Investing is a complex and ever-evolving field that requires careful planning and consideration. One key aspect of investing that often goes overlooked is insurance. While insurance may not seem directly related to investing, it plays a crucial role in protecting your investments and minimizing financial risks.

That’s where EverQuote Insurance comes in, providing investors with a trusted tool to navigate the world of insurance.

What is EverQuote Insurance?

EverQuote Insurance is an online marketplace connecting individuals with reputable insurance providers. Their platform allows users to compare quotes from multiple companies, ensuring they find the best policy for their needs. Insurance serves as a safety net, protecting investments from unforeseen events like accidents or natural disasters.

By understanding the importance of insurance coverage, individuals can make informed decisions that safeguard their financial well-being.

The Need for a Reliable Point of Contact

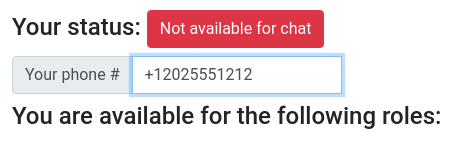

Having a reliable point of contact is crucial for investors, as it ensures accessibility, convenience, personalized assistance, and guidance. When it comes to insurance matters, the EverQuote Insurance phone number serves as an invaluable resource in meeting these needs.

The ability to reach out to a trusted source at any time is essential for investors. With the EverQuote Insurance phone number readily available, assistance is just a call away. Whether you are on the move or at your desk, having direct access to experts provides peace of mind and saves valuable time.

No longer do investors have to wait for email responses or navigate through automated systems; they can now connect directly with knowledgeable representatives who are ready to address their questions or concerns promptly.

Investing in insurance can be overwhelming due to its complexities. However, by utilizing the EverQuote Insurance phone number, investors gain access to personalized assistance tailored to their unique needs and goals. A knowledgeable representative can guide them through various options based on their investment objectives and risk tolerance.

This personalized approach ensures that investors receive recommendations that align with their financial aspirations and help them make informed decisions about which insurance policies best suit their circumstances.

In summary, having a reliable point of contact is indispensable for investors seeking insurance solutions. The EverQuote Insurance phone number offers accessibility and convenience by being readily available whenever assistance is required.

Moreover, it provides personalized support from experts who can offer guidance based on individual investment goals and risk tolerance levels. By utilizing this valuable resource, investors can navigate the complexities of insurance policies with confidence and achieve financial peace of mind.

| Benefits |

|---|

| – Accessibility and Convenience |

| – Personalized Assistance and Guidance |

Finding the Right Insurance with EverQuote

When it comes to protecting your investments, finding the right insurance is essential. With EverQuote, you can easily find the coverage you need to safeguard your hard-earned assets.

Whether it’s protecting against unforeseen events like accidents or natural disasters or minimizing financial risks associated with investing, EverQuote offers a wide range of policies tailored to your specific needs.

Their user-friendly platform and knowledgeable team make the process simple and efficient, giving you peace of mind as you navigate the world of investing. Trust in EverQuote to secure a brighter future for your investments today.

How to Use EverQuote Insurance Phone Number

When it comes to utilizing EverQuote Insurance’s phone number, the process is straightforward and efficient, providing investors with access to expert advice and support. By following a few simple steps, individuals can tap into the wealth of knowledge offered by EverQuote’s experienced professionals.

To get started, simply dial the number provided by EverQuote. This will connect you with an agent or representative who specializes in investment-related insurance. These knowledgeable professionals are well-equipped to guide you through the insurance options that align with your specific needs and circumstances.

Once connected, be prepared to provide necessary information about your investments and personal circumstances. This information will help the agent create a personalized insurance quote tailored to your unique situation.

By sharing details such as your investment portfolio and any relevant personal factors, you enable the agent to offer you the most suitable coverage options.

By using EverQuote Insurance’s phone number in this manner, investors gain direct access to experts who can provide valuable insights and recommendations for their insurance needs.

Whether you are looking for coverage for your investments or seeking advice on how best to protect your financial assets, EverQuote’s professionals are here to assist you every step of the way.

