Investing in the stock market is an exciting endeavor, filled with opportunities to uncover hidden gems that can lead to significant returns. One such tool that can help investors in their quest is a high implied volatility screener. If you’re familiar with investing and want to learn more about this powerful tool, then you’re in the right place.

Understanding implied volatility and its significance in investing

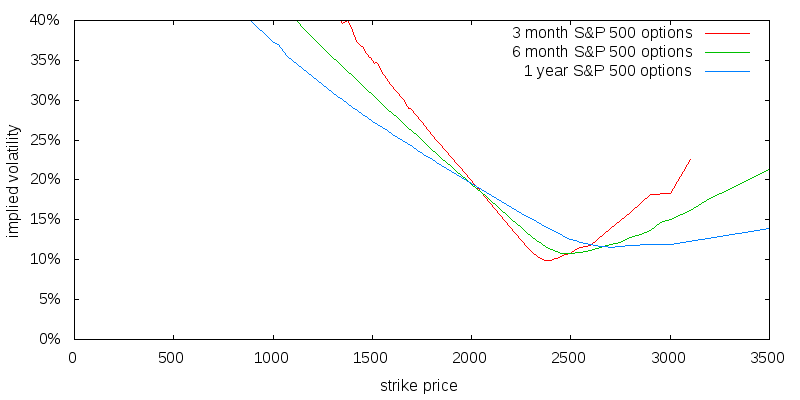

Implied volatility is a measure of expected future price fluctuations derived from options prices. It reflects market expectations of a stock’s volatility over a specific period. This concept is crucial in options pricing, affecting the premiums investors pay for options contracts.

Implied volatility provides insights into market sentiment and helps identify potential mispricings. However, it should be used alongside other factors for informed investment decisions.

The Thrill of High Implied Volatility Stocks

Discovering high implied volatility stocks is like stumbling upon a hidden treasure in the stock market. These unique investments offer exhilarating potential for substantial gains, thanks to their significant price movements.

High implied volatility stocks present both opportunities and risks. By identifying and analyzing them, investors can take advantage of profit opportunities through strategies like option trading or capitalizing on short-term price swings.

Option trading allows investors to leverage these price swings for maximum gains by purchasing options contracts tied to high implied volatility stocks. Additionally, astute investors can buy low during temporary dips and sell high as these stocks rebound, taking advantage of short-term price swings.

However, it’s important to approach these investments with caution. Thorough research and analysis are crucial to mitigate potential losses associated with the inherent risks of high implied volatility stocks.

Unveiling the Power of a High Implied Volatility Screener

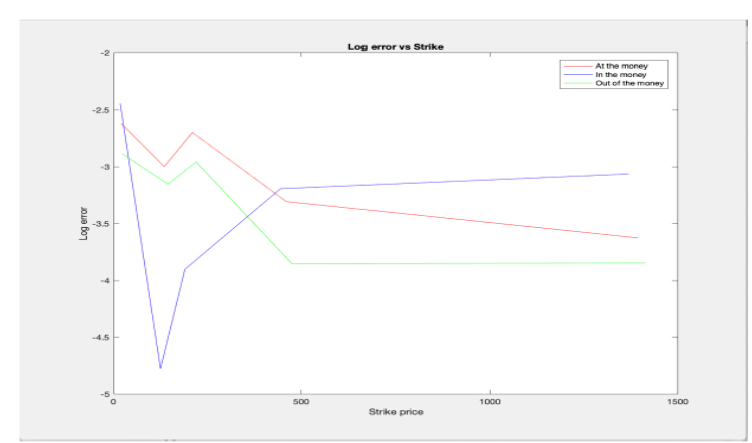

A high implied volatility screener is a powerful tool for investors. It scans through vast amounts of data, including options prices and volume, to identify stocks with elevated levels of implied volatility. This saves investors time and effort by highlighting potential opportunities aligned with their strategies.

The screener is especially useful for options traders and those seeking short-term trading opportunities. By focusing on stocks with high implied volatility, investors can increase their chances of capturing significant price swings and maximizing returns.

