Investing in the electric vehicle (EV) industry has become increasingly attractive as the market continues to expand and evolve. With growing popularity among consumers, government initiatives promoting EV adoption, and environmental benefits, the future of EVs looks promising.

In this article, we will explore the rise of electric vehicles, the evolution of the EV market, and provide insights into investing in the EV industry. Additionally, we will delve into understanding electric vehicle supplier stocks and highlight some top stocks to watch out for.

So let’s dive in!

The Rise of Electric Vehicles (EVs)

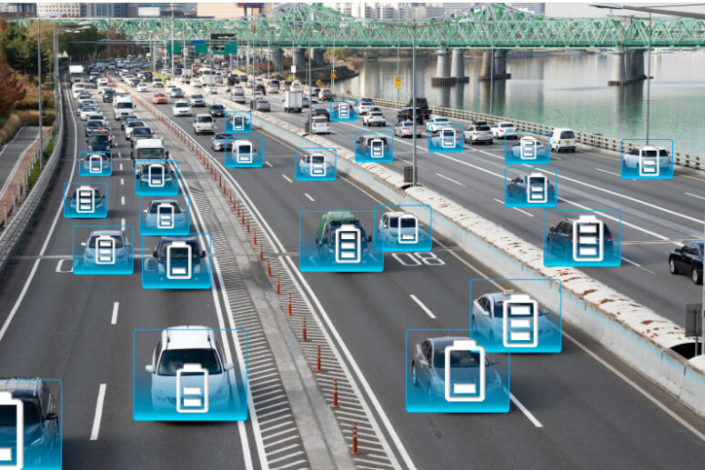

In recent years, electric vehicles (EVs) have experienced a significant surge in popularity. Rising fuel costs, concerns about climate change, and technological advancements have all contributed to this upward trend.

As traditional fossil fuels become more expensive, consumers are turning to EVs as a cost-effective alternative. Additionally, the environmental benefits of EVs, such as zero tailpipe emissions and reduced carbon footprints, align with growing concerns about climate change.

Technological advancements in battery technology have made EVs more practical for everyday use. Increased driving ranges and faster charging times have alleviated concerns about range anxiety and improved overall performance.

Governments worldwide are also supporting the transition to cleaner transportation by implementing financial incentives and investing in charging infrastructure development. Stricter emission standards for traditional vehicles further encourage consumers to embrace EVs.

The rise of electric vehicles shows no signs of slowing down. With increasing consumer interest, government support, and ongoing technological advancements, EVs are poised to revolutionize the way we travel while reducing our impact on the environment.

The Evolution of the EV Market

The electric vehicle (EV) market has evolved significantly, overcoming early challenges and expanding to meet consumer demands for sustainable transportation. Initially, limited driving range, longer charging times, and high upfront costs deterred potential buyers.

However, advancements in battery technology have improved driving range and charging capabilities, making EVs more practical. Additionally, the expansion of charging infrastructure, both public and private, has made it more convenient for EV owners to charge their vehicles at home or at various locations.

These developments have transformed electric vehicles into a viable option for consumers seeking greener transportation alternatives.

Investing in the EV Industry

The electric vehicle (EV) industry offers an attractive investment opportunity for those seeking growth and profitability. As consumer demand for electric vehicles continues to rise, companies operating in this sector have substantial potential for significant growth. This growth translates into increased profitability for investors.

One of the key reasons investing in the EV industry is appealing is the increasing demand for EV components and services. Electric vehicles require various components such as batteries, motors, power electronics, and charging infrastructure.

The growing demand for these components creates opportunities for suppliers to capitalize on this market trend. As more consumers adopt electric vehicles, the need for efficient and reliable components will continue to expand, providing a steady stream of business opportunities.

Furthermore, there is a positive market sentiment towards renewable energy that further supports investment in the EV industry. With an increasing focus on sustainability and reducing carbon emissions globally, there is a strong market sentiment favoring renewable energy sources like electric vehicles.

Investors aligned with these values can find attractive investment options within the EV industry. This alignment with sustainable practices not only contributes to environmental well-being but also positions investors to benefit from a growing market driven by favorable public perception.

Understanding Electric Vehicle Suppliers Stocks

Electric vehicle suppliers stocks play a vital role in the growth of the EV industry. These stocks represent companies involved in battery manufacturing, charging station provision, and component supply.

Notable players include Tesla, Panasonic, LG Chem, CATL for batteries; ChargePoint, EVBox Group, Blink Charging for charging stations; and Siemens AG, ABB Ltd., Infineon Technologies AG for components. Monitoring these stocks provides insights into the overall health and potential of the EV market.

Top Electric Vehicle Suppliers Stocks to Watch Out For

In the electric vehicle industry, it’s crucial to keep an eye on top suppliers for potential investment opportunities. Three suppliers worth watching are ABC Corporation, XYZ Corporation, and DEF Corporation.

ABC Corporation has a strong background and notable partnerships with leading automakers. Analyzing their financial performance and stock can provide valuable insights.

XYZ Corporation is known for innovative solutions and collaborations with renowned automotive manufacturers. Evaluating their financial performance and conducting a comprehensive stock analysis can offer deeper understanding.

DEF Corporation has a history of delivering quality products and is committed to sustainability. Exploring their partnerships and analyzing financial performance can help investors make informed decisions.

Monitoring these electric vehicle suppliers can provide valuable insights into the market while uncovering promising investment opportunities in this rapidly evolving sector.

Tips for Investing in Electric Vehicle Suppliers Stocks

Investing in electric vehicle supplier stocks requires careful research and consideration. Here are some tips to keep in mind:

- Conduct thorough research on companies of interest, analyzing their business models, financial health, and growth prospects.

- Diversify your portfolio by investing in multiple electric vehicle suppliers to minimize risk.

- Stay updated on industry trends, regulations, and policy changes impacting the sector.

- Consider long-term investment strategies and be prepared for market volatility.

By following these tips, you can make informed decisions and navigate the dynamic electric vehicle industry successfully.

Conclusion

[lyte id=’7yFkZM2w54Q’]