In summary, leveraging EverQuote Insurance’s phone number is a simple yet effective way for investors to access expert advice and support regarding their insurance needs.

By following these steps and engaging with knowledgeable agents or representatives, individuals can obtain personalized quotes and tap into the extensive knowledge base offered by EverQuote’s experienced professionals.

Benefits of Using EverQuote Insurance Phone Number

Having a reliable insurance phone number like EverQuote’s can provide numerous benefits for investors. One of the key advantages is quick access to expert advice and support.

By connecting with an EverQuote representative, investors gain immediate access to professionals who can provide tailored advice based on their investment goals and risk tolerance. This ensures that informed decisions are made when selecting insurance options, effectively protecting investments.

Furthermore, utilizing the EverQuote Insurance phone number saves both time and effort when comparing insurance quotes. Comparing quotes from different providers can be a time-consuming and overwhelming task for investors who are already busy managing multiple responsibilities.

However, with EverQuote’s extensive network of insurance providers, investors can receive multiple quotes within minutes, eliminating the need for individual research. This efficient process allows investors to save valuable time and effort, enabling them to focus on what matters most – growing their investments.

In addition to saving time, using the EverQuote Insurance phone number also offers the benefit of receiving recommendations tailored to individual needs. These personalized recommendations enable investors to choose insurance policies that align with their long-term investment strategies.

By selecting policies that cater specifically to their requirements, investors can ensure they have adequate coverage while maximizing their potential returns.

Overall, utilizing the EverQuote Insurance phone number provides convenience and efficiency for investors in managing their insurance needs.

The quick access to expert advice, time-saving comparison of quotes, and personalized recommendations all contribute to making informed decisions that protect investments effectively while allowing individuals to focus on growing their financial portfolios.

Tips for Maximizing Your Experience with EverQuote

To make the most out of using EverQuote’s insurance phone number, consider the following tips:

- Have necessary information ready before making the call. This includes details about your investments, personal circumstances, and any specific requirements you may have.

- Ask questions and clarify any doubts during the conversation. The representative is there to assist you and address any concerns you may have.

- Take notes for future reference and comparison. Keeping track of the information provided allows you to make an informed decision when selecting an insurance policy.

By following these tips, you can ensure a seamless experience when utilizing EverQuote’s insurance phone number.

Frequently Asked Questions about EverQuote Insurance Phone Number

When it comes to providing personal information over the phone, rest assured that EverQuote takes privacy and security seriously. They have robust measures in place to protect your data.

You can trust the quotes provided by EverQuote as they work with reputable insurance providers to ensure accuracy.

If you have specific requirements or unique circumstances, the experienced representatives at EverQuote will take them into account when providing recommendations.

EverQuote is committed to helping you find reliable insurance coverage that meets your unique needs.

Conclusion: Empowering Investors with EverQuote Insurance

Investing in the financial market is a brave endeavor that often comes with its fair share of risks and uncertainties. However, in the face of these challenges, investors can find solace and confidence by utilizing the powerful tools offered by EverQuote Insurance.

By providing a convenient phone number, EverQuote Insurance enables investors to navigate the complexities of insurance coverage with ease. This direct line of communication grants quick access to expert advice, personalized assistance, and a vast network of reputable insurance providers.

With EverQuote Insurance by your side, you can safeguard your long-term investment strategy against unforeseen events and minimize potential financial risks. The right insurance coverage acts as a shield, protecting your hard-earned investments from unexpected circumstances that could otherwise jeopardize your financial stability.

Don’t hesitate to explore the valuable resources that EverQuote offers to cater to all your insurance needs. Their expertise and commitment ensure that you have access to comprehensive coverage options tailored specifically for investors like yourself.

By leveraging the convenience and reliability provided by EverQuote Insurance, you empower yourself as an investor in an ever-evolving market landscape.

As you embark on your investment journey, remember that knowledge is power. Educate yourself about different insurance policies and their significance in various investment scenarios. With EverQuote Insurance’s guidance, you can make informed decisions about protecting your investments while keeping an eye on future growth opportunities.

[lyte id=’WPNAfpUt9Yc’]