Fast food has become an integral part of our modern lifestyle. From grabbing a quick bite on the way to work to indulging in a guilty pleasure during weekends, fast food has captured our taste buds and wallets.

But have you ever considered that it could also be a lucrative investment opportunity? In this article, we will explore the enticing world of fast food stocks and why they are worth your attention as an investor.

The Allure of Fast Food Stocks: Why They’re Worth Your Attention

Investing in fast food companies offers several advantages that make them highly attractive to investors. Firstly, the consistent demand for their products ensures a steady stream of revenue, regardless of economic conditions.

Secondly, well-established brands like McDonald’s and KFC have a global presence, providing security and potential for expansion into new markets. Lastly, these companies continuously innovate and adapt to meet evolving consumer preferences. By staying ahead of trends, they maintain relevance and attract new customers.

Overall, fast food stocks present an enticing opportunity for investors seeking stability and growth potential.

Bite-Sized Profits: How to Identify Promising Fast Food Investment Opportunities

To identify promising fast food investment opportunities, thorough research is essential. Consider evaluating the financial performance and stability of potential companies, assessing their brand recognition and reputation, and examining market competition and growth potential.

Analyze factors such as revenue growth, profitability, debt levels, customer perceptions, market positioning, and future revenue drivers. By carefully considering these factors, investors can increase their chances of reaping substantial returns in the fast food industry.

