Investing in dividend stocks can be a smart and lucrative move for investors looking to maximize their returns. With the potential for both capital appreciation and regular income, dividend stocks provide a unique opportunity for long-term wealth accumulation.

In this article, we will explore the concept of high dividend opportunities model portfolio – a carefully curated selection of stocks that offer attractive dividends. Whether you are a seasoned investor or just starting out, understanding the benefits and strategies behind these investments is essential.

Why Invest in Dividend Stocks?

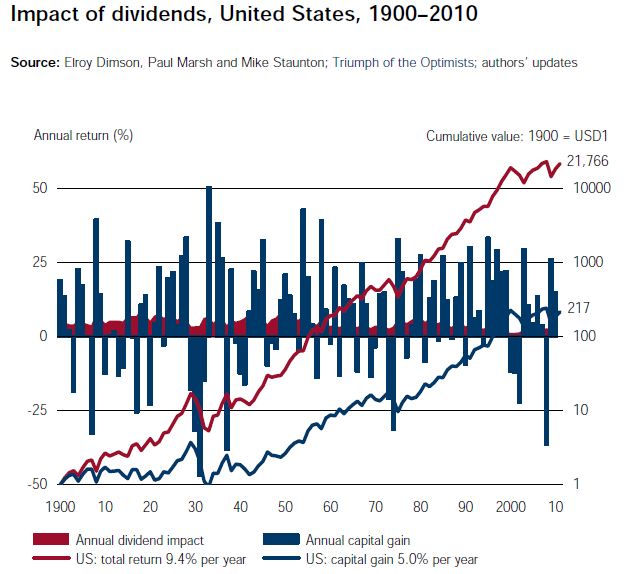

Dividend stocks provide stability and consistent income. Unlike growth stocks, dividend stocks pay out regular profits to shareholders, ensuring cash flow even during market downturns. These companies are financially stable and established, making dividend stocks less volatile compared to other investments.

Additionally, dividend stocks act as a hedge against inflation and offer the opportunity for compounding returns. Overall, investing in dividend stocks is a reliable way to generate income and grow wealth over time.

Best High Dividend Stocks Model Portfolio

Our team of experts has created a highly effective model portfolio focusing on high dividend stocks. Our meticulous research and analysis consider factors such as company financials, dividend history, industry trends, and market conditions.

The portfolio is diversified across sectors, including reliable blue-chip stocks and promising up-and-coming companies with growth potential. With our carefully curated selection, investors can confidently generate passive income and build wealth over time.

Utilizing Our Expert Stock Picks

Investors who utilize our expert stock picks gain access to a carefully curated portfolio that aims to deliver superior returns over time. With our extensive research process and rigorous criteria for selection, we aim to provide our subscribers with high-quality investment opportunities.

By investing in our model portfolio, you can benefit from our expertise and save time on individual stock analysis. Our team continuously monitors the performance of the stocks in the portfolio, making adjustments as needed to ensure optimal returns.

In summary, utilizing our expert stock picks provides investors with access to a thoughtfully curated portfolio, comprehensive research analysis, and ongoing monitoring for optimal returns. Let us be your trusted partner on your journey towards financial success.

