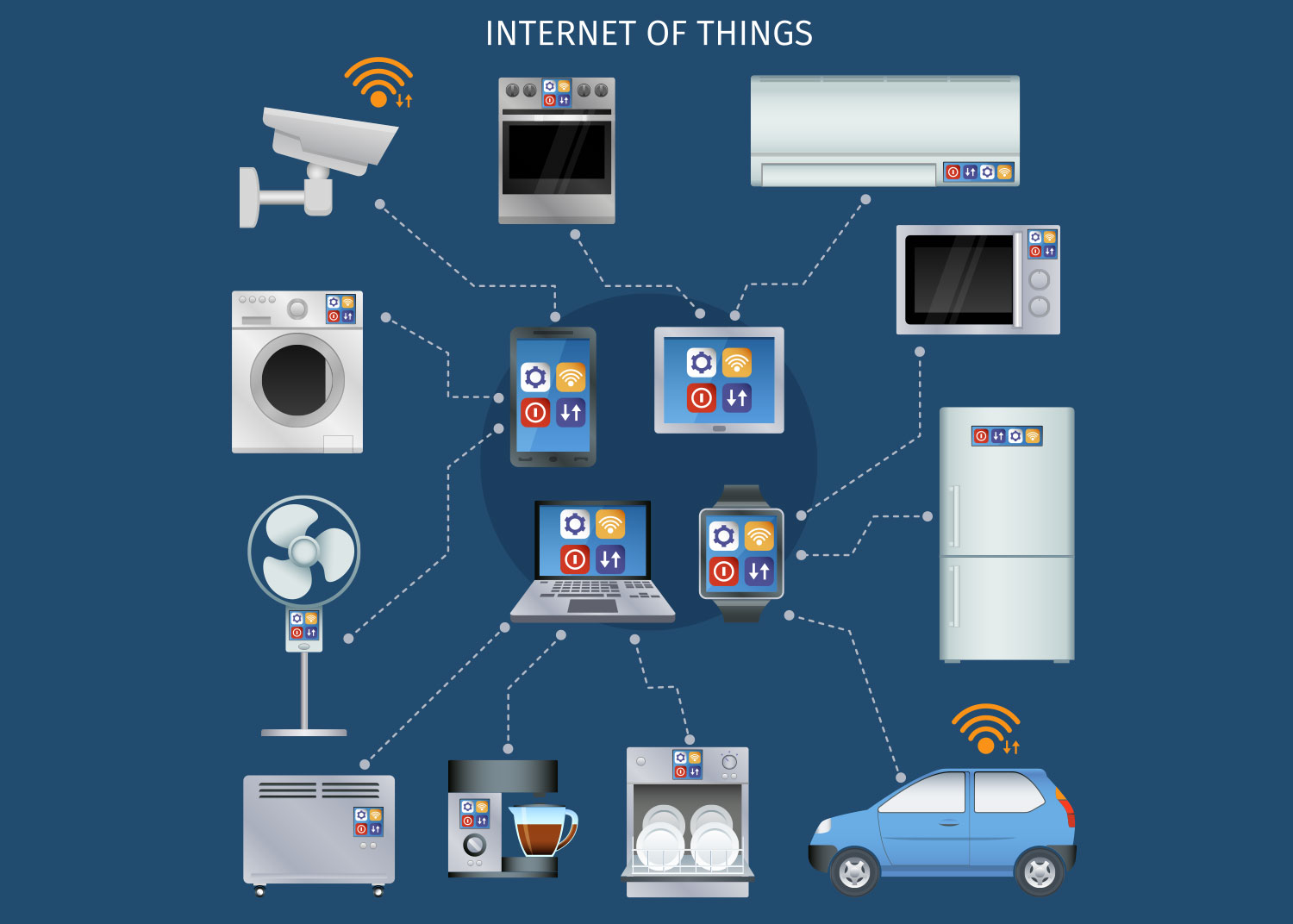

The Internet of Things (IoT) has transformed our lives by connecting physical objects with sensors and software, enabling them to collect and exchange data seamlessly. From controlling our homes through smartphones to wearable devices that monitor our health, IoT is now an integral part of daily life.

IoT offers immense growth potential for businesses and investors. Global spending on IoT is projected to reach $1.1 trillion by 2025, driven by advancements in connectivity, cloud computing, and artificial intelligence. Industries are embracing IoT for improved efficiency and productivity, making it an attractive sector for investment.

With IoT, healthcare providers can remotely monitor patients’ vital signs and agriculture can optimize crop yields through automated irrigation systems. The applications of IoT span across sectors like manufacturing, transportation, and retail.

Understanding the impact of IoT is crucial in today’s technologically driven world. It brings convenience to our homes and transforms industries, offering endless opportunities for innovation and growth. Staying informed about its capabilities will be key for individuals, businesses, and investors looking to leverage this groundbreaking technology.

Introduction to Exchange-Traded Funds (ETFs)

Exchange-Traded Funds (ETFs) have become increasingly popular investment vehicles in recent years. These funds are traded on stock exchanges and aim to track the performance of a specific index or sector.

Unlike traditional mutual funds, ETFs offer greater flexibility as they can be bought and sold throughout the trading day, just like individual stocks. This liquidity and transparency make ETFs an appealing choice for investors.

One of the key benefits of investing in ETFs is the instant diversification they provide. By including a basket of securities within a specific industry or theme, such as IoT, ETFs allow investors to spread their investments across multiple companies within that sector.

This diversification helps mitigate risk while still allowing investors to participate in the potential growth of the sector.

