Investing in emerging markets has always been an attractive option for investors seeking high growth potential. However, navigating the complexities of these markets can be challenging. One way to mitigate risks while still capitalizing on the potential rewards is through investing in Exchange-Traded Funds (ETFs) with low expense ratios.

In this article, we will explore the significance of expense ratios in ETFs and their impact on investment returns. We will also delve into the world of emerging market ETFs, highlighting their benefits and risks. Furthermore, we will discuss the rise of low expense ratio ETFs in emerging markets and how they can enhance long-term returns.

Finally, we will provide readers with tips for successful investing in these funds and discuss future trends in low expense ratio ETFs.

By the end of this article, you will have a comprehensive understanding of how to make informed investment decisions when it comes to emerging market ETFs with low expense ratios.

So let’s dive right in!

Understanding the Importance of Expense Ratios in ETFs

Expense ratios are a crucial factor to consider when investing in Exchange-Traded Funds (ETFs). These ratios measure the operating expenses incurred by an ETF as a percentage of its total assets under management. While they may seem small, expense ratios can significantly impact investment returns over time.

Lower expense ratios lead to higher returns for investors, assuming all other factors remain constant. For example, two similar ETFs with different expense ratios will generate different returns. Over a 20-year investment horizon, an ETF with a lower ratio can accumulate approximately 30% more wealth due to the compounding effect of lower expenses.

Low expense ratios are desirable for investors because they translate into higher net returns and improved risk-adjusted performance. By minimizing costs, investors keep more of their money working for them in the market and benefit from increased potential for outperformance.

Additionally, low expense ratios provide peace of mind and transparency by avoiding excessive charges and allowing investors to understand how much they are paying for fund management services.

In summary, understanding and prioritizing low expense ratios is essential for investors in ETFs. These ratios directly impact investment returns and can make a significant difference in long-term wealth accumulation.

By choosing funds with lower expenses, investors can maximize their net returns while enjoying improved risk-adjusted performance and greater transparency.

Introduction to Emerging Market ETFs

Emerging market ETFs provide investors with exposure to rapidly growing economies of developing countries. These markets offer high growth potential due to favorable demographics, abundant resources, and increasing consumer demand. Investing in emerging market ETFs offers diversification, liquidity, and cost-effectiveness.

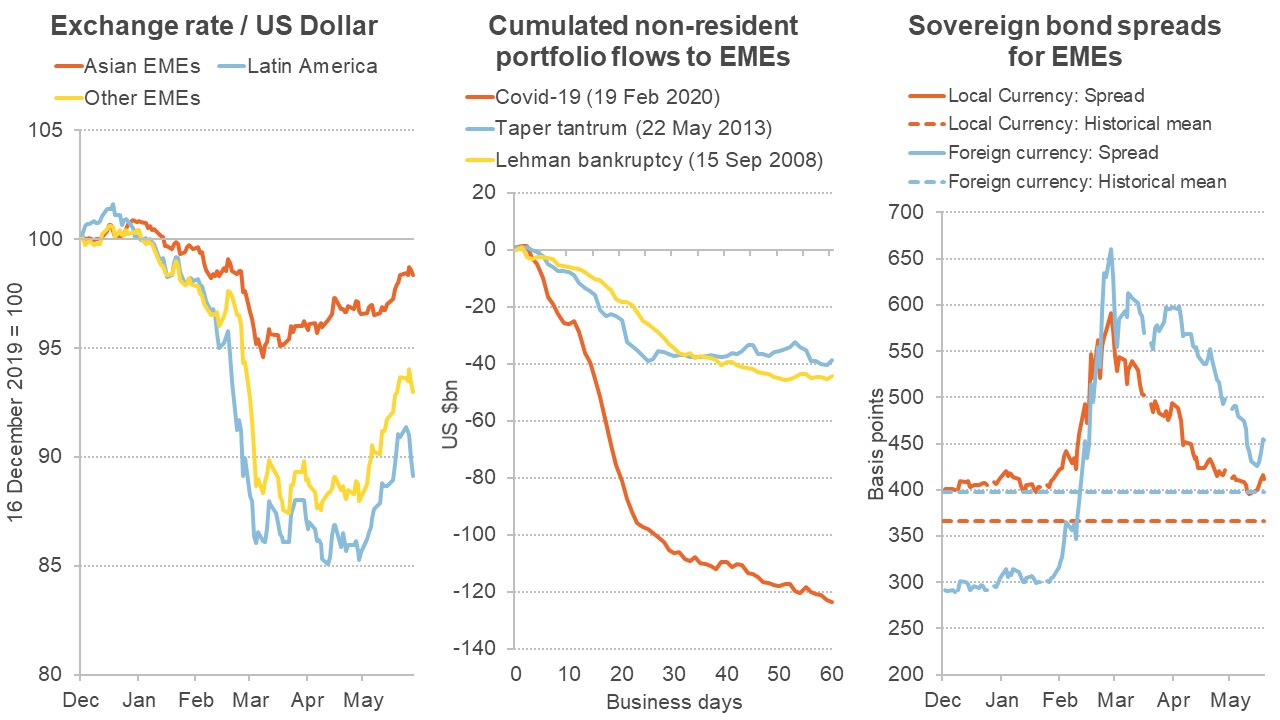

However, it’s important to consider the risks associated with investing in these markets, such as volatility, currency risk, and lack of transparency. Despite these risks, many investors are attracted to the growth potential offered by emerging markets and seek opportunities through low expense ratio ETFs.

Stay tuned for Part III where we explore the rise of low expense ratio ETFs in emerging markets and their potential for enhancing long-term returns!

[lyte id=’XDM1WhkwFSI’]