Investing in cutting-edge technologies has always been an enticing opportunity for investors looking to stay ahead of the curve. One such technology that has captured the attention of both scientists and investors alike is graphene.

In this article, we will explore the world of graphene manufacturing companies and delve into the potential investment opportunities they offer.

What is Graphene?

Graphene, often referred to as a “wonder material,” is a unique substance consisting of a single layer of carbon atoms arranged in a two-dimensional lattice structure. With an astonishing thickness of just one atom, graphene possesses exceptional properties that distinguish it from other materials.

This remarkable material exhibits extraordinary strength and flexibility, making it 200 times stronger than steel while remaining incredibly lightweight. Its electrical conductivity surpasses that of copper, and its thermal conductivity outperforms any known material.

These properties, combined with its transparency and impermeability to gases, have made graphene highly sought-after in various industries.

Compared to graphite, another form of carbon, graphene showcases distinct characteristics. While both are composed entirely of carbon atoms, graphite consists of stacked layers of graphene sheets. This arrangement gives graphite its characteristic slippery feel and the ability to leave marks on paper.

On the other hand, graphene’s single-layer structure grants it unique physical and chemical properties that have captivated scientists and engineers worldwide.

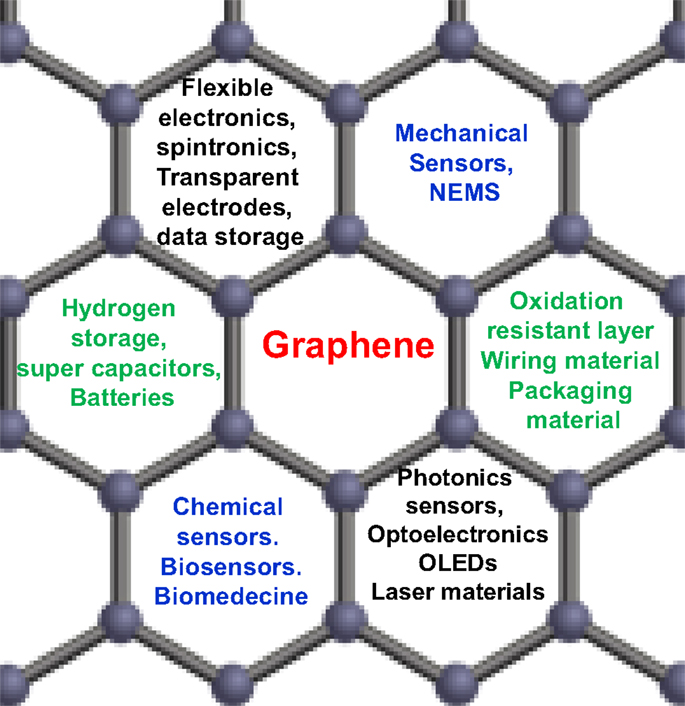

Graphene’s versatility has led to numerous applications in fields such as electronics, energy storage, aerospace, and medicine. Its potential impact on technology is vast: from improving smartphone batteries’ lifespan to revolutionizing solar cell efficiency.

Scientists continue to explore this “wonder material” in hopes of unlocking even more groundbreaking applications.

Good Properties of Graphene

Graphene, often referred to as a “wonder material,” possesses exceptional properties that make it highly sought after in science and technology. It is incredibly strong yet lightweight, making it ideal for aerospace engineering and wearable technology.

Graphene also has high electrical conductivity, enabling fast data transfer speeds and low power consumption for electronic devices. Its excellent thermal conductivity allows for efficient heat dissipation, benefiting industries like computer chip manufacturing and renewable energy.

Additionally, graphene’s transparency and unique optical properties make it promising for applications in optoelectronics and photovoltaic devices such as transparent displays and solar cells. These good properties of graphene represent just a fraction of its potential across various industries.

Private Graphene Companies

Private companies have emerged as leaders in graphene production, driving the research and development in this field. These companies have invested heavily in state-of-the-art facilities and manufacturing processes to produce high-quality graphene at scale.

They are not only focused on graphene production but also on developing applications across various industries.

One such company, Company 1, stands out for its commitment to collaboration with academic institutions and industry partners. By leveraging these partnerships, they aim to drive innovation and commercialization of graphene-based products.

Their investment in research facilities enables them to produce graphene of exceptional quality, meeting the demanding requirements of different industries.

Company 2 takes a unique approach to graphene production by utilizing advanced nanomaterial synthesis techniques. This proprietary method allows them to produce high-purity graphene with tailored properties, making it suitable for specific applications such as energy storage devices or advanced composites.

Through continuous innovation, Company 2 pushes the boundaries of what is possible with graphene technology.

These private graphene companies play a crucial role in advancing the field of graphene research and development. Their contributions go beyond just manufacturing graphene; they are actively exploring new applications and pushing the limits of what can be achieved with this remarkable material.

In summary, private graphene companies like Company 1 and Company 2 are at the forefront of producing high-quality graphene and driving its commercialization across various industries.

Through their investments in research facilities, collaborations with academic institutions, and innovative approaches to production, these companies continue to shape the future of this exciting field.

Investing in Graphene Companies: An Exciting Opportunity (Updated 2023)

Investing in graphene companies is a promising opportunity as the demand for this versatile material continues to grow across industries. With its remarkable properties and potential applications in electronics, energy storage, healthcare, and more, graphene presents a lucrative market for investors.

Evaluating factors such as technological capabilities, market opportunities, financial stability, and regulatory landscapes can help investors make informed investment decisions. By aligning their strategies with the industry’s growth trajectory, investors can capitalize on the ongoing advancements and increasing demand for graphene.

Potential Risks and Challenges with Graphene Investments

Investing in graphene companies brings exciting opportunities, but it also comes with potential risks and challenges. Competition from alternative materials or technological advancements poses a threat to the market demand for graphene-based products.

The evolving regulatory landscape surrounding graphene requires investors to stay informed about potential changes that could impact market dynamics. Additionally, market volatility and fluctuating stock prices of graphene companies can be influenced by various factors, necessitating diversification strategies.

Research and development costs, scalability limitations, and global economic factors further contribute to the complexities of investing in this emerging industry.

In summary, while the prospects of investing in graphene are promising, it is crucial to consider the risks associated with competition, regulations, market volatility, R&D expenses, scalability issues, and global economic conditions.

By conducting thorough research and staying informed about these challenges, investors can make more informed decisions in this dynamic sector.

Success Stories and Lessons Learned from Graphene Investments

Investors who recognized graphene’s potential early on have achieved significant returns, despite the risks involved. These success stories emphasize the importance of thorough research, industry awareness, and a long-term investment perspective.

One investor saw the potential of graphene in electronics and strategically invested in innovative companies at the forefront of graphene technology. Their investments soared as these companies established themselves as leaders in the graphene industry.

Another investor focused on graphene-based batteries, anticipating their impact on energy storage. Their early support paid off when a company developed a groundbreaking battery with unmatched performance, leading to substantial profits.

These success stories highlight valuable lessons for investors considering entering the graphene market. Thorough research, staying informed about industry developments, and taking a long-term approach are essential for making informed investment decisions.

Conclusion: Navigating the Exciting World of Graphene Investing (Updated 2023)

[lyte id=’edt_J82PvPQ’]