Investing in the stock market can be overwhelming, especially with the countless options available. However, Exchange-Traded Funds (ETFs) have emerged as a popular choice for investors looking to diversify their portfolios.

In this article, we will explore one specific ETF that is gaining attention in the investing world – the Global X Uranium ETF stock.

Explaining the Concept of an ETF

An exchange-traded fund (ETF) is an investment vehicle that offers a convenient way to access a range of assets. By pooling investors’ money, an ETF can hold various investments like stocks, bonds, or commodities. It provides instant diversification and flexibility as investors can buy and sell shares on stock exchanges throughout the trading day.

ETFs also offer transparency, tax efficiency, and often have lower expense ratios compared to mutual funds. Overall, ETFs are popular among individuals and institutions seeking cost-effective portfolio diversification.

Introducing the Global X Uranium ETF stock

The Global X Uranium ETF (ticker symbol: URNM) allows investors to gain exposure to the global uranium industry. This ETF focuses on companies involved in uranium mining and nuclear energy production, providing a diversified portfolio of stocks in this sector.

With URNM, individuals can invest indirectly in various companies within the global uranium industry, benefiting from the potential growth of this vital energy source.

As an exchange-traded fund, URNM offers flexibility and liquidity, allowing investors to buy or sell shares throughout market hours. The fund aims to track the Solactive Global Uranium & Nuclear Components Total Return Index, which includes companies engaged in all aspects of the uranium industry.

Investing in the Global X Uranium ETF provides diversification across different geographic regions and helps mitigate risks associated with individual company performance or geopolitical factors affecting specific regions.

With its focus on thematic investment solutions and expertise from Global X, URNM presents an efficient way for individuals to access this growing sector.

In summary, the Global X Uranium ETF (URNM) offers investors a convenient vehicle to participate in the global uranium industry by providing exposure to a diversified portfolio of companies involved in uranium mining and nuclear energy production.

Benefits of Investing in the Global X Uranium ETF

The Global X Uranium ETF offers significant advantages for investors. It provides exposure to a niche sector with high growth potential due to increasing global demand for nuclear energy. The ETF diversifies investments by including various companies from different regions and segments of the uranium industry.

Additionally, it offers liquidity and easy access to buy or sell shares on major stock exchanges throughout the trading day. With low management fees, this ETF is a cost-effective option for investors looking to maximize returns while minimizing expenses.

Overall, the Global X Uranium ETF presents a compelling investment opportunity in the uranium market.

Performance and Key Metrics of the Global X Uranium ETF

Understanding the performance and key metrics of the Global X Uranium ETF is essential for evaluating its investment potential. This exchange-traded fund has consistently delivered strong returns due to increasing interest in nuclear energy.

Analyzing its historical performance, expense ratio, average annual return, volatility measures, and assets under management can provide valuable insights into its profitability and risks. By considering these factors, investors can make informed decisions about investing in this ETF.

Analysis of Asset Allocation and the 60/40 Portfolio Strategy

The Global X Uranium ETF’s asset allocation strategy can impact its performance and risk profile. We will explore how it aligns with the traditional 60/40 portfolio strategy, which involves a mix of 60% stocks and 40% bonds.

Understanding this alignment helps investors assess if the ETF complements their portfolio or serves as a standalone investment.

The Global X Uranium ETF contributes to fixing the 60/40 portfolio by introducing diversification. By including exposure to uranium-related stocks, it offers potential gains from the growing uranium sector. This specialized sector adds an additional element to traditional portfolios, potentially enhancing performance.

Investors should consider their risk tolerance and goals before including the Global X Uranium ETF in their 60/40 portfolio. While it offers potential for higher returns, volatility and geopolitical factors can affect the uranium sector.

Including Uranium Stocks for Portfolio Diversification

Diversifying an investment portfolio is essential for managing risk and potentially enhancing returns. One way to achieve diversification is by including uranium stocks in a traditional 60/40 portfolio.

Uranium stocks offer exposure to a sector that operates independently from traditional equities and bonds, providing uncorrelated returns. The Global X Uranium ETF serves as an accessible vehicle for investing in this asset class.

By incorporating uranium stocks, investors can tap into the growing demand for nuclear energy and support sustainable development goals. This alternative asset class offers the potential for both financial gains and contributions to clean energy initiatives.

Including uranium stocks in a portfolio goes beyond conventional investments, offering unique opportunities for diversification and participation in a sector driven by its own market dynamics.