Consider John’s story as an example. He used a high implied volatility screener to identify stocks with elevated levels of implied volatility. Through further analysis and well-timed trades, John achieved impressive returns that outperformed market averages and significantly boosted his portfolio’s value.

In summary, a high implied volatility screener empowers investors by saving time, enhancing decision-making processes, and identifying potential opportunities in the dynamic stock market landscape.

Using a High Implied Volatility Screener to Identify Opportunities

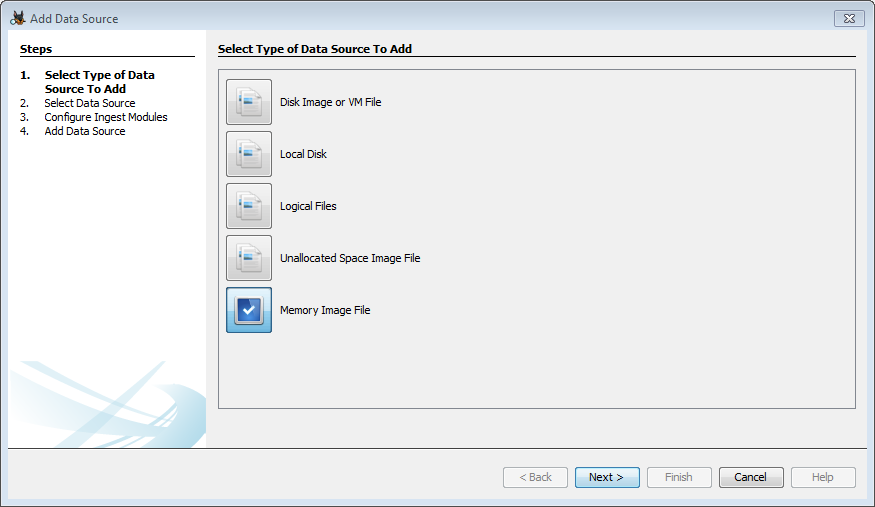

To identify investment opportunities, utilizing a high implied volatility screener is essential. Start by choosing a reliable platform with comprehensive data and advanced screening capabilities. Set your search criteria based on your investment strategy, such as minimum implied volatility or specific sectors of interest.

Analyze the results thoroughly, considering factors like financials and industry trends, to make informed decisions aligned with your goals and risk tolerance. By effectively leveraging a high implied volatility screener, you can uncover potential opportunities that may have otherwise gone unnoticed in the market.

