Investing can be a complex and ever-changing landscape, but with the right tools and insights, you can navigate the market with confidence. One such tool that has gained significant popularity among investors is Elliott Wave analysis.

In this article, we will delve into the world of Elliott Wave financial forecasting, introducing you to its principles, experts, and how you can access these invaluable forecasts.

Introduction to Elliott Wave Analysis

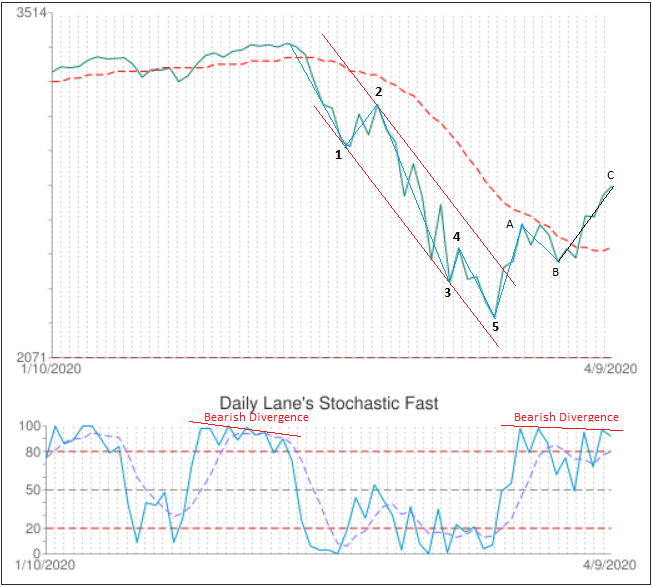

Elliott Wave Analysis is a powerful tool used by investors to identify patterns in financial markets. Developed by Ralph Nelson Elliott, this principle suggests that market prices unfold in recognizable wave patterns driven by investor psychology and market sentiment.

By understanding these wave patterns and their relationships, investors can gain insights into future price movements and make informed investment decisions. One important aspect of Elliott Wave analysis is having a clear monthly view of the U.S. markets.

Examining long-term trends using monthly charts provides a clearer picture of overall market trends and helps identify major turning points.

With a clear monthly view, investors can make more accurate forecasts and avoid getting caught up in short-term fluctuations. By combining technical analysis with investor psychology, Elliott Wave Analysis offers a systematic approach to understanding market behavior and empowers investors to navigate financial markets with confidence.

Meet the Experts: Steven Hochberg, Chief Market Analyst

Steven Hochberg, the Chief Market Analyst at Elliott Wave International, is a highly esteemed authority in the application of Elliott Wave analysis to financial markets. With an extensive background spanning decades, Hochberg has consistently provided invaluable insights into market trends and guided investors through various market cycles.

Hochberg firmly believes that understanding investor psychology is crucial when utilizing Elliott Wave analysis. He emphasizes that waves are not merely arbitrary movements but rather reflections of collective sentiment among market participants.

By studying these patterns meticulously, investors can anticipate shifts in sentiment and strategically position themselves for maximum advantage.

One of the notable advantages of employing Elliott Wave analysis, as highlighted by Hochberg, is its ability to identify significant turning points and smaller-scale opportunities within larger trends. This unique capability allows investors to capture substantial profits while effectively managing risks associated with their investments.

Meet the Experts: Peter Kendall, Chief Analyst for U.S. Markets and Cultural Trends

Peter Kendall, the Chief Analyst for U.S. Markets and Cultural Trends at Elliott Wave International, combines his expertise in Elliott Wave analysis with an understanding of cultural trends to provide a comprehensive view of market dynamics.

By recognizing the impact of social mood on market sentiment, Kendall offers investors a deeper understanding of the underlying forces driving the markets. His holistic approach considers broader societal factors such as politics, technology, and cultural shifts, enabling investors to make more informed decisions based on a broader perspective.

With his unique insights and integrated analysis, Kendall equips investors with the knowledge they need to navigate today’s complex financial landscape.

Conclusion and Accessing Elliott Wave Financial Forecasts

Elliott Wave financial forecasting is a powerful tool for analyzing market trends and making informed investment decisions. With experts like Steven Hochberg and Peter Kendall at the helm, the application of Elliott Wave analysis becomes even more valuable.

To access Elliott Wave financial forecasts and benefit from their expertise, subscribe to Elliott Wave International’s services. Their comprehensive reports and analysis provide up-to-date market insights, wave counts, and actionable investment opportunities.

[lyte id=’GZcbQy24B2I’]