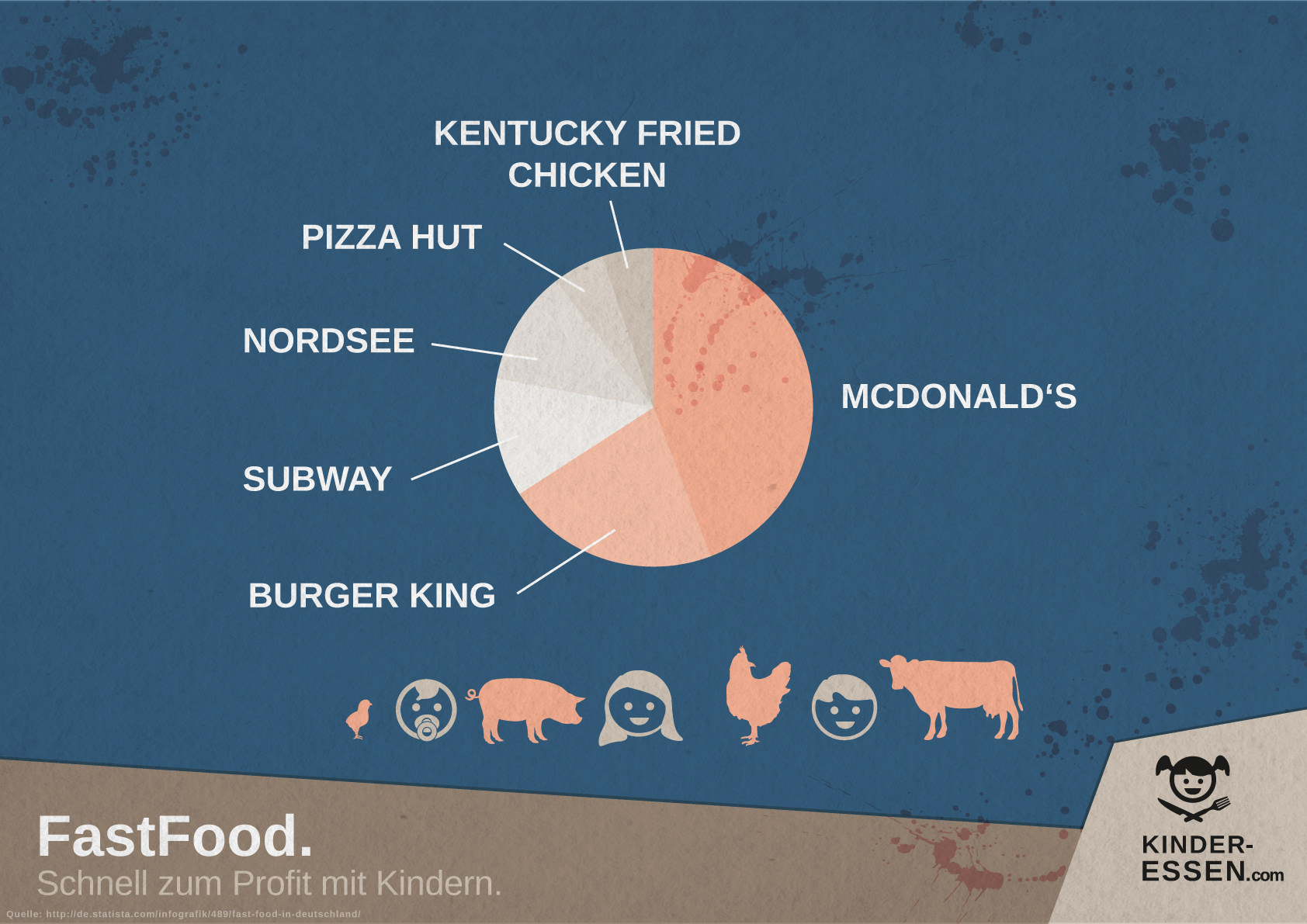

Golden Arches or Whopper? Comparing Major Players in the Fast Food Market

McDonald’s and Burger King are two major players in the fast food market. McDonald’s is a global behemoth with nearly 40,000 locations worldwide. It excels in brand recognition, operational efficiency, diverse menu options, and continuous innovation.

However, it faces challenges such as changing consumer preferences and increased competition from emerging fast-casual chains.

Burger King, although not as widespread as McDonald’s, has a loyal customer base and a distinct brand identity. Known for its flame-grilled burgers and iconic Whopper sandwich, Burger King offers growth potential through expansion into new markets and embracing digital advancements.

But it also faces intense competition from other fast food giants and the need for continuous innovation to stay relevant.

Both companies have their strengths and weaknesses. McDonald’s dominates with its global presence, while Burger King sets itself apart with its unique flavor profile. Investors should carefully consider these factors before making any investment decisions in this dynamic industry.

| McDonald’s | Burger King | |

|---|---|---|

| Strengths | Global brand recognition, operational efficiency | Distinct flavor profile |

| Weaknesses | Changing consumer preferences towards healthier options | Intense competition |

| Opportunities | Continuous innovation | Expansion into new markets |

| Challenges | Increased competition from emerging fast-casual chains | Need for continuous innovation |

From Drive-Thrus to Doorsteps: Exploring Technological Advancements in Fast Food

Technology has revolutionized the fast food industry, transforming how companies operate and engage with customers. Two significant advancements include online ordering platforms and delivery services, which offer convenience and increased accessibility.

Fast food chains that embrace these technologies benefit from expanded customer reach and personalized experiences. Integrating artificial intelligence enables tailored promotions and menu suggestions based on individual preferences, enhancing customer satisfaction while providing valuable data for operational optimization.

These advancements have reshaped the fast food landscape, making it easier for customers to order their favorite meals and improving overall dining experiences.

The Franchise Phenomenon: Expanding Opportunities in Fast Food Investments

Franchising in the fast food industry presents unique investment opportunities. Burger franchises like Five Guys and Shake Shack offer established brand recognition and ongoing support. Fried chicken franchises like KFC and Popeyes tap into a dedicated global fan base.

Sandwich franchises such as Subway and Jimmy John’s cater to health-conscious consumers. Pizza franchises like Domino’s and Pizza Hut capitalize on the enduring popularity of pizza. Explore these franchise options for a chance to enter the thriving fast food market.

The Risks on the Menu: Potential Pitfalls to Watch Out For

Investing in fast food stocks carries risks that investors should be aware of. Two key factors are changing consumer preferences and rising costs.

Fast food companies need to adapt their menus to cater to evolving consumer tastes for healthier options. Failure to do so can result in a loss of market share and declining profits. Investors should monitor how companies respond to changing preferences and stay competitive in the industry.

Rising costs, including ingredients, labor, and real estate, can eat into profit margins if not managed effectively. Investors should assess a company’s ability to navigate these challenges while maintaining profitability over the long term.

By addressing changing consumer preferences and managing rising costs, fast food companies can mitigate risks and offer potential returns for investors.

The Recipe for Success: Tips for Building a Profitable Fast Food Investment Portfolio

To build a profitable fast food investment portfolio, consider these tips:

Diversify your investments: Spread your risk by investing in a mix of fast food stocks across different industry segments.

Stay informed: Keep up with emerging market opportunities, changing consumer preferences, and technological advancements that could impact the industry.

Seek professional advice: Consult financial advisors who specialize in the restaurant sector to gain valuable insights and navigate the complexities of fast food investments.

By following these strategies, you can increase your chances of success and build a profitable fast food investment portfolio.

Conclusion: Savoring the Potential Returns of Fast Food Investments

[lyte id=’ShhFdWrPJ-E’]