Investing in the stock market has become increasingly popular, with more and more individuals seeking opportunities to grow their wealth. If you’re considering entering the world of investing, you’ve likely come across E*TRADE as a leading online brokerage platform.

Known for its user-friendly interface, wide range of investment options, and cutting-edge technology features, E*TRADE has earned a strong reputation in the industry.

But what if you’re looking for alternatives to E*TRADE? In this article, we’ll explore similar companies that offer competitive services to help you make informed investment decisions.

From Fidelity Investments to TD Ameritrade and Charles Schwab, we’ll dive into the strengths and weaknesses of each platform to assist you in finding the best fit for your investment needs.

Why E*TRADE is a Popular Choice for Investors

ETRADE has established itself as a leading choice among investors for several compelling reasons. With a history spanning back to 1982, ETRADE is widely recognized as one of the pioneers in online trading.

This extensive experience has allowed the platform to build a solid reputation for reliability and trustworthiness, which is highly valued by investors seeking stability in their investment journey.

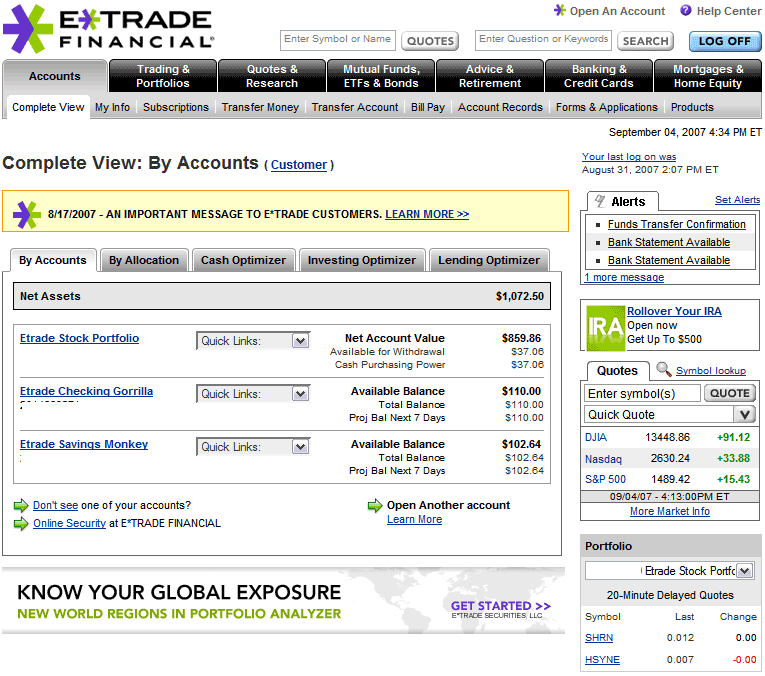

One of the standout features of ETRADE is its user-friendly interface and advanced technology offerings. Regardless of your level of expertise, navigating through ETRADE’s intuitive platform design is effortless.

The platform provides a seamless and enjoyable trading experience, with features such as real-time quotes, customizable charts, and comprehensive research materials readily available. These tools empower investors to make informed decisions and stay on top of market trends.

Furthermore, ETRADE caters to the diverse needs and preferences of investors by offering a wide range of investment options. Whether you’re interested in stocks, bonds, options, or futures, ETRADE has you covered. The platform enables investors to create a well-rounded portfolio that aligns with their risk appetite and investment goals.

Additionally, E*TRADE provides access to both domestic and international markets, allowing investors to explore opportunities beyond their local markets.

In summary, it’s easy to understand why E*TRADE remains a popular choice for investors. Its long-standing presence in the industry coupled with its user-friendly interface and robust technology features make it an attractive option for both beginners and experienced traders alike.

Furthermore, the wide range of investment options available on ETRADE ensures that investors can find opportunities that suit their individual preferences. As such, it comes as no surprise that many investors continue to place their trust in ETRADE when it comes to their financial future.

Exploring Similar Companies to E*TRADE

When it comes to online brokerage firms, E*TRADE is undeniably popular. However, it’s important to explore other companies in the market that offer similar services. These alternative options provide investors with a diverse landscape, offering different pricing structures, tools, and features that may align better with their investment style.

To make an informed decision about which platform suits your needs best, it’s crucial to compare and contrast the fees and commissions charged by these similar companies. While E*TRADE may have competitive rates, exploring how other platforms stack up in terms of cost-effectiveness is essential.

