When investing in Vanguard funds, having trusted advice is crucial. Independent advisers provide unbiased recommendations based on their clients’ best interests. They customize investment strategies to align with individual goals and risk tolerance.

These professionals offer a range of services such as portfolio management, retirement planning, and tax optimization strategies. By working with an independent adviser, Vanguard investors can expect personalized guidance and ongoing monitoring to maximize returns.

Choosing the right adviser involves considering qualifications, experience, reputation, and communication style. Ultimately, independent advisers play a vital role in helping investors make informed decisions and achieve long-term success.

Explaining the Value of Investment Advice from Independent Advisers

Independent advisers bring extensive knowledge and experience to investing in Vanguard funds. They understand market trends, fund performance, and asset allocation strategies, providing valuable insights to optimize investment portfolios.

Additionally, they offer personalized advice tailored to each individual’s financial situation and goals, considering factors like risk tolerance and time horizon. This customized approach ensures that investors receive advice aligned with their unique circumstances.

Independent advisers also act as a buffer against emotional decision-making and stay updated on industry research and developments. Overall, their expertise enhances the investment experience and helps investors achieve their financial goals.

Our Approach to Investing

At [Company Name], we pride ourselves on our unique approach to investing for Vanguard investors. We believe that successful investment strategies are built on a foundation of long-term growth and risk management.

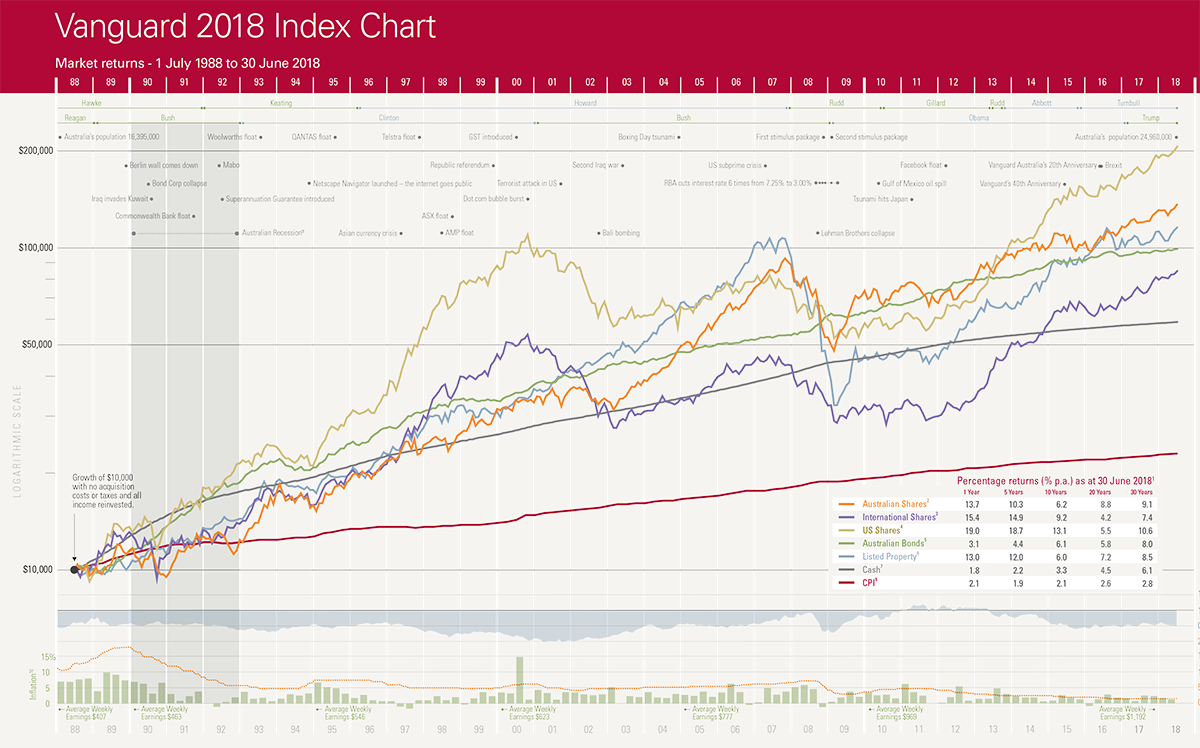

Central to our philosophy is the concept of diversification. We advocate for a well-balanced and diversified portfolio that includes a mix of Vanguard funds across various asset classes. By spreading our investments across different sectors and regions, we aim to minimize risk while maximizing potential returns.

