Investing in today’s dynamic market requires a strategic approach that can adapt to changing trends and capitalize on opportunities. One such approach gaining popularity among investors is exchange-traded funds (ETFs).

These investment vehicles offer a world of possibilities, allowing investors to diversify their portfolios and potentially earn significant returns. In this article, we will explore the concept of ETFs, delve into the insights shared by tactical investors, and highlight the best ETFs worth considering.

Furthermore, we will introduce you to the Tactical Investor ETF Trader service, a game-changing platform designed to guide investors towards success in ETF investing.

So buckle up and get ready to unlock the potential of ETF investing with Tactical Investor!

What is an ETF?

An exchange-traded fund (ETF) is a unique investment vehicle that trades on stock exchanges, similar to individual stocks. Its purpose is to pool together assets from multiple investors and invest in a diversified portfolio of securities such as stocks, bonds, commodities, or currencies.

By doing so, ETFs provide investors with exposure to a specific market index or industry sector.

One of the key benefits of investing in ETFs is the instant diversification they offer. Unlike buying individual stocks or bonds, which can be time-consuming and require significant capital, ETFs allow investors to spread their risk across various assets without having to individually purchase each security.

This means that even with a relatively small investment, you can gain exposure to a wide range of securities within a specific category or index.

Another advantage of ETFs is their liquidity. Unlike mutual funds or other types of investments that can only be bought or sold at the end of the trading day at the net asset value (NAV), ETFs can be easily bought and sold throughout the trading day at market prices.

This flexibility provides investors with the ability to react quickly to market conditions and make timely investment decisions.

In addition to diversification and liquidity, cost-effectiveness is another reason why many investors choose ETFs. Generally, ETFs have lower expense ratios compared to mutual funds or actively managed funds. This means that you pay less in fees over time, allowing your investment returns to potentially grow faster.

Overall, ETFs are an attractive option for investors looking for broad market exposure and diversification while enjoying the advantages of liquidity and cost-effectiveness. Whether you are new to investing or an experienced investor, understanding what an ETF is and how it works can help you make informed decisions about your investment strategy.

Tactical Investor Thoughts on ETF Investing

Tactical investors are increasingly recognizing the value and potential that lie within the realm of ETF investing. They view it as a strategic opportunity to capitalize on market trends efficiently while managing risk effectively.

These astute investors firmly believe that incorporating ETFs into an investment portfolio can enhance diversification and provide exposure to specific sectors or asset classes.

When considering ETF investing, tactical investors emphasize the importance of having a clear and well-defined strategy. They meticulously analyze market trends, economic indicators, and other relevant factors to identify potential opportunities and risks.

By conducting thorough research, they ensure that their investment decisions are well-informed and aligned with their overall investment objectives.

One key aspect highlighted by tactical investors is the need for ongoing monitoring and adjustment of ETF holdings. They understand that markets are dynamic and subject to change. Therefore, they actively monitor their ETF investments to adapt to evolving market conditions in order to optimize their returns.

This continuous analysis allows them to stay ahead of the curve and make informed adjustments when necessary.

Moreover, tactical investors also recognize that not all ETFs are created equal. Each ETF has its own unique set of characteristics, such as expense ratios, tracking error, liquidity, and underlying assets. Therefore, they carefully evaluate these factors before making any investment decisions.

This comprehensive evaluation ensures that they select ETFs that align with their investment strategy and provide optimal exposure to desired sectors or asset classes.

In summary, tactical investors have embraced the potential benefits offered by ETF investing.

By incorporating these funds into their portfolios with a clear strategy in mind, continuously monitoring and adjusting holdings based on market conditions, and conducting thorough evaluations of different ETF options available, these astute investors aim to maximize returns while effectively managing risk.