Factors Driving High Implied Volatility Stocks

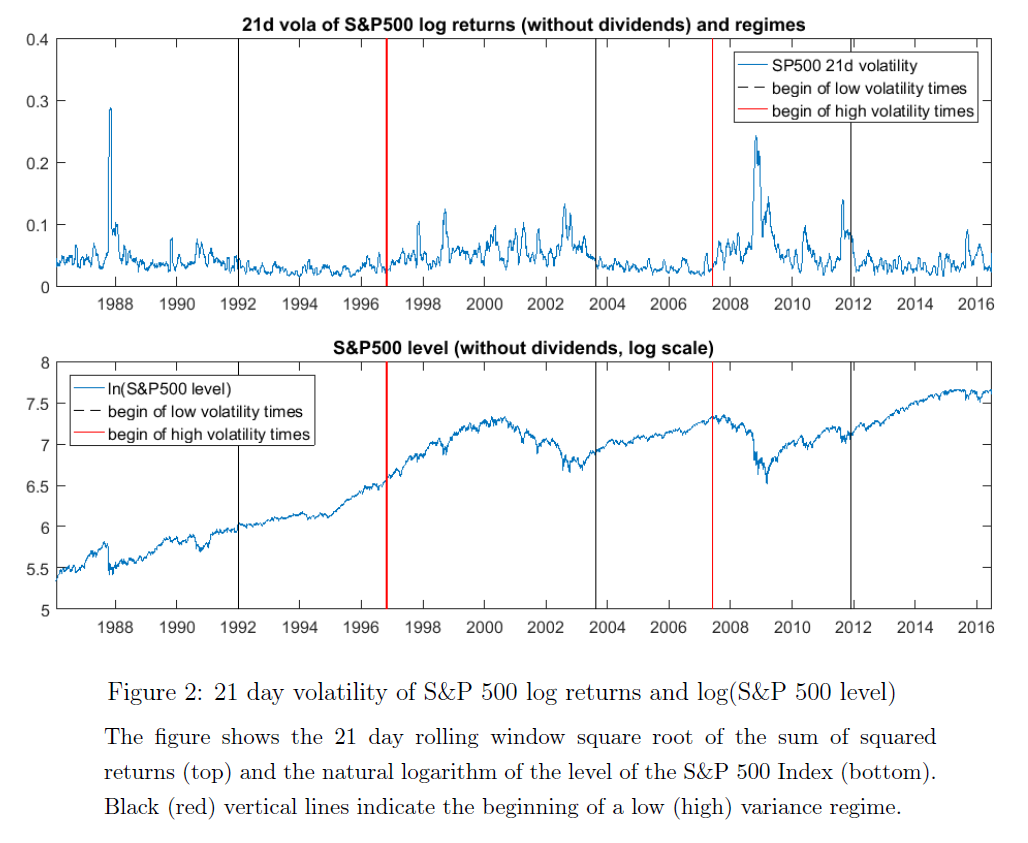

Understanding the factors that drive high implied volatility stocks is crucial for investors. Earnings announcements and market expectations can trigger price movements and increased volatility. Corporate events like mergers or acquisitions create uncertainty, leading to heightened implied volatility.

Market sentiment and macroeconomic factors such as economic indicators or geopolitical tensions also impact stock prices and elevate implied volatility levels. By monitoring these factors and using a high implied volatility screener, investors can strategically position themselves for potential gains in this dynamic market.

Risks and Challenges of Trading High Implied Volatility Stocks

Trading high implied volatility stocks presents enticing profit potential, but it comes with risks that should not be overlooked. These stocks are known for larger price swings, which can lead to substantial gains or losses if not managed properly.

Lower liquidity levels compared to established securities can result in wider bid-ask spreads, making it challenging to execute trades at desired prices. To mitigate these risks, implement proper risk management strategies such as setting stop-loss orders, diversifying your portfolio, and closely monitoring positions.

Approach trading high implied volatility stocks with caution and a thorough understanding of the associated challenges.

Case Studies: Real-Life Examples of Successful Trades Using High IV Screeners

Investors and traders have discovered the power of high implied volatility (IV) screeners in identifying stocks with potential for profitable trades. Let’s explore two real-life anecdotes that illustrate how these screeners have been instrumental in achieving success:

-

Sarah, an astute investor, used a high IV screener during earnings season to identify stocks with elevated implied volatility. By executing well-timed trades based on her findings, she capitalized on significant price movements and achieved impressive profits.

-

Mark, a savvy trader, closely monitored corporate events using a high IV screener. When news broke about a merger involving companies he had been tracking, he swiftly identified the opportunity and executed strategic trades to leverage the heightened implied volatility. This resulted in substantial gains.

These case studies demonstrate how high IV screeners provide valuable insights and enable investors and traders to make informed decisions, capturing profitable trading opportunities in the process.

Tips for Maximizing Success with High IV Screeners

To maximize success with high implied volatility (IV) screeners, there are a few key tips to keep in mind.

-

Stay updated with market news and events: Keep informed about factors that can impact stock prices and IV levels. This helps you identify potential opportunities more effectively.

-

Set realistic expectations for returns: Understand that trading involves risks and not every trade will result in substantial gains. Set achievable goals to manage expectations.

-

Combine fundamental analysis with high IV screeners: Use high IV screeners as part of a broader strategy that includes analyzing a company’s financials, competitive position, and industry outlook. This enhances your investment decisions.

By following these tips, you can maximize the effectiveness of high IV screeners and increase your chances of making profitable trades in the market.

[lyte id=’SuS5u0wxw7o’]