To ensure that our clients’ portfolios remain aligned with their investment objectives, we emphasize disciplined rebalancing and regular portfolio reviews. We closely monitor market conditions and make adjustments accordingly. This proactive approach allows us to take advantage of opportunities as they arise and protect against potential downturns.

Our team of expert advisors understands the importance of staying informed about market trends, economic indicators, and global events that can impact investment performance. Through thorough research and analysis, we provide our clients with valuable insights that help guide their investment decisions.

Transparency is another key aspect of our approach to investing. We believe in keeping our clients well-informed about their investments, providing them with regular reports and updates on portfolio performance. This open communication ensures that our clients have a clear understanding of their investment strategy and can make informed decisions.

In summary, at [Company Name], we have developed an approach to investing for Vanguard investors that prioritizes long-term growth, risk management, diversification, disciplined rebalancing, proactive monitoring, expert insights, and transparency.

With these principles at the core of what we do, we strive to help our clients achieve their financial goals while navigating the ever-changing landscape of the investment world.

Table:

| Key Features |

|————–|

| Long-term growth |

| Risk management |

| Diversification |

| Disciplined rebalancing |

| Proactive monitoring |

| Expert insights |

| Transparency |

How We Work with You

At [Company Name], we believe in fostering a collaborative approach when working with our clients. Our aim is to provide personalized investment strategies that align with each client’s unique financial situation, goals, and risk tolerance.

To begin, we conduct an in-depth analysis of our clients’ financial circumstances. This includes a thorough examination of their current assets, liabilities, income, and expenses. By understanding these details, we can develop a holistic view of their financial picture and tailor our services accordingly.

Once we have gathered all the necessary information, we work closely with our clients to create a customized investment plan. This plan takes into account their long-term objectives, such as retirement planning or funding educational expenses. It also considers their short-term goals and any specific preferences they may have.

Throughout our partnership, we provide ongoing support and guidance to ensure our clients stay on track towards achieving their financial aspirations. Regular portfolio reviews are conducted to assess performance and make any necessary adjustments based on market trends or changes.

Our proactive communication keeps clients informed about any developments that may impact their investments.

Transparency is a core value at [Company Name]. We believe it is essential for clients to have complete visibility into their portfolios. That’s why we provide detailed reports that outline portfolio holdings, performance metrics, and associated fees.

These reports are easily accessible so that clients can make informed decisions about their investments.

In summary, at [Company Name], our collaborative approach ensures that each client receives personalized attention and tailored investment strategies. We prioritize open communication, transparency, and ongoing support to empower our clients on their journey toward financial success.

| Key Features |

|---|

| In-depth analysis of financial situation |

| Customized investment plans |

| Regular portfolio reviews |

| Proactive communication about market trends |

| Transparent reporting on holdings, performance, and fees |

What You Can Expect from Us

As your independent adviser for Vanguard investments, [Company Name] is dedicated to helping you achieve your financial objectives while minimizing unnecessary risk. With our proven approach, many clients have experienced steady portfolio growth over time.

We stay true to our investment principles and leverage our expertise to deliver consistent returns aligned with your long-term goals.

When you choose us, expect personalized attention and tailored strategies based on your unique financial situation. We take the time to understand your goals, risk tolerance, and time horizon, crafting a comprehensive investment plan exclusively for you.

Transparency and open communication are at the forefront of our service. We keep you informed with regular updates on investment performance and promptly address any questions or concerns you may have.

