Investing in the stock market can be a thrilling and potentially lucrative endeavor. However, it also comes with its fair share of risks and uncertainties. One aspect that plays a significant role in the world of investing is stock volatility.

While many investors may shy away from volatile stocks due to their unpredictable nature, others see them as opportunities for high returns. In this article, we will delve into the concept of stock volatility, its importance in investment decision-making, and how to identify and navigate through good volatile stocks.

What is Stock Volatility?

Stock volatility refers to rapid and significant price fluctuations in the stock market. It measures the variation in a stock’s price over time and reflects market uncertainty or risk. High volatility implies increased uncertainty or investor anxiety, while low volatility suggests stability.

Factors contributing to stock volatility include market sentiment, economic events, and company-specific news. Emotional reactions from investors, economic factors like interest rates and GDP growth rates, and company-related news can all impact stock prices and increase volatility.

Understanding stock volatility is crucial for investors as it provides insights into market dynamics and investor sentiment. By analyzing volatility levels, investors can assess risks and potential rewards associated with an investment.

Monitoring market sentiment, economic indicators, and company-specific news helps investors make informed decisions and manage their investment risks effectively.

Why is Stock Volatility Important?

Stock volatility is crucial for investors as it offers insights into opportunities and risks. By understanding stock volatility, investors can identify unique chances for gains when prices fluctuate significantly.

Additionally, it helps assess risk levels associated with a stock and allows for more effective portfolio management by diversifying investments. Monitoring stock volatility also provides valuable market trend information. Overall, comprehending stock volatility is essential for successful investment decision-making.

Factors Affecting Stock Volatility

Stock volatility is influenced by economic factors, market conditions, and company-specific events. Economic indicators like interest rates, inflation, unemployment levels, and GDP growth rates impact stock prices across the board. Market sentiment and overall conditions also play a significant role in stock volatility.

Additionally, company-specific factors such as financial performance, industry trends, competition, and regulatory changes can contribute to stock price movements. Understanding these factors helps investors anticipate potential price swings and make informed decisions based on thorough analysis.

| Economic Factors | Market Conditions | Company-Specific Factors |

|---|---|---|

| Interest rates | Investor sentiment | Financial performance |

| Inflation rates | Overall market conditions | Industry trends |

| Unemployment levels | Bullish and bearish markets | Competitive landscape |

| GDP growth rates | Regulatory changes |

By considering these factors collectively, investors can navigate the complexities of stock volatility and make well-informed decisions to achieve their investment goals.

Finding Volatile Stocks: Strategies and Tools

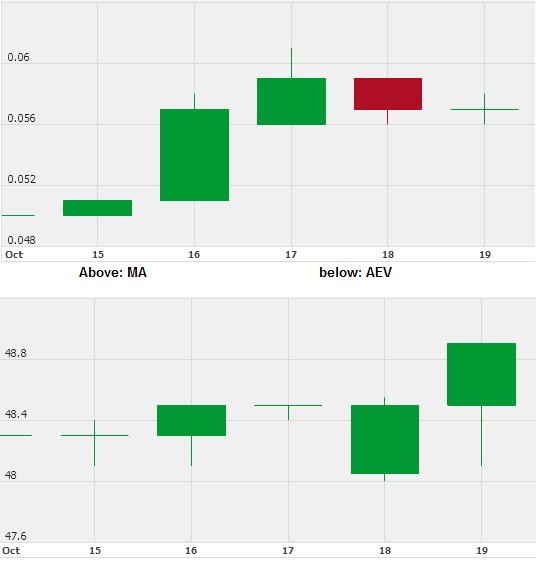

To identify volatile stocks, diligent research and analysis are essential. Two common strategies are technical analysis and fundamental analysis. Technical analysis involves studying historical price patterns, volume trends, and technical indicators to identify entry or exit points for trades.

Fundamental analysis evaluates a company’s financial health to determine its intrinsic value and potential opportunities. Staying updated with news, market trends, and investor sentiment is also crucial. Tools such as stock screeners and advanced charting software can streamline the search for volatile stocks.

By employing these strategies and tools, investors can navigate the stock market and uncover promising opportunities for growth or profit.

Investing in Volatile Stocks: Pros and Cons

Investing in volatile stocks can be both rewarding and risky. These stocks have the potential for high returns if timed correctly, allowing investors to capitalize on significant gains. Additionally, frequent price swings present opportunities for short-term traders.

However, investing in volatile stocks also comes with increased uncertainty and a higher risk of losses. It is crucial to assess your risk tolerance and investment goals before deciding if this aligns with your overall strategy.

Determining if Volatile Stocks are Right for You

Investing in volatile stocks can be a potentially rewarding but also risky endeavor. Before diving into this type of investment, it is essential to carefully evaluate several factors that will help determine whether volatile stocks align with your investment strategy and personal circumstances.

One crucial consideration is your risk tolerance. Assessing your ability to handle fluctuations in portfolio value without succumbing to impulsive decisions or excessive stress is paramount.

Volatile stocks can experience significant price swings within short periods, and if you find yourself constantly worried or making hasty trading choices based on these fluctuations, it may not be the right investment avenue for you.

Next, it’s important to assess your investment goals. Determine whether the potential risks and rewards associated with volatile stocks align with what you aim to achieve. If your objective is long-term growth and you have the patience to weather market ups and downs, volatile stocks might offer the potential for higher returns over time.

However, if stability and capital preservation are more important to you, other investment options may be better suited.

Consideration should also be given to your time horizon. Managing investments requires time and attention, but volatile stocks often demand even more active monitoring due to their unpredictable nature.

If you have limited availability or prefer a hands-off approach, investing in less volatile assets or utilizing a professional advisor might be a wiser choice.

By assessing these factors – risk tolerance, investment goals, and time horizon – you can make an informed decision regarding whether volatile stocks are suitable for your investment strategy.

Remember that investing always carries some level of risk; therefore, it’s crucial to thoroughly research and educate yourself before committing funds into any asset class.

| Factors |

|---|

| Risk Tolerance |

| Investment Goals |

| Time Horizon |

Managing Risk When Investing in Volatile Stocks

To mitigate risk when investing in volatile stocks, consider implementing the following strategies:

-

Diversification: Spread your investments across different sectors, industries, and asset classes to reduce risk by minimizing the impact of any single stock’s volatility on your overall portfolio.

-

Stop-Loss Orders: Place stop-loss orders to automatically sell a stock if it reaches a predetermined price level, limiting potential losses.

-

Risk Management Techniques: Establish a clear risk management plan that includes setting realistic profit targets and adhering to strict stop-loss levels to protect your capital.

By diversifying your portfolio, using stop-loss orders, and implementing effective risk management techniques, you can navigate the unpredictable nature of volatile stocks with more confidence and protect yourself from substantial financial loss.

Seeking Professional Advice: When Should You Consult an Expert?

Investing in volatile stocks can be complex and challenging. That’s why it’s wise to consult a financial advisor or investment professional. If you’re new to investing or lack confidence in navigating volatile markets, their expert guidance can help you make informed decisions.

During periods of extreme market volatility or uncertainty, seeking professional advice can assist in understanding risks and identifying opportunities. Their expertise gives you access to valuable knowledge and experience that can enhance your investment strategy and increase your chances of success.

[lyte id=’VC327ko8DfE’]