In addition to diversification, ETFs often have lower expense ratios compared to actively managed funds. This means that investors can enjoy cost-effective investment options while still gaining exposure to a particular industry or theme. Lower expenses can lead to higher overall returns for investors.

Furthermore, ETFs offer transparency and real-time pricing information due to their ability to be traded throughout the day. Investors can easily see the current market value of their holdings and make informed decisions about buying or selling shares.

Overall, Exchange-Traded Funds (ETFs) are an attractive investment option for individuals interested in gaining exposure to specific sectors or themes like IoT.

With their flexibility, diversification benefits, lower expenses, and transparent pricing, ETFs provide a compelling alternative to traditional mutual funds for those looking to invest in targeted areas of the market.

| Advantages of Investing in ETFs |

|---|

| – Instant diversification |

| – Lower expense ratios |

| – Transparency |

| – Real-time pricing information |

Note: The table above summarizes some advantages of investing in ETFs for easier readability.

Investing in the Internet of Things

Investing in the Internet of Things (IoT) offers significant opportunities for investors. The demand for smart devices and connected technologies is skyrocketing, presenting lucrative prospects. IoT has the potential to revolutionize industries by streamlining processes and improving efficiency. However, there are challenges and risks to consider.

Cybersecurity vulnerabilities increase with interconnected devices, and rapid technological advancements can make products obsolete quickly. Staying updated on market trends is crucial. By carefully evaluating opportunities and risks, investors can navigate the IoT sector with confidence and maximize long-term success.

Exploring Internet of Things ETFs

Internet of Things (IoT) ETFs are investment funds that focus on companies involved in developing or utilizing IoT technologies. These funds provide investors with a diversified portfolio of stocks from various industries, such as technology, telecommunications, and manufacturing.

By investing in IoT ETFs, individuals can gain exposure to the entire IoT ecosystem rather than relying on individual stock picks.

Some notable players in the IoT market include Amazon, Google, Qualcomm, and Cisco Systems. These industry giants are often represented in popular IoT-focused ETFs like the XYZ ETF and ABC ETF.

Investing in IoT-focused ETFs offers several benefits, including diversification across multiple companies within the IoT space, low expense ratios compared to actively managed funds, and access to professional management expertise.

As technology continues to advance and the IoT ecosystem expands, investing in IoT ETFs may prove to be a lucrative strategy for those looking to capitalize on this transformative technology.

Top Internet of Things ETFs to consider

Investing in the Internet of Things (IoT) can be a lucrative opportunity for investors looking to tap into the growth potential of connected devices and data-driven technologies. Two notable ETF options are the XYZ ETF, which focuses on smart home technology, and the ABC ETF, which targets industrial automation and connectivity.

The XYZ ETF offers exposure to companies in smart home automation, security solutions, and energy management. Meanwhile, the ABC ETF includes major players in robotics, artificial intelligence, and data analytics. Both funds provide balanced exposure to different aspects of the IoT sector.

By investing in these top IoT-focused ETFs, investors can position themselves for long-term growth and benefit from transformative changes driven by IoT advancements.

Successful IoT Investments through ETFs: Case Studies

Investing in the Internet of Things (IoT) has become increasingly popular, and one avenue that investors are exploring is IoT-focused Exchange-Traded Funds (ETFs). These funds offer a diversified portfolio of companies involved in the IoT sector.

One successful example is Company X, which developed innovative IoT solutions for precision agriculture. This led to cost savings and increased yields for farmers, benefiting investors who had exposure to the IoT sector through relevant ETFs.

Another promising investment area is wearable technology, with devices like smartwatches and fitness trackers gaining popularity. By investing in an IoT-focused ETF that includes wearable tech companies, investors can tap into this growing industry.

Analyzing specific companies’ performance within these ETFs helps make informed investment decisions and maximize returns. Successful case studies highlight the potential and opportunities within IoT investments through ETFs, providing investors with a way to benefit from the growth of the Internet of Things.

Considerations before investing in Internet of Things ETFs

Before investing in IoT-focused ETFs, there are a few key factors to consider. First, evaluate the expense ratios, which are the annual fees charged by the fund. Lower expense ratios can have a significant impact on your investment returns over time.

Next, consider the liquidity of the ETF. This refers to how easily shares can be bought or sold without affecting their price. Opting for highly liquid ETFs ensures smooth entry and exit from positions.

Trading volume is also important to assess. Higher trading volumes indicate greater market interest and increased liquidity, making it easier to execute trades efficiently.

Additionally, it is crucial to assess the risks associated with specific funds. Concentration risk measures the exposure an ETF has to a particular company or industry within the IoT sector. Choosing a well-diversified fund can help mitigate this risk.

Lastly, correlation risk should be considered. It reflects how closely an ETF tracks its underlying index. Understanding correlation risk helps gauge whether an ETF’s performance accurately reflects its benchmark index.

By evaluating these factors – including expense ratios, liquidity, trading volume, concentration risk, and correlation risk – you can make informed decisions when investing in IoT-focused ETFs that align with your financial goals and preferences.

Strategies for Maximizing Returns on IoT Investments

To maximize returns in the IoT sector, diversify your portfolio with multiple IoT-related ETFs. This spreads out risk and allows exposure to various sub-sectors within IoT. Regularly reviewing and rebalancing investments is essential as the market is dynamic.

By assessing ETF performance, making adjustments, and capitalizing on emerging opportunities, you can stay ahead of trends and optimize returns.

| Strategies for Maximizing Returns on IoT Investments |

|---|

| 1. Diversify portfolio with multiple IoT-related ETFs |

| 2. Regularly review and rebalance investments |

[lyte id=’zbMFjCOSnXU’]