Additionally, we provide access to advanced research tools and analysis. Our team of professionals utilizes cutting-edge technology and industry insights to identify investment opportunities that align with your objectives.

At [Company Name], we build long-term relationships with our clients. We see ourselves as partners dedicated to navigating the complexities of the financial landscape alongside you. Our commitment extends beyond initial investments – we continuously monitor and adjust your portfolio to ensure it remains aligned with your evolving needs.

Choose [Company Name] as your independent adviser for Vanguard investments and expect tangible results driven by personalized attention, transparent communication, comprehensive research, and a lasting partnership focused on helping you achieve financial success.

Case Studies: Success Stories from Vanguard Investors

Real-life success stories demonstrate the undeniable value of independent advisers for Vanguard investors. At [Company Name], our experienced advisers have helped individuals achieve their financial goals through personalized guidance and tailored strategies.

Jane Doe, a Vanguard investor, sought advice after seeing minimal growth in her portfolio. Our independent adviser analyzed Jane’s risk tolerance and long-term goals, providing customized recommendations. As a result, her portfolio experienced steady growth that surpassed expectations.

John Smith, a retiree, wanted to preserve his wealth while generating income. Our expert adviser strategically rebalanced John’s portfolio with dividend-focused Vanguard funds, ensuring a stable income stream while safeguarding his capital.

Both success stories highlight the effectiveness of our comprehensive strategies, including asset allocation adjustments and disciplined rebalancing. Working with independent advisers who understand individual circumstances can lead to significant portfolio growth and financial goal achievement.

At [Company Name], we are committed to helping Vanguard investors succeed by providing tailored advice and guidance based on their unique needs. These case studies exemplify the positive impact independent advisers can have on investors’ financial journeys.

Addressing Common Concerns about Working with Independent Advisers

When considering working with independent advisers for your financial investments, concerns about costs, trust, and transparency may arise. However, these concerns can be effectively addressed.

Costs: While independent advisers typically charge a fee for their services, it’s important to view this as an investment in your financial future. Their expertise and personalized guidance often outweigh the associated costs.

Trust: Choosing independent advisers with a solid reputation and track record of success is crucial. Recommendations from trusted sources or thorough research can help establish trust before making a decision.

Transparency: Independent advisers prioritize transparency by clearly communicating fees and maintaining open communication throughout the investment process.

At [Company Name], we understand the importance of addressing these concerns. We offer transparent fee structures, clear communication channels, and a team of experienced advisers dedicated to building long-term relationships based on trust and mutual respect.

By directly addressing concerns related to costs, trust, and transparency, independent advisers like us strive to provide the support necessary for your financial success.

Tips for Choosing an Independent Adviser

Selecting the right independent adviser is crucial when it comes to managing your Vanguard investments. To ensure you make an informed decision, there are several key factors that you should consider.

Firstly, it’s important to research the reputation and track record of any potential adviser. Look for professionals who have a solid history of delivering successful outcomes within the industry. By doing so, you can gain confidence in their ability to navigate the complexities of investment management effectively.

Next, consider whether the services offered by the independent adviser align with your specific investment needs. Some advisers provide comprehensive financial planning services, while others may specialize in ongoing portfolio management or have specific expertise in Vanguard funds.

It’s essential to choose an adviser whose offerings closely match your requirements to maximize the value they can provide.

Transparency is another critical factor when selecting an independent adviser. Ensure that the adviser is upfront about their fee structure and clearly communicates how they will engage with you throughout the investment process.

Clear communication and a transparent fee structure are fundamental in building a trusting relationship and avoiding any surprises down the line.

In summary, when choosing an independent adviser for your Vanguard investments, take into account their reputation and track record, compatibility with your needs, as well as their transparency in fees and communication.

By carefully considering these factors, you can make a more informed decision and increase your chances of finding an adviser who will help guide you towards financial success.

| Factors to Consider |

|---|

| Reputation & Track Record |

| Services Offered & Compatibility |

| Transparency in Fees & Communication |

[lyte id=’vTQBfbhZ0EI’]