Best ETFs to Consider

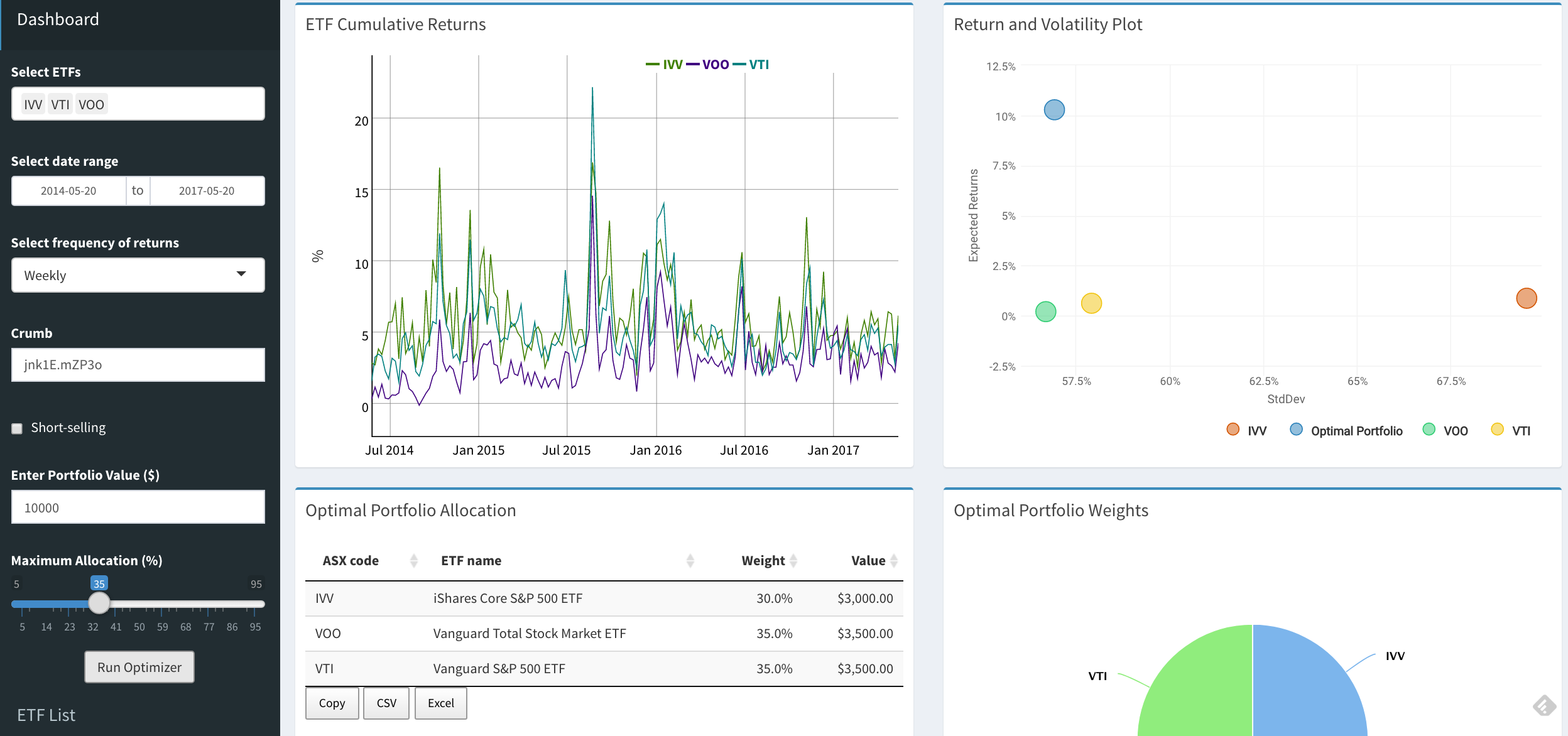

When it comes to choosing the best ETFs for your investment portfolio, there are several standout options. The Vanguard Total Stock Market ETF (VTI) offers broad exposure to the entire U.S. equity market, making it a great choice for long-term growth.

The iShares Core S&P 500 ETF (IVV) tracks the performance of leading U.S. large-cap companies, providing convenient access to top-performing stocks.

The Invesco QQQ Trust (QQQ) focuses on technology companies like Apple and Microsoft, while SPDR Gold Shares (GLD) provides exposure to physical gold as a hedge against inflation and market uncertainties. These are just a few examples among many options available in the world of ETF investing.

Conduct thorough research and consider your individual goals and risk tolerance when making investment decisions.

Introducing the Tactical Investor ETF Trader Service

The Tactical Investor ETF Trader service is a game-changer in the world of ETF investing. It combines advanced algorithms, artificial intelligence, and seasoned investment professionals’ expertise to provide accurate analysis and timely recommendations.

Subscribers gain access to real-time trade alerts, customizable watchlists, portfolio tracking, and educational resources. With this service by your side, you can unlock your true potential as an ETF investor and confidently seize profitable opportunities in the market.

Other Articles of Interest for Investors

To enhance your investment endeavors, here are some valuable articles and resources:

Learn different techniques to effectively manage risk within your investment portfolio through diversification. Explore various asset classes and consider diversifying within each class.

Discover strategies for minimizing risk exposure and protecting your investments. Learn about stop-loss orders, trailing stops, position sizing, and hedging techniques.

Stay updated on the latest market trends through insightful analysis and predictions from industry experts. Anticipate market movements by considering economic indicators, political developments, technological advancements, and consumer behavior.

Expanding your knowledge base in these areas will help you make more informed decisions in pursuit of your financial goals. Continuous learning is key to long-term investment success.

Testimonials from Satisfied Customers of the Tactical Investor ETF Trader Service

The success of any service lies in the satisfaction of its customers, and the Tactical Investor ETF Trader Service has garnered praise from many.

John D., a customer, credits our service for helping him identify profitable opportunities in the ever-changing world of ETFs, while Sarah L. emphasizes the accuracy of our trade alerts and comprehensive educational resources.

These testimonials highlight how our service empowers investors to achieve their goals and unlock their full potential in ETF investing. With personalized strategies and expert guidance, we provide a reliable partner for investors at every level. Join us today and experience the difference for yourself.

Conclusion: Why Choose ETF Investing with Tactical Investor

[lyte id=’akOvY0aFfYI’]