Overall, adding uranium stocks to a traditional 60/40 portfolio can provide investors with valuable diversification benefits and potential exposure to a promising industry.

Exploring the Potential Benefits and Risks of Adding Uranium Stocks to a Portfolio

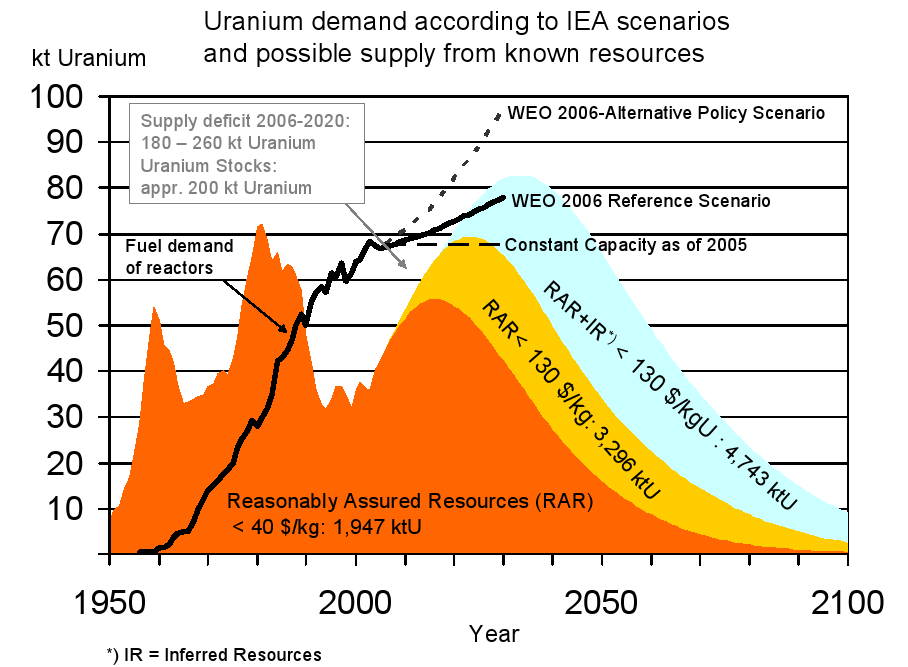

Investing in uranium stocks can offer potential benefits, but it’s essential to consider the associated risks. On the upside, including uranium stocks in a portfolio provides an opportunity for substantial returns due to the resilient demand for nuclear energy.

As countries seek cleaner energy alternatives, the demand for nuclear power is expected to rise, potentially driving up the value of uranium stocks.

However, there are risks to be aware of as well. Market volatility can lead to price fluctuations in uranium stocks, making stable returns challenging. Additionally, regulatory uncertainty within the nuclear industry can impact stock performance, as changes in regulations or delays in obtaining permits may affect profitability.

To navigate these risks effectively, investors should conduct thorough research on individual companies and consider alternative investments like exchange-traded funds (ETFs) focused on uranium for diversified exposure.

By carefully weighing both the benefits and risks associated with adding uranium stocks to a portfolio, investors can make informed decisions about their investment strategies.

Detailed Breakdown of Companies in the Fund’s Portfolio

To truly grasp the Global X Uranium ETF, it’s important to analyze its underlying holdings. This section provides a thorough breakdown of the companies within the fund’s portfolio, highlighting their weightings and significance in the uranium industry.

The Global X Uranium ETF includes notable companies like Cameco Corporation (NYSE: CCJ), known for its extensive mining operations in Canada and Kazakhstan. NexGen Energy Ltd (NYSE: NXE) is another prominent inclusion with its high-grade uranium resources and growth potential from the Arrow deposit in Canada.

Denison Mines Corp (NYSE: DNN) also adds value with its diverse asset base and commitment to sustainable practices.

Additional companies featured in this diversified portfolio include Energy Fuels Inc (NYSE: UUUU), Forsys Metals Corp (TSX: FSY), and Uranium Participation Corporation (TSX: U). Each contributes unique strengths to the fund, providing investors exposure to different segments of the uranium industry.

While these company weightings may change over time, monitoring their performance is crucial for investors interested in exploring opportunities within the uranium sector.

By understanding the breakdown of these companies in the Global X Uranium ETF’s portfolio, investors can make informed decisions and potentially benefit from this diversified investment vehicle.

[lyte id=’djAkpTPgHWU’]