Understanding the fee structures of different brokerage firms ensures that your investments remain profitable.

Beyond fees, analyzing the strengths and weaknesses of each company is equally important. Some platforms excel in customer service, providing exceptional support for investors. Others prioritize advanced trading tools or offer extensive educational resources.

Evaluating these aspects allows you to determine which factors matter most to you as an investor.

It’s worth noting that while ETRADE has established itself as a popular choice among investors, there are several other online brokerage firms* worth considering. These alternatives present unique offerings and advantages that may suit your specific investment goals better.

By exploring similar companies to E*TRADE and delving into their fee structures and overall strengths and weaknesses, you can make a well-informed decision about which platform aligns best with your needs as an investor.

| Aspect | Consideration |

|---|---|

| Fees & Commissions | Compare costs across platforms |

| Strengths & Weaknesses | Evaluate customer service |

| Assess trading tools | |

| Review educational resources |

Remember that choosing an online brokerage firm requires careful consideration beyond just popularity or name recognition. Taking the time to explore alternative options will ensure that you find a platform that meets your specific requirements and enhances your investment experience.

Fidelity Investments: A Worthy Competitor to E*TRADE

Fidelity Investments, a heavyweight in the world of investing with a history dating back to 1946, stands as a formidable competitor to E*TRADE. Known for its extensive range of investment products and services, Fidelity has earned a reputation that precedes it in the industry.

One of Fidelity’s notable strengths lies in its robust investment platform, which caters to both beginners and experienced investors alike. With an array of tools at their disposal, investors can make informed decisions and navigate the complexities of the market with ease.

Fidelity’s platform provides access to technical analysis charts, real-time market data, and a wealth of educational resources such as webinars and articles. This comprehensive suite empowers investors by equipping them with the necessary tools to stay ahead.

In terms of fees and commissions, Fidelity offers a competitive edge with its low-cost structure. By keeping expenses low, investors can maximize their returns and minimize unnecessary costs. Moreover, Fidelity’s commitment to accessibility is evident through its lack of account minimum requirements for most accounts.

This makes it an attractive option for individuals starting with smaller amounts of capital or those looking to test the waters before committing larger investments.

When comparing Fidelity Investments to its rival E*TRADE, it becomes clear that both firms have established themselves as leaders in the industry.

However, Fidelity’s extensive range of investment products and services combined with its user-friendly platform and attractive fee structure positions it as a worthy competitor in this highly competitive landscape.

TD Ameritrade: Another Leading Option for Investors

TD Ameritrade stands as a formidable choice for investors seeking a reliable brokerage firm with a long-standing reputation. Since its establishment in 1975, TD Ameritrade has built a solid track record of serving the investment community.

With a focus on meeting the needs of both novice and experienced traders, this brokerage firm offers an array of features and resources that set it apart.

