Investing in the stock market can be an exhilarating yet daunting experience. The ups and downs, twists and turns, can make it feel like a roller coaster ride. For some investors, this volatility is what makes investing exciting and potentially lucrative.

But how do you find those wild, unpredictable stocks that can deliver substantial gains? In this article, we will explore the world of volatile stocks and uncover strategies for identifying them.

Understanding Volatility: The Roller Coaster Ride of the Stock Market

Volatility in the stock market refers to the variation in a stock’s price over time. It is crucial for investors as it presents opportunities for gains or losses. High-volatility stocks can deliver impressive returns but also come with higher risks. Volatility directly affects stock prices by influencing supply and demand dynamics.

Increased trading activity leads to price swings as buyers and sellers compete for shares. By understanding volatility, investors can make more informed decisions and navigate the stock market with confidence.

Factors Influencing Stock Volatility

Stock volatility is influenced by economic indicators and earnings reports. Economic indicators, such as GDP growth rates, inflation levels, interest rates, consumer confidence indexes, and employment data, provide insights into the overall health of an economy and affect investor sentiment towards stocks.

Positive economic news reduces volatility, while negative news increases it. Earnings reports impact stock prices based on positive or negative surprises. Analyzing historical earnings data helps identify potential price swings. Understanding these factors allows investors to make informed decisions in navigating stock market volatility.

Researching and Identifying High-Volatility Stocks

To identify high-volatility stocks, investors can use beta as a measure of stock volatility. Beta greater than 1 suggests higher volatility, while beta less than 1 indicates lower volatility. Online tools and platforms offer screening capabilities based on specific criteria, including beta values.

Historical price data analysis through charts reveals patterns and trends in stock volatility. Technical analysis tools like moving averages and Bollinger Bands help identify periods of heightened volatility. Recognizing support and resistance levels can anticipate potential price reversals or breakouts.

By incorporating these strategies, investors can make informed decisions to maximize profit while managing risks associated with high-volatility stocks.

Managing Risk while Investing in Volatile Stocks

Investing in volatile stocks can be a profitable but risky endeavor. To navigate this volatility and protect their investments, investors must implement effective risk management strategies. Diversification is one such strategy that involves spreading investments across different sectors and asset classes.

By doing so, investors can reduce their exposure to any single investment or sector, thereby mitigating the impact of volatility on their overall returns.

Including blue-chip stocks in a diversified portfolio can also help manage the risk associated with volatile stocks. Blue-chip stocks are shares of well-established companies with a history of stable earnings and dividends. These stocks tend to be less volatile than smaller, riskier companies.

By adding blue-chip stocks to their portfolio, investors can offset the potential downside risks associated with highly volatile stocks.

Another crucial risk management tool is setting stop-loss orders. A stop-loss order is an instruction given to a broker to sell a stock if its price falls below a certain threshold. This tool allows investors to limit their losses by automatically exiting positions when prices decline beyond predetermined levels.

Determining appropriate stop-loss levels is essential and depends on an investor’s risk tolerance. Conservative investors may opt for tighter stop-loss levels to protect against significant losses, while more aggressive investors may choose wider stop-loss levels that allow for greater price fluctuations.

Overall, managing risk while investing in volatile stocks requires diversification, including blue-chip stocks in the portfolio, and setting appropriate stop-loss orders based on individual risk tolerance.

By implementing these strategies, investors can safeguard their investments and navigate the challenges posed by stock market volatility effectively.

Capitalizing on Volatile Markets with Strategic Timing

In volatile markets, strategic timing is key to seizing opportunities and maximizing returns. Breaking news, such as earnings surprises or geopolitical events, can significantly impact stock prices and create volatility.

Reacting quickly to breaking news allows investors to capitalize on price movements before the market fully absorbs the new information. Swing trading is another strategy that takes advantage of short-term price swings within a larger trend.

By setting specific entry and exit points based on technical analysis indicators and risk-reward ratios, swing traders aim to maximize profitability while managing risk effectively. With proper planning and execution, investors can navigate through volatility successfully and achieve their investment goals.

| Heading | Content |

|---|---|

| V. Capitalizing on Volatile Markets with Strategic Timing | Exploring strategies for making the most of volatile markets by utilizing strategic timing. |

| A. Seizing Opportunities with Breaking News | Understanding how breaking news impacts stock prices and creates volatility, along with the potential advantages and risks of reacting quickly to such news. |

| B. Swing Trading: Riding the Ups and Downs for Profit | Introducing swing trading as a strategy to capitalize on short-term price swings within a larger trend in volatile markets. |

Tools and Resources for Tracking Volatility

Investors need reliable tools to monitor market volatility and make informed decisions. Financial news websites like Bloomberg, CNBC, and Reuters offer real-time updates on market trends, breaking news, economic indicators, and company developments. Subscribing to newsletters or alerts from these platforms ensures timely updates on market dynamics.

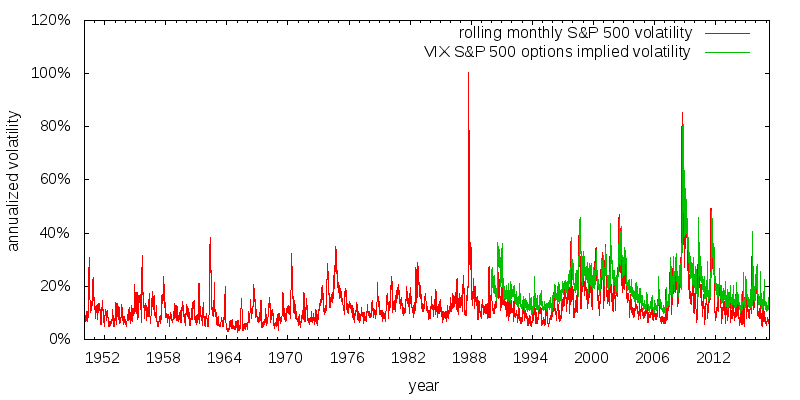

Volatility indices, such as the VIX (Volatility Index), measure market expectations of near-term volatility based on options prices. Monitoring these indices provides insights into overall market sentiment and potential volatility levels.

High volatility indices indicate increased fear or uncertainty among traders, potentially leading to higher stock price swings.

By staying informed through financial news websites and using volatility indices as gauges for market sentiment, investors can navigate volatile markets with confidence.

Learning from Successful Volatility Trades

The world of investing is filled with unpredictable ups and downs, making stock volatility a key consideration for traders. By studying successful examples of volatility trades, investors can gain valuable insights into navigating turbulent markets.

One prime case study is Tesla, known for its extreme stock price fluctuations. Analyzing Tesla’s historical price movements and identifying triggers of significant volatility provides crucial insights for trading similar stocks.

Successful traders during Tesla’s roller coaster journey employed strategies such as short-selling during overvaluation periods or buying during significant dips caused by negative news events or market corrections.

Another notable case study is the GameStop saga, where retail investors on Reddit’s WallStreetBets forum fueled skyrocketing stock volatility. This episode emphasizes the importance of understanding market dynamics, conducting thorough research, and managing risk when dealing with highly volatile stocks.

Lessons can be learned from both the short-term gains made by some traders and the long-term consequences faced by others caught on the wrong side of this volatile trade.

Conclusion: Navigating the World of Volatile Stocks

[lyte id=’VC327ko8DfE’]