Investing in capital stock is a crucial aspect of building wealth and achieving financial goals. Capital stock refers to the total amount of physical assets, such as machinery, equipment, and infrastructure, that are used in the production process. These assets play a vital role in generating income and driving economic growth.

Understanding the Concept of Capital Stock

Capital stock is a vital aspect of investing, representing the productive capacity of an economy or a company. It measures their ability to generate profits and allows individuals and businesses to participate in industry growth and success.

In investing, capital stock refers to the total value of shares or ownership interests issued by a company. By purchasing shares, investors become partial owners with rights and potential dividends. It offers diversification, potential returns, and support for companies or industries.

For businesses, issuing capital stock raises funds for expansion without relying on debt or internal financing. This enables investment in research, technology, hiring, or market expansion.

However, investing in capital stock carries risks like fluctuating prices and potential dilution of holdings. Nevertheless, understanding its significance empowers investors and businesses to make informed decisions in the financial world.

Exploring the Relationship between Energy and Capital Stock

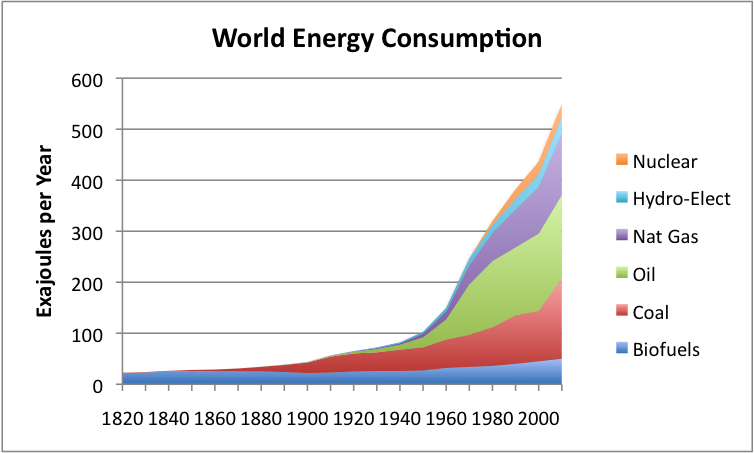

Energy is a critical component in capital stock investments. Without a sufficient energy supply, the efficient use of physical assets becomes challenging. Energy fuels production processes, powers machinery, and enables transportation systems necessary for economic activities.

The availability and affordability of energy directly impact economic growth. Access to reliable energy sources enhances productivity across sectors, leading to increased output and improved living standards. Energy-intensive industries like manufacturing heavily rely on adequate energy supply for efficient operations.

Countries with abundant oil reserves have experienced rapid economic growth by leveraging this valuable resource for industrial development. Conversely, nations facing energy shortages may struggle to sustain economic progress.