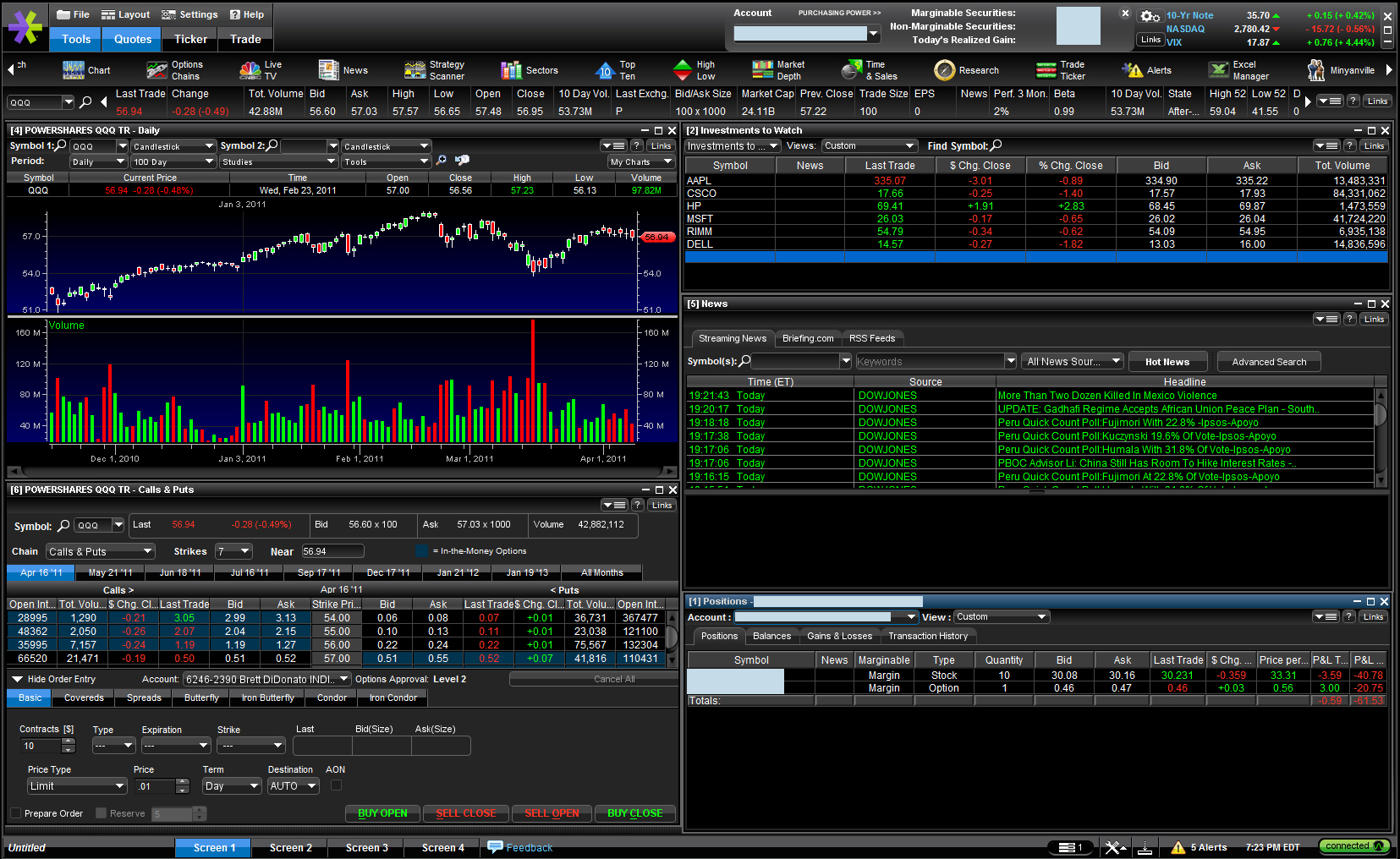

One of the key highlights of TD Ameritrade is its advanced trading platform, Thinkorswim. This robust platform presents an impressive range of tools tailored to empower traders. Among its notable features are advanced charting tools, customizable screeners, and an extensive library of educational materials.

Whether you aim to delve into technical analysis or explore complex options strategies, TD Ameritrade’s comprehensive resources have you covered.

When comparing fees, commissions, and account features offered by TD Ameritrade with those provided by other prominent brokerages such as ETRADE, it becomes evident that TD Ameritrade holds its ground in terms of competitive pricing structures*.

However, it is essential to exercise due diligence and carefully review the fee schedules of each company to grasp any nuances that may impact your specific investment strategy.

In summary, TD Ameritrade emerges as another top contender in the realm of online investing. With its extensive experience in serving investors since 1975 and its commitment to providing advanced trading platforms and educational resources, this brokerage firm remains dedicated to meeting the diverse needs of traders at every level.

By evaluating factors such as fees, commissions, and account features alongside other leading firms like E*TRADE, investors can make informed decisions based on their unique investment goals and preferences.

Charles Schwab: A Comprehensive Investment Solution Provider

With over four decades of experience, Charles Schwab is a trusted name in the investment industry. As one of the largest brokerage firms in the United States, they offer a wide range of investment products, including stocks, bonds, mutual funds, ETFs, options, and futures.

Their competitive pricing, excellent customer service, and technologically advanced platforms make them an ideal choice for investors looking for a comprehensive solution provider. With Charles Schwab, you can build a well-rounded portfolio that aligns with your goals and receive prompt support when needed.

Trust in their expertise to help you navigate the world of investing with confidence.

Choosing the Right Online Brokerage Platform for Your Investment Needs

When selecting an online brokerage platform, it’s crucial to consider factors such as fees, investment options, trading tools, educational resources, and customer support. Assess your investment goals and trading style to find a platform that aligns with your needs.

Compare fee structures, evaluate available investments, explore user interfaces, and read reviews from trusted sources for a well-informed decision. Choose a platform that suits your unique requirements and helps you achieve your financial goals.

Conclusion

[lyte id=’Dg8OUucdM7Q’]