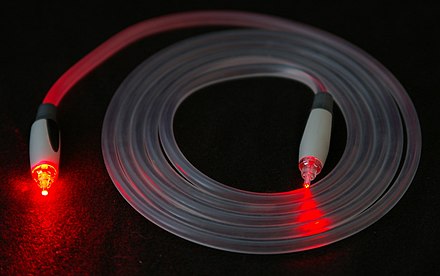

Fiber optic technology is revolutionizing communication networks with its reliable and high-speed capabilities. Unlike traditional copper wires, fiber optics transmit data using light pulses over long distances with minimal signal loss.

These ultra-thin strands of glass or plastic offer unparalleled speed, capacity, and low latency, making them ideal for various industries. From telecommunications to healthcare and finance, fiber optics have transformed the way we communicate, work, and conduct business in our interconnected world.

With its superior bandwidth and efficiency, fiber optic technology is shaping the future of communication technology.

Importance of Fiber Optic Technology in the Modern World

Fiber optic technology has revolutionized various sectors, including telecommunications, healthcare, finance, and entertainment. Its higher bandwidth capabilities allow for faster internet speeds, improved video streaming quality, and seamless data transmission.

It has bridged the digital divide by providing high-speed internet access to remote areas, empowering individuals with educational resources and unlocking economic opportunities. In addition, fiber optics have transformed the entertainment industry by enabling high-definition content delivery without buffering.

Overall, fiber optic technology has created a more connected world and facilitated advancements in communication and data transfer capabilities across industries.

What are fiber optic company stocks?

Investing in fiber optic company stocks means buying shares in companies that develop and manufacture fiber optic technology. These companies produce cables, networking equipment, and components for telecommunications infrastructure.

Fiber optic company stocks offer a chance to benefit from the increasing demand for high-speed internet and data transmission. As more industries rely on fiber optics, investing in these companies can be profitable with potential for significant returns.

The global need for faster internet connections has driven the growth of fiber optic technology. It offers advantages like higher bandwidth and longer transmission distances. This makes it the preferred choice for telecommunications networks and data centers.

Companies involved in fiber optics play a crucial role in developing advanced solutions for seamless communication across various industries. Investing in them allows individuals to capitalize on the widespread adoption of fiber optics worldwide.

Telecommunication networks are a prime area where fiber optics is gaining traction. With the rise of smartphones, streaming services, and IoT devices, telecom companies deploy fiber optic infrastructure to enhance network capacity and provide faster speeds.

Other sectors such as healthcare, finance, transportation, and energy also use fiber optics to improve operations. Hospitals share medical records quickly through optical networks, while financial institutions rely on fast data transmission for seamless transactions.

In summary, investing in fiber optic company stocks enables participation in a growing market driven by the demand for high-speed internet and reliable data transmission. These companies are well-positioned to take advantage of opportunities as the industry expands.

With technological advancements and diverse sector needs, they offer promising potential for investors seeking long-term returns.

Why Consider Investing in Fiber Optic Company Stocks?

Investing in fiber optic company stocks is a compelling opportunity due to the industry’s rapid growth driven by increasing demand for high-speed internet and advanced communication networks. By diversifying investments within this sector, investors can capitalize on the growth potential of different companies involved in fiber optic technology.

Additionally, aligning portfolios with future trends and technological advancements allows investors to benefit from society’s increasing reliance on digital infrastructure. However, it is important to conduct thorough research and analysis as there are risks associated with market volatility, competition, and technological advancements.

Overall, investing in fiber optic company stocks offers the potential for significant returns in a rapidly expanding industry.

Exploring the Growth Potential of the Fiber Optic Market

The fiber optic market has seen significant growth in recent years and shows immense potential for further expansion. With increasing internet usage, rising demand for high-speed data transmission, and widespread adoption across various industries, fiber optics is becoming indispensable in our communication networks.

According to a report by Market Research Future, the global fiber optic market is projected to reach USD 9.12 billion by 2023, growing at a CAGR of 10%.

This growth is driven by factors such as the exponential increase in data consumption from streaming services and social media, as well as the need for real-time data transfer and advanced analytics in sectors like healthcare, finance, and manufacturing.

Additionally, the rapid adoption of IoT devices and smart technologies necessitates robust and scalable communication networks. Fiber optics can handle the massive amounts of data generated by these devices while maintaining low latency and high reliability.

As countries invest in upgrading their communication infrastructure, the demand for fiber optic technology is set to soar. The growth potential lies in meeting the increasing need for high-speed internet connectivity and advanced communication networks across sectors.

Key Players in the Fiber Optic Industry

The fiber optic industry is dominated by major companies with extensive expertise and market presence. Corning Incorporated (GLW) is a renowned manufacturer of optical fibers, contributing significantly to the advancement of fiber optic technology.

Lumentum Holdings (LITE) specializes in optical networking components used for high-speed data transmission.

Emerging players like Ciena Corporation and CommScope Holdings (COMM) are also making waves in the industry. Ciena focuses on advanced networking solutions to meet growing bandwidth requirements, while CommScope offers a comprehensive range of network infrastructure products.

These key players demonstrate the potential for growth and disruption within the fiber optic industry, creating attractive investment opportunities. Their innovative technologies are shaping the future of communication systems worldwide.

Advantages of Investing in Fiber Optic Company Stocks

Investing in fiber optic company stocks offers attractive returns due to their high growth potential. As the global demand for high-speed internet and data transmission continues to rise, fiber optic companies thrive and generate lucrative opportunities for investors.

These stocks also provide diversification within the technology sector, allowing investors to spread risk and take advantage of multiple growth avenues. With the increasing reliance on digital technologies across industries, the growing need for high-speed connectivity positions fiber optic companies to benefit from this expanding market.

Overall, investing in fiber optic company stocks presents a promising opportunity to capitalize on the future of connectivity.

Risks Associated with Investing in Fiber Optic Company Stocks

Investing in fiber optic company stocks comes with its fair share of risks. The stock market can be volatile, influenced by factors like economic conditions and industry trends. Short-term price fluctuations are common, so it’s important to focus on long-term growth prospects rather than getting caught up in market ups and downs.

The fiber optic industry is highly competitive, with technological advancements and changing customer preferences posing challenges for established companies. It’s essential to evaluate a company’s competitive advantages, innovation capabilities, and ability to adapt to market dynamics before making investment decisions.

Regulatory changes can also impact the fiber optic industry, so staying informed about potential legislation is crucial. Additionally, macroeconomic factors like global economic downturns can affect the performance of fiber optic stocks as businesses may reduce technology infrastructure spending during uncertain times.

Lastly, individual company risks such as poor management decisions or financial instability should be taken into account. Diversification across different segments or regions is recommended to spread risk and take advantage of various growth opportunities.

In summary, being aware of the volatility in the stock market, evaluating a company’s competitiveness and adaptability, monitoring regulatory changes, considering macroeconomic factors, and diversifying investments are all important strategies for mitigating risks when investing in fiber optic company stocks.

[lyte id=’5TVUmX1B0FI’]