How We Identify the Best High Dividend Stocks

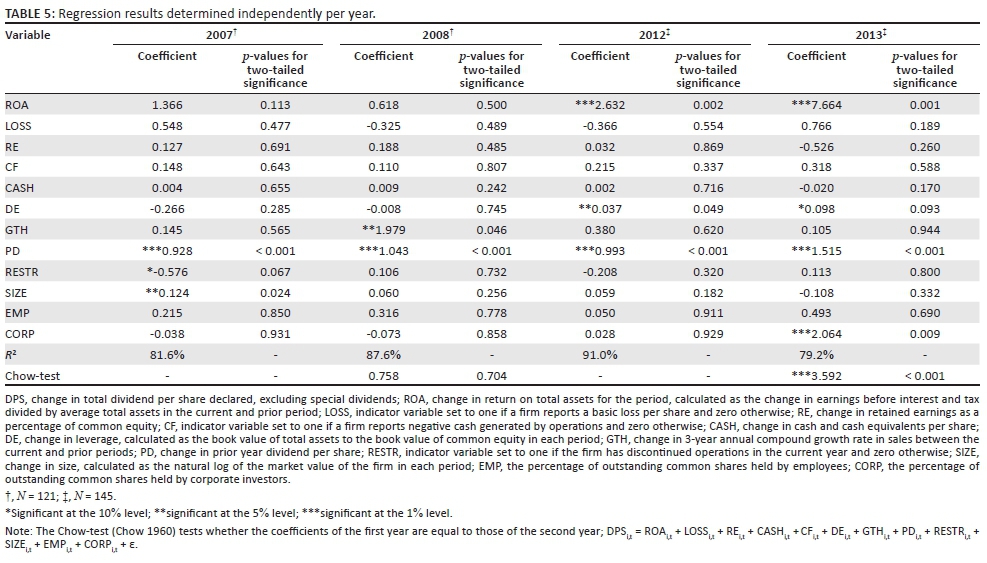

Identifying the best high dividend stocks involves a systematic and thorough analysis. Our team follows a rigorous screening process, considering factors such as attractive dividend yields, sustainable payout ratios, strong balance sheets, consistent cash flow generation, dividend growth potential, and company fundamentals.

We begin by analyzing the dividend yield to gauge the return investors can expect. However, we don’t solely rely on this metric. Sustainable payout ratios ensure that companies can maintain their dividends over time. We also evaluate balance sheets to ensure financial stability and examine cash flow generation to assess consistency.

In addition to financial metrics, we consider dividend growth potential and overall company fundamentals. Companies with a history of increasing dividends demonstrate commitment to rewarding shareholders and offer potential income growth opportunities.

By combining quantitative analysis with qualitative evaluation, our aim is to provide subscribers with a well-rounded selection of high dividend stocks. This comprehensive approach helps identify investments with attractive yields, sustainable payouts, and strong long-term prospects.

Our team is dedicated to helping investors make informed decisions and build portfolios that generate consistent income over time. We provide top-notch research and recommendations to ensure access to the best high dividend stocks in the market.

Setting Up the Portfolio for Maximum Yield

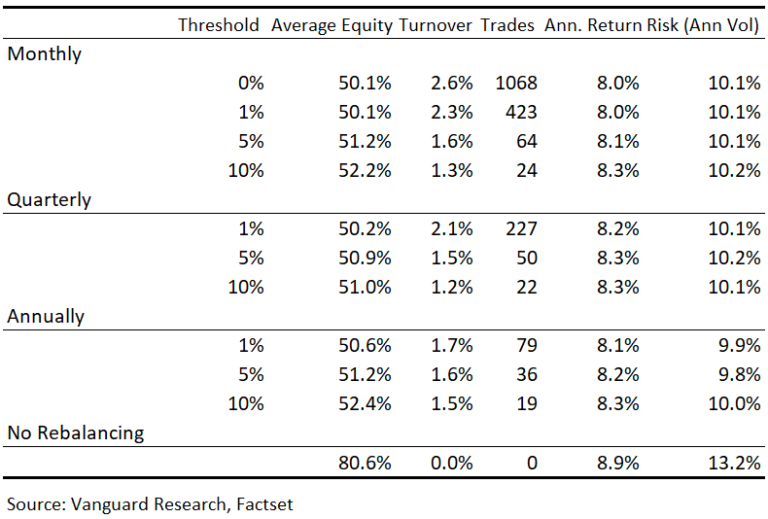

To maximize yield while managing risk, setting up a portfolio requires careful consideration. Diversification is key to mitigate exposure to specific risks by spreading investments across sectors and industries. Regular rebalancing ensures alignment with market conditions and investment strategies.

Leveraging expert stock picks and following a disciplined approach can enhance returns. Investing in high dividend stocks offers consistent income and potential capital appreciation. However, thorough research and professional advice are essential due to the inherent risks involved.

By considering diversification, rebalancing, expert insights, and disciplined strategies, investors can optimize their portfolios for maximum yield and achieve their financial goals effectively.

| Key Considerations |

|---|

| Diversify across sectors and industries |

| Regular portfolio rebalancing |

| Leverage expert stock picks |

| Follow a disciplined investment strategy |

Note: The markdown table above highlights key considerations for setting up a portfolio for maximum yield.

[lyte id=’cD0-b6p1OaU’]