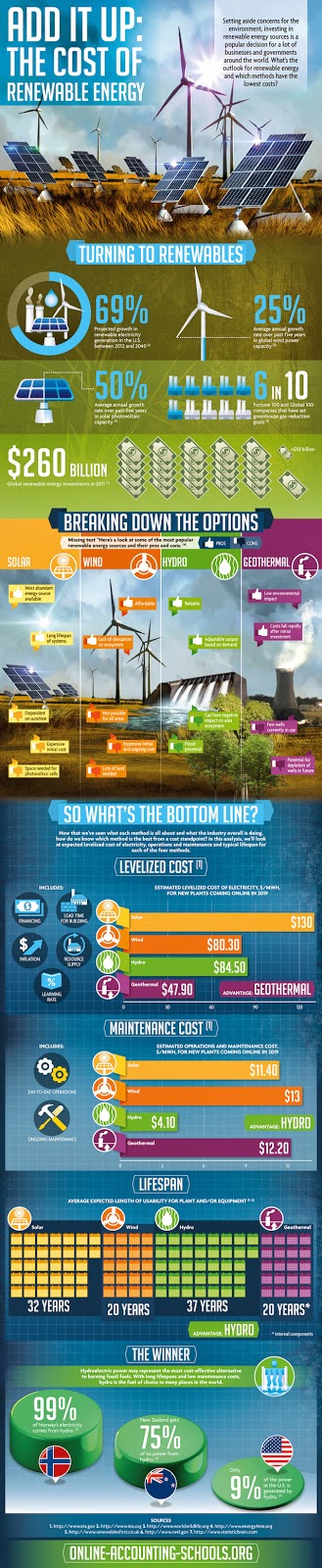

Investing in renewable energy-related capital stock can yield significant returns. Early investments in renewable technologies, such as solar power and wind energy, have proven highly profitable due to their exponential growth. These sectors offer attractive investment opportunities while contributing to sustainability efforts.

Renewable energy sources present compelling investment prospects that align with the demand for sustainable solutions. They offer benefits such as reduced carbon emissions and potential cost savings over time.

Introduction to Renewable Energy Sources

Renewable energy sources are sustainable alternatives to finite fossil fuels, providing a continuous supply of clean energy. Solar power, wind energy, hydroelectricity, and geothermal heat are examples of naturally replenished sources that contribute to reducing environmental degradation.

- Solar Power and Investment Potential

Solar power harnesses sunlight using photovoltaic cells or concentrated solar power systems to generate electricity. With technological advancements and supportive government policies, the solar industry has seen remarkable growth.

Investing in solar projects can be lucrative due to declining panel costs and incentives like tax credits or feed-in tariffs.

- Wind Energy and Market Growth

Wind energy converts the kinetic energy of wind into electricity through turbines. As countries seek cleaner power generation, the wind sector has experienced significant expansion worldwide. Investing in wind projects offers attractive returns through long-term contracts known as power purchase agreements (PPAs).

Analyzing Financial Potential in Renewable Energy Investments

Evaluating the financial prospects and associated risks is crucial when considering renewable energy investments. Factors such as projected returns on investment, government policies and incentives, market demand, operational costs, maintenance requirements, and technological advancements must be carefully assessed for informed decision-making.

By conducting thorough analysis and staying informed about market trends and regulatory changes, investors can maximize returns while contributing to a sustainable future.

Evaluating Returns on Investment for Solar and Wind Projects

Investing in solar and wind projects requires thorough evaluation of factors that affect profitability. Location, technology efficiency, and government incentives play crucial roles. Assessing costs, installation expenses, maintenance requirements, and projected electricity prices is essential.

Calculating the payback period measures financial performance by determining how long it takes to recover the initial investment. Other metrics like net present value (NPV) and internal rate of return (IRR) provide further insights.

Careful consideration of these factors ensures wise allocation of capital for maximum returns on investment while positively impacting the environment.

Investing in renewable energy capital stock carries risks that investors need to consider. Policy changes, technological advancements, market competition, and resource intermittency can all impact the financial viability of renewable energy projects.

These risks require careful evaluation and management to ensure successful investments in this sector.

