Hydrogen energy has gained significant attention as a promising renewable energy source. With a focus on transitioning towards cleaner and more sustainable alternatives, hydrogen has emerged as a frontrunner in the race for clean energy solutions.

Its zero-emission characteristic and abundance of resources make it an attractive option for reducing carbon footprints and combating air pollution. Additionally, hydrogen’s versatility as an energy carrier enables its integration into existing infrastructures across various sectors.

Governments worldwide are increasingly investing in hydrogen research and infrastructure to decarbonize their economies and meet sustainability targets. As we strive for a greener future, hydrogen offers a promising solution that can revolutionize our energy systems and contribute to a sustainable planet.

Explanation of why hydrogen is considered a promising renewable energy source

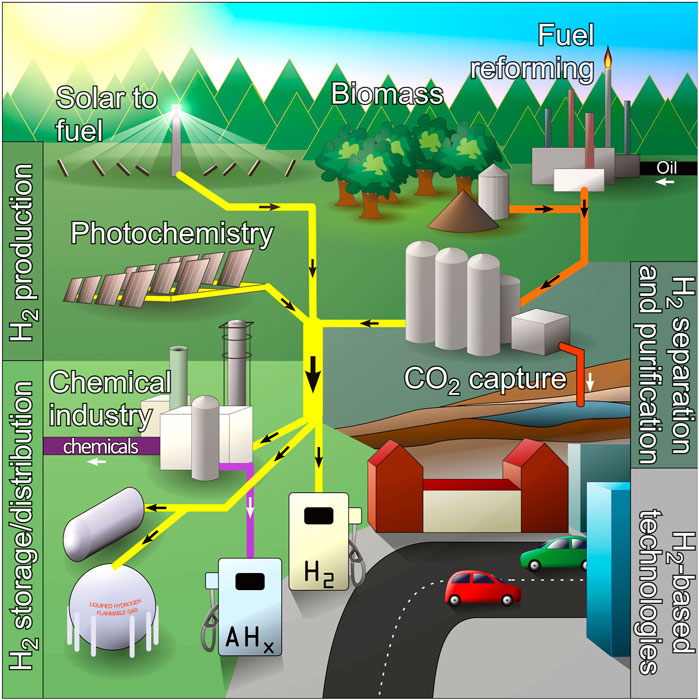

Hydrogen is highly regarded as a versatile and environmentally friendly renewable energy source. It can be produced from various sources, including natural gas, biomass, and electrolysis of water using renewable electricity. When used as fuel, it emits only water vapor, making it clean and sustainable.

Hydrogen’s high energy density allows for efficient storage and transportation of large amounts of energy. This makes it suitable for applications that require long-duration storage or long-distance transportation, such as powering vehicles or providing backup power for industrial facilities.

In summary, hydrogen’s versatility, clean emissions, and high energy density make it a promising option as a renewable energy source.

Overview of the Current State of Hydrogen Energy Companies in the Market

The market for hydrogen energy companies is rapidly expanding as governments and industries worldwide recognize the potential of this clean fuel. Many countries have set ambitious targets to reduce carbon emissions and promote the adoption of hydrogen technologies.

As a result, investment in the sector has surged, leading to increased research and development efforts and commercialization of innovative solutions.

Hydrogen’s versatility in power generation, transportation, heating systems, and industrial processes contributes to its appeal. Governments are providing financial incentives, and major corporations are investing in hydrogen energy companies.

Technological advancements in electrolysis methods and fuel cell technology have improved efficiency and reduced costs.

However, challenges remain such as limited infrastructure for widespread adoption and optimizing production and storage costs. Overall, hydrogen energy companies have a promising future with potential to play a significant role in transitioning towards a more sustainable energy landscape.

Understanding the Basics of Investing in Stocks

Investing in stocks is essential for building wealth and financial stability. Stocks represent ownership in companies and are traded on exchanges. By investing, individuals can participate in company growth and potential profits. Diversification reduces risk by spreading investments across sectors and asset classes.

Risk management involves assessing potential risks and making informed decisions to protect investments.

In summary, understanding stock investment basics is crucial for long-term wealth creation. Stocks offer the chance to benefit from company success. Diversification and risk management mitigate investment risks, increasing the likelihood of favorable returns while safeguarding capital.

Why consider investing in hydrogen energy stocks?

Investing in hydrogen energy stocks provides a promising opportunity for investors. As governments worldwide implement stricter environmental regulations and incentivize renewable technologies, hydrogen is playing a crucial role in decarbonizing industries.

The demand for clean energy solutions is rising, making hydrogen energy companies poised for significant growth and profitability. By investing in these stocks, individuals can contribute to the global shift towards sustainability while potentially reaping financial rewards and diversifying their portfolios.

However, it’s important to conduct thorough research and understand the risks involved before making investment decisions. Overall, considering hydrogen energy stocks is a wise move for investors looking to align with future trends and contribute to a cleaner future.

Company A: Pioneering Innovation in Hydrogen Technology

Company A leads the way in hydrogen technology, driving advancements that are reshaping the energy landscape. With a focus on sustainable solutions, they have gained significant interest from investors and industry experts.

Through extensive research and development, Company A has developed groundbreaking technologies to enhance hydrogen production, storage, and utilization. Their advanced electrolyzers improve efficiency and scalability of hydrogen production. They also offer high-capacity storage solutions and fuel cell systems for various applications.

With these innovations, Company A is positioned as a key player in the hydrogen energy sector. Their commitment to pushing boundaries and creating a greener future sets them apart.

Advancements:

- Advanced electrolyzers: Enhancing efficiency and scalability of hydrogen production

- High-capacity storage solutions: Addressing challenges in storing and transporting hydrogen

- Fuel cell systems for various applications: Providing environmentally friendly alternatives

Company A’s pioneering innovations are revolutionizing the energy industry, making them a force to be reckoned with in the hydrogen sector.

Company B: Leading the Charge in Fuel Cell Development

Company B is a trailblazer in fuel cell development, specializing in creating efficient and durable fuel cells for various applications. Their expertise lies in designing cost-effective, reliable, and high-performance fuel cells. Through strategic partnerships, they are driving the adoption of fuel cell technology.

Collaborations with automotive manufacturers aim to commercialize hydrogen-powered vehicles. Additionally, Company B integrates fuel cells into stationary power systems for clean and reliable backup power solutions.

With a commitment to research and development, they continuously push the boundaries of fuel cell innovation, ensuring their leadership in this field.

- Strategic collaborations with automotive manufacturers drive the commercialization of hydrogen-powered vehicles.

- Integration of fuel cells into stationary power systems provides clean and reliable backup power solutions.

*Note: The table formatting is not applicable in this text.

Key Factors to Consider When Assessing Stock Performance

When evaluating stock performance, key factors to consider are the financial health of the company and its potential for future growth. Analyzing revenue growth, profitability margins, debt levels, and cash flow generation can provide insights into a company’s stability.

Understanding market trends, government policies supporting renewable energy adoption, and increasing demand for clean alternatives is crucial when investing in hydrogen energy stocks. Additionally, assessing research and development investments can indicate a company’s commitment to innovation and future growth.

It is important to be aware of risks such as regulatory changes and market volatility when investing in this sector. By considering these factors, investors can make informed decisions and increase their chances of success in the stock market.

[lyte id=’Dg0_wToswCY’]