Investing in companies before they go public can be a lucrative opportunity for investors looking to get in on the ground floor of a potentially high-growth company.

In this article, we will explore the process of investing in a company before its initial public offering (IPO) and provide valuable insights on how to identify promising pre-IPO companies, evaluate their potential, and navigate the risks associated with these investments.

Whether you are an experienced investor or just starting out, this guide will equip you with the knowledge needed to make informed investment decisions in the world of pre-IPO investing.

Understanding the IPO Process

An initial public offering (IPO) is when a private company offers shares of its stock to the public for the first time. This allows the company to raise capital, expand its operations, and become publicly traded on a stock exchange.

Going public also provides liquidity for existing shareholders, enhances brand reputation, and attracts top talent through employee stock options.

The stages of an IPO involve selecting underwriters, filing registration documents with regulatory authorities like the SEC, conducting roadshows to generate interest from investors, pricing the shares, and listing them on a stock exchange.

Overall, understanding the IPO process is essential for companies looking to access new funding opportunities and grow their presence in the market.

Researching Pre-IPO Companies

To identify potential pre-IPO companies worth investing in, thorough research and analysis are essential. Two key strategies can be employed: analyzing industry trends and leveraging networking connections within the investment community.

Stay informed about emerging industries or sectors with strong growth potential. Look for companies operating in these industries that can capitalize on market opportunities.

Build a network of contacts within the investment community. Attend conferences, seminars, and join professional organizations related to your areas of interest. These connections provide valuable insights and access to potential pre-IPO opportunities.

By combining industry trend analysis with networking connections, investors can increase their chances of identifying promising pre-IPO companies. Thorough research is crucial for making informed investment decisions aligned with financial goals.

Evaluating Pre-IPO Companies

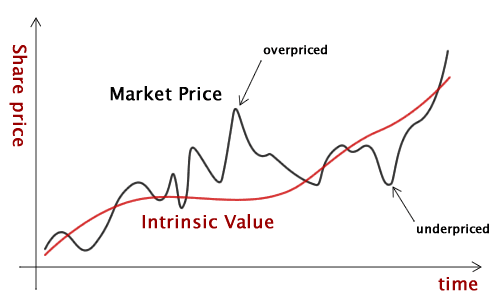

Investing in pre-IPO companies offers high-growth opportunities, but proper evaluation is crucial. Assessing the company’s financials involves analyzing revenue growth, profitability, debt levels, and cash flow.

Understanding their business model and competitive advantage requires assessing their unique selling proposition (USP), market share, and competition. Thorough evaluation helps investors make informed decisions and minimize risks associated with these investments.

Conducting comprehensive due diligence is essential for maximizing rewards while minimizing pitfalls.

Understanding the Risks of Investing in Pre-IPO Companies

Investing in pre-IPO companies carries certain risks that investors should be aware of:

-

Lack of historical data: Pre-IPO companies have limited operating histories, making it challenging to assess their performance or predict future outcomes based on historical data.

-

Limited liquidity and exit options: Shares in pre-IPO companies are not readily tradable like publicly traded stocks, leading to difficulties in selling shares and realizing investments, especially if the company fails to go public or is acquired.

-

Higher volatility: Pre-IPO companies are still developing their business models and face uncertainties, resulting in substantial fluctuations in share prices and potential investment losses.

To mitigate these risks, investors should conduct thorough due diligence, analyze the company’s potential, diversify their portfolios, and make informed investment decisions.

Accessing Pre-IPO Investments

Investors seeking to tap into the potential of promising companies before they go public have several avenues to explore. Venture capital firms and angel investors are key players in funding early-stage companies with high growth potential. They have access to pre-IPO investment opportunities and offer valuable insights and expertise.

Equity crowdfunding platforms, on the other hand, allow individual investors to participate in pre-IPO funding rounds alongside institutions, providing a way for retail investors to gain exposure to startups before they go public.

However, it’s important for investors to conduct thorough due diligence and be aware of the risks involved in these illiquid investments.

In summary, accessing pre-IPO investments can provide exciting opportunities for investors looking to get involved with high-growth companies before they enter the public market.

Whether through venture capital firms and angel investors or equity crowdfunding platforms, careful evaluation and understanding of the risks are essential when considering these investments.

Conducting Due Diligence on Pre-IPO Investments

Before investing in pre-IPO companies, conducting thorough due diligence is essential. This involves analyzing key financial information, assessing risk factors, and evaluating the management team.

Understanding the company’s financial health, identifying potential risks, and ensuring a capable management team are crucial for making informed investment decisions.

Building a diversified portfolio of pre-IPO investments helps mitigate risk and maximize returns. Spreading investments across different industries reduces exposure to industry-specific risks and capitalizes on diverse growth opportunities.

Investing in pre-IPO companies requires patience and a long-term mindset. Holding onto investments for several years before an exit opportunity arises is common. It’s important to evaluate each company thoroughly and wait for the right investment opportunity that aligns with your goals and risk tolerance.

Seeking advice from a financial advisor specializing in pre-IPO investments is beneficial. They provide valuable insights, navigate complexities, and assess suitability based on individual circumstances. Consider experience, track record, fee structure transparency, and alignment of interests when choosing an advisor.

Successful case studies like Amazon and Spotify illustrate the potential rewards of investing in pre-IPO companies. Early investors in Amazon benefited from its disruptive business model, while those who invested in Spotify before its IPO took advantage of rapid growth in music streaming services.

By conducting due diligence, building a diversified portfolio, exercising patience, seeking professional advice, and learning from successful case studies, investors can make informed decisions when investing in pre-IPO companies.

Conclusion

Investing in companies before they go public presents a unique opportunity for investors to tap into high-growth potential.

By gaining a deep understanding of the IPO process, conducting thorough research, evaluating financials and business models, and diversifying one’s portfolio, investors can position themselves for success in the world of pre-IPO investing.

The process of investing in pre-IPO companies requires careful consideration and due diligence. It is important to exercise patience and seek professional advice when needed. Staying informed about market trends and investment opportunities is crucial for making well-informed decisions.

One key advantage of investing in pre-IPO companies is the potential for significant returns. These investments often offer access to promising ventures that have not yet reached the public markets. By getting in early, investors may benefit from the company’s growth trajectory as it transitions into a publicly traded entity.

However, it is important to keep in mind that investing in pre-IPO companies also carries risks. These ventures are typically less established compared to publicly traded companies, which means there may be uncertainties surrounding their future performance.

Investors should carefully evaluate factors such as the company’s management team, competitive landscape, industry trends, and potential risks before committing capital.

Diversification plays a vital role when investing in pre-IPO opportunities. Spreading investments across multiple companies helps mitigate risk and increases the chances of capturing successful outcomes. This strategy allows investors to balance potential gains with any losses incurred from unsuccessful ventures.

In conclusion, investing in companies before their IPOs can be an exciting and rewarding strategy for long-term investors looking to capitalize on high-growth potential. It offers a chance to participate in the early stages of promising ventures with significant upside possibilities.

However, it is essential to approach these investments with caution by conducting thorough research and seeking professional guidance when necessary.

[lyte id=’OOfN39YccaM’]