| Potential Risks |

|---|

| Policy Changes |

| Technological Advancements |

| Market Competition |

| Resource Intermittency |

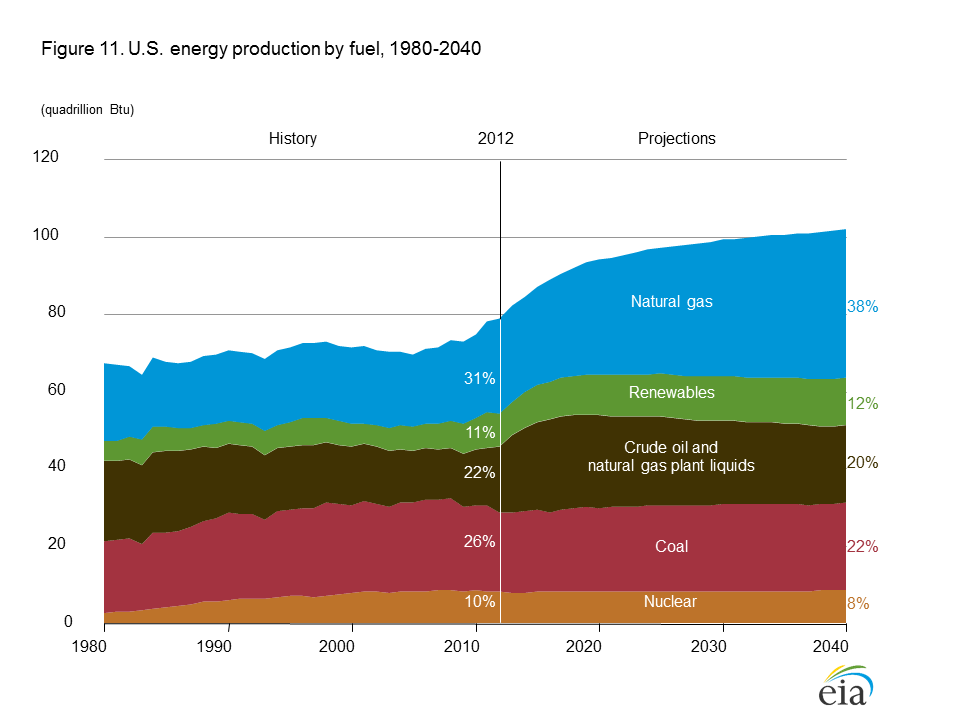

An overview of traditional energy sources

Traditional energy sources encompass fossil fuels like oil, coal, and natural gas, along with nuclear power. Fossil fuels have been widely used due to their high energy density and transportation convenience. However, concerns about greenhouse gas emissions and environmental impact have led to a push for cleaner alternatives.

Oil remains vital but faces market volatility due to geopolitical tensions and fluctuating demand. Coal has declined in popularity due to its environmental impact and cost competitiveness compared to cleaner options. Natural gas, a relatively cleaner fossil fuel, has gained traction as a transition fuel with lower carbon emissions.

Nuclear power generates electricity through controlled reactions. It offers significant energy output with low carbon emissions but is controversial due to safety concerns, waste management issues, and the potential for accidents.

Assessing the challenges faced by traditional energy sources

Traditional energy sources face significant challenges that impact their long-term viability. These challenges include environmental concerns and climate change implications. The burning of fossil fuels releases greenhouse gases, leading to climate change and prompting governments to implement policies to reduce carbon emissions.

Environmental regulations and public sentiment towards clean energy alternatives also pose challenges, increasing operational costs and compliance requirements.

Volatility in global oil prices is another challenge for traditional energy sources. Oil prices are influenced by geopolitical events, supply-demand dynamics, and decisions by organizations like OPEC. This volatility creates risks for investors in traditional energy stocks, making it difficult to plan for growth or attract long-term investments.

To navigate these challenges, traditional energy sources must embrace sustainable practices and consider diversifying revenue streams. Adapting to an evolving energy landscape will be essential for their long-term viability.

Exploring Prospects for Traditional Energy Investments

Traditional energy sources continue to offer opportunities for investors amidst a transitioning world. The fossil fuel industry is investing in innovation and sustainability initiatives to remain relevant, improving extraction techniques while reducing environmental impact.

Investors should assess companies’ commitment to sustainability practices and their ability to adapt to changing market dynamics.

Technological advancements in nuclear power generation, such as small modular reactors (SMRs) and Generation IV reactors, present potential solutions to conventional nuclear power challenges. Investors should monitor advancements and regulatory developments to assess the future prospects of this controversial energy source.

Government policies play a crucial role in shaping the investment landscape for both renewable and traditional energy sources. Understanding these policies is vital for investors looking to enter or expand their presence in traditional energy investments.

[lyte id=’zUrOZKYl9iI’]