Investing in high dividend opportunities can be a lucrative strategy for those looking to grow their wealth. However, with so many options available, it’s important to evaluate each opportunity carefully before making any investment decisions.

In this article, we will explore the various types of investment opportunities available on High Dividend Opportunities (HDO) and provide tips for evaluating potential investments. We will also discuss how to maximize returns and offer tips for success on HDO.

Introduction to Different Types of Investment Opportunities Available on HDO

When investing in high dividend opportunities on HDO, there are two main categories: equity investments and fixed income investments.

-

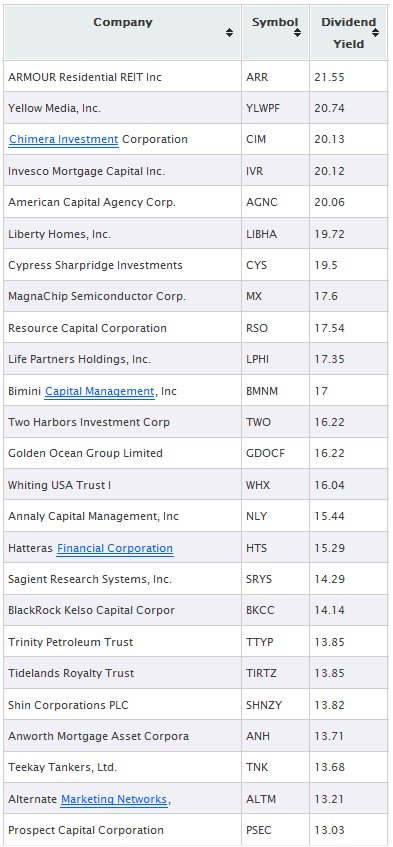

Dividend-Paying Stocks: Stocks of companies that distribute profits as dividends, providing both income and potential for capital appreciation.

-

Master Limited Partnerships (MLPs): Publicly traded partnerships generating income from energy infrastructure or real estate leasing, offering high dividend yields and tax efficiency.

-

Real Estate Investment Trusts (REITs): Investments in real estate without direct ownership, earning income through rental properties or mortgages with significant dividend distribution.

-

Preferred Shares: Ownership in a company with fixed dividends and priority over common stockholders during liquidation.

-

Corporate Bonds: Debt securities issued by companies, providing regular interest payments until maturity.

Understanding these investment options is crucial for making informed decisions aligned with financial goals, risk tolerance, and investment preferences. Researching each opportunity thoroughly ensures they fit into an overall investment strategy on HDO.

Tips for Evaluating Potential Investments

When evaluating potential investments, thorough research and analysis are crucial. Consider the following tips:

-

Conduct thorough research on each opportunity, including examining historical performance, financial health, and dividend history. Evaluate industry trends, market conditions, and economic factors that may impact the investment’s future prospects. Assess the management team’s track record.

-

Utilize research reports and analysis provided by HDO to gain deeper insights into each opportunity’s risks and rewards.

-

Diversify your portfolio across different sectors and asset classes to mitigate risk. Implement risk management strategies such as setting stop-loss orders or using options for downside protection.

By following these tips, you can make informed investment decisions aligned with your financial goals.

Maximizing Returns with High Dividend Opportunities

Investors seeking to maximize returns through high dividend opportunities can employ two key strategies: creating a diversified portfolio and reinvesting dividends for compounding returns.

To enhance returns and manage risk effectively, it is crucial to allocate investments across different sectors and asset classes.

By spreading investments across various sectors such as healthcare, technology, and energy, as well as diversifying asset classes between stocks, bonds, and REITs (real estate investment trusts), the impact of any single investment on overall portfolio performance can be reduced.

Diversification also helps mitigate risk by striking a balance between higher-risk investments and more stable ones. This approach provides a cushion during market downturns while reducing volatility in the portfolio. By not relying solely on one industry or type of investment, investors can safeguard their capital against potential losses.

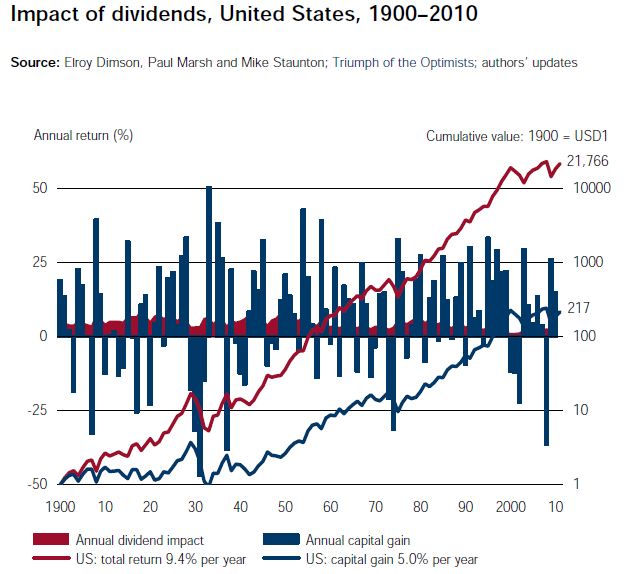

The power of dividend reinvestment plans (DRIPs) cannot be underestimated. DRIPs allow investors to automatically reinvest their dividends into additional shares of the same investment. Over time, this compounding effect can significantly boost overall returns.

By reinvesting dividends instead of withdrawing them as cash, investors take advantage of the benefits of compounding over time. The longer dividends are reinvested, the greater the potential returns become. Compounding allows investors to earn not only on their initial investment but also on the reinvested dividends themselves.

This wealth-building strategy enables exponential growth in one’s portfolio over an extended period.

In summary, maximizing returns with high dividend opportunities requires a two-pronged approach: creating a diversified portfolio and harnessing the power of dividend reinvestment for compounding returns.

By employing these strategies effectively, investors can enhance their chances of achieving long-term financial success while managing risk in an ever-changing market environment.

Tips for Success on High Dividend Opportunities

When investing in high dividend opportunities (HDO), it’s important to consider these key tips for success:

-

Define Your Investment Goals and Risk Tolerance: Clearly establish your investment objectives and assess how much risk you are comfortable with. This will help you align your investments accordingly.

-

Set Realistic Expectations: While HDO can offer attractive yields, remember to set realistic expectations based on historical performance and market conditions. Understand that higher yields often come with higher risks.

-

Stay Informed: Regularly monitor updates from the platform or brokerage firm you use for HDO investments. Being aware of current market conditions and changes in the investment landscape will aid in making informed decisions.

-

Consider Expert Recommendations: Take into account the insights provided by HDO analysts when evaluating potential investments. Their expertise can offer valuable perspectives and help you make more informed decisions.

By following these tips, you can navigate the world of HDO successfully, align your investments with your goals, and increase your chances of achieving financial success.

Conclusion

[lyte id=’cD0-b6p1OaU’]

.jpg)

.jpg)