Gold has captivated humans for centuries, and its allure as a valuable asset remains strong to this day. From ancient civilizations to modern investors, gold has held a special place in our hearts and portfolios.

In this article, we will delve into the reasons behind gold’s significance, explore how it can provide stability during uncertain times, and introduce an innovative platform called Robinhood that has revolutionized the investing landscape.

Why gold has remained a valuable asset throughout history

Gold’s enduring value can be attributed to several factors. Firstly, gold is a scarce resource with limited supply, making it inherently valuable. Unlike paper currency or other assets that can be easily created or destroyed, the rarity of gold ensures its worth.

Additionally, gold is resistant to corrosion and decay over time, allowing it to retain its physical properties and desirability.

Furthermore, gold holds universal appeal across cultures and serves as a hedge against economic uncertainty. Its aesthetic beauty and symbolic significance have made it a cherished commodity throughout history. As a safe haven investment, gold provides stability during times of financial instability.

Lastly, advancements in technology have expanded the utility of gold beyond adornment. With applications in various industries like electronics and medicine, the demand for this versatile metal continues to grow.

The Cultural and Historical Significance of Gold

Gold has played a central role in human societies throughout history, holding immense cultural and historical significance. Used in jewelry, religious artifacts, and as a symbol of wealth and power, gold resonates with people today.

Its radiant beauty has adorned individuals across various civilizations, while its use in religious objects signifies purity and divinity. Furthermore, gold’s association with prosperity and influence remains strong, making it a sought-after asset for preserving wealth.

Overall, gold’s enduring allure represents our fascination with beauty, power dynamics, and the desire for prestige and luxury.

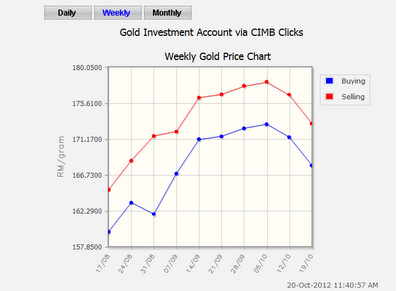

How Gold Investment Provides Stability During Uncertain Times

Investing in gold offers stability during uncertain economic periods. When stock markets fluctuate or currencies face instability, gold acts as a safe haven asset, retaining its value and often increasing when other investments decline.

Its scarcity and universal acceptance make it a reliable long-term investment option that can withstand economic fluctuations. Additionally, advancements in technology, such as platforms like Robinhood, have made investing in gold more accessible to all investors, regardless of experience level.

By understanding the benefits of gold investment, individuals can protect their wealth and diversify their portfolios during times of uncertainty.

Overview of the Robinhood Platform and Its Popularity Among Investors

The Robinhood platform has become incredibly popular among investors due to its commission-free trading and user-friendly interface. It allows users to buy and sell a variety of securities, including stocks, options, cryptocurrencies, and ETFs.

With its intuitive design and simplified approach to investing, Robinhood has attracted millions of users who appreciate the ease of investing without traditional brokerage fees. The platform’s accessibility as a mobile app enables investors to manage their portfolios conveniently from anywhere at any time.

Moreover, Robinhood provides real-time data, educational resources, and a social community where users can discuss investment strategies. These factors have contributed to the growing popularity of Robinhood among both beginner and experienced investors.

The User-Friendly Interface and Accessibility for Beginners

One of the standout features that sets Robinhood apart is its commitment to providing a user-friendly interface designed specifically with beginners in mind. The platform’s clean and intuitive layout simplifies the investment process, making it accessible to everyone, regardless of their level of financial expertise.

Robinhood understands that investing can be intimidating, especially for those who are new to the world of finance. That’s why they have placed great emphasis on creating an interface that is not only visually appealing but also easy to navigate.

With a few simple clicks, users can access all the necessary tools and information needed to make informed investment decisions.

Upon signing up for an account, users are greeted with a streamlined onboarding process that efficiently guides them through each step. From verifying personal information to linking bank accounts, Robinhood ensures that the setup process is seamless and hassle-free.

Once inside the platform, beginners will appreciate how Robinhood presents complex financial concepts in a way that is easy to understand.

Whether it’s exploring different stocks or learning about various investment options, Robinhood provides educational resources and explanations that empower beginners to confidently navigate the world of investing.

Executing trades on Robinhood is also a breeze. The platform offers a straightforward trading system where users can buy or sell stocks with just a few taps on their mobile devices or clicks on their desktops.

This simplicity eliminates any unnecessary complications and allows beginners to focus on what matters most – building their investment portfolio.

How Robinhood Disrupted the Traditional Investment Landscape

Robinhood’s elimination of trading commissions has disrupted the investment landscape. By offering commission-free trades, the platform leveled the playing field for retail investors and challenged established industry norms. With its user-friendly interface and mobile app, Robinhood made investing more accessible to a broader audience.

The platform’s simplicity and emphasis on education have attracted novice traders, empowering them to participate in the financial markets. Overall, Robinhood’s innovative business model has revolutionized investing, making it more inclusive and empowering for all.

Understanding the Importance of Portfolio Diversification

Portfolio diversification is a key strategy to minimize risk and maximize returns. By spreading investments across different asset classes, like stocks, bonds, real estate, and commodities, you can reduce exposure to any single investment.

Including gold in your portfolio enhances diversification because it behaves differently from traditional securities. Gold’s enduring value and limited supply make it a safe haven during market volatility or inflation. Its low correlation with other assets helps offset potential losses and provides stability.

Consult a financial advisor for guidance on how much gold to allocate based on your goals and risk tolerance. Diversifying with gold strengthens your portfolio and protects against market uncertainties.

Exploring the Benefits of Gold in Your Investment Mix

Gold has long been recognized as a hedge against inflation and economic instability, making it a valuable addition to any investment portfolio. While traditional currencies can lose value during periods of rising prices, gold has historically maintained its worth, safeguarding against wealth erosion caused by inflation.

Additionally, gold provides an opportunity to balance risk and potentially achieve more stable returns within your portfolio. When economic uncertainty or market volatility strike, stocks and bonds often suffer significant declines. In contrast, gold tends to experience increased demand during these times, leading to potential price appreciation.

By including gold in your investment mix, you can effectively diversify your portfolio and reduce exposure to riskier assets.

To begin investing in gold through the user-friendly Robinhood platform, follow these steps:

- Download the Robinhood app.

- Create an account and verify your identity.

- Link your bank account for easy funding and access to profits.

- Set up Two-Factor Authentication (2FA) for added security.

- Deposit funds into your Robinhood account.

Incorporating gold into your investment mix through Robinhood offers the potential benefits of hedging against inflation and economic instability while balancing risk within your portfolio. Remember to conduct thorough research and seek advice from qualified professionals before making any investment decisions that align with your financial goals.

[lyte id=’waJcGflXq8k’]