Investing in the oil sector can be a lucrative opportunity for those looking to diversify their portfolio and potentially earn higher returns. One way to gain exposure to this market is through double leveraged oil ETFs. These investment vehicles offer the potential for amplified gains, but they also come with increased risks.

In this article, we will explore the ins and outs of double leveraged oil ETFs, including their benefits, costs, and considerations. Whether you are a seasoned investor or just starting out, this article will provide you with valuable insights to help you make informed investment decisions in the world of double leveraged oil ETFs.

So let’s dive in!

What is an ETF?

An Exchange-Traded Fund (ETF) is a type of investment fund that trades on stock exchanges, similar to individual stocks. It provides investors with instant diversification and lower transaction costs compared to buying individual securities.

ETFs track specific indexes, asset classes, or sectors, allowing investors to gain exposure to a wide range of securities within those categories. They offer benefits such as diversification, liquidity, transparency, lower costs, and trading flexibility.

Understanding the basics of ETFs sets the stage for exploring more specific types, like double leveraged oil ETFs, which we’ll discuss later.

Understanding the Costs Associated with Double Leveraged Oil ETFs

Before investing in double leveraged oil ETFs, it’s important to consider the associated costs. Two key factors to look at are expense ratios and management fees.

Expense ratios reflect the annual fee charged by an ETF provider for managing the fund. It’s vital to compare expense ratios among different funds as higher ratios can eat into investment gains and reduce profitability.

Tracking error measures how closely an ETF tracks its index or benchmark. Since double leveraged oil ETFs aim to deliver twice the daily return of their index, any deviation in tracking can have a significant impact on their performance.

Liquidity is also crucial when trading ETFs. High liquidity ensures investors can enter or exit positions quickly and at fair prices. Assessing liquidity is especially important if you plan to actively trade double leveraged oil ETFs.

By understanding these costs, including expense ratios, tracking error, and liquidity considerations, investors can make more informed decisions about double leveraged oil ETFs.

Now let’s explore the potential advantages and risks associated with these types of investments.

The Pros and Cons of Investing in Double Leveraged Oil ETFs

Double leveraged oil ETFs offer the potential for higher returns through leverage, but they also come with increased risks. These funds aim to deliver double the daily return of their underlying index, allowing investors to magnify gains during favorable market conditions.

Additionally, investing in double leveraged oil ETFs provides diversification benefits within the oil sector, spreading investments across different companies. However, these funds tend to be more volatile than traditional ETFs, which can result in significant losses during market downturns or periods of heightened price volatility.

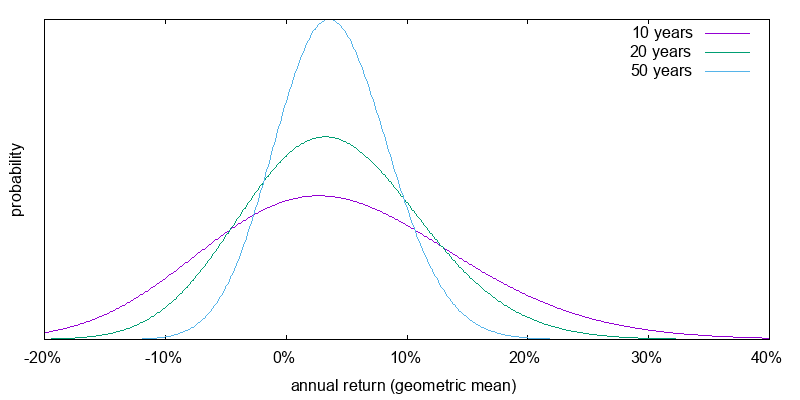

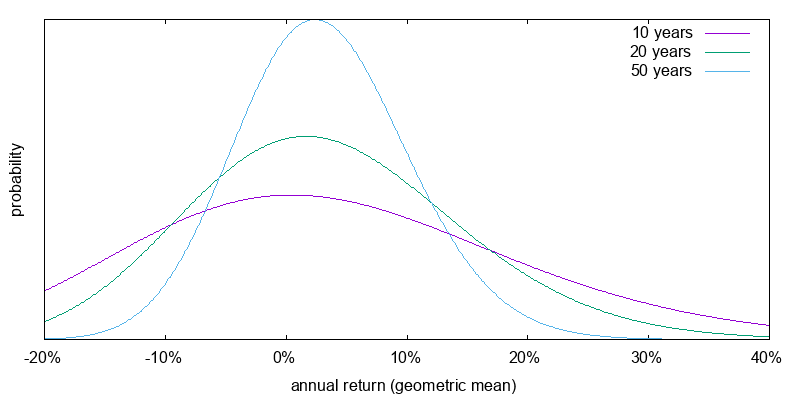

Furthermore, the use of leverage can lead to compounding effects on long-term returns, amplifying both gains and losses. Before investing in double leveraged oil ETFs, it is crucial to carefully consider these advantages and risks and assess personal risk tolerance levels.

Factors to Consider Before Investing in Double Leveraged Oil ETFs

Before investing in double leveraged oil ETFs, it’s crucial to consider key factors that can impact their performance and align with your investment goals. Analyzing market conditions and oil price volatility helps you make informed decisions based on prevailing trends.

Additionally, considering your time horizon and investment goals is vital since these funds are designed for short-term trading strategies. Active management and regular evaluation are essential due to the higher risk profile associated with these investments.

By carefully assessing these factors, you’ll be better equipped for successful investing in double leveraged oil ETFs.

Strategies for Successful Investing in Double Leveraged Oil ETFs

Investing in double leveraged oil ETFs requires careful research and risk management. Here are some key strategies to consider:

Research and Selection:

– Evaluate fund performance, historical data, expense ratios, tracking error, and liquidity.

– Analyze historical performance to assess alignment with investment objectives.

– Compare expense ratios and consider tracking error and liquidity for efficient trading.

Risk Management:

– Set stop-loss orders to limit potential losses by selling shares at a predetermined price level.

– Regularly monitor investments and adjust positions based on changing market conditions or goals.

By researching and selecting the right funds while implementing effective risk management techniques, successful investing in double leveraged oil ETFs becomes more achievable.

In the next section, we will address common misconceptions about double leveraged oil ETFs.

Common Misconceptions about Double Leveraged Oil ETFs

Double leveraged oil ETFs are often misunderstood, leading to misconceptions about their potential returns and complexity. One common misconception is that these ETFs guarantee high profits. While they have the potential for amplified returns, there are no guarantees.

Investors should be aware of the risks involved and carefully consider their goals and risk tolerance.

Another misconception is that double leveraged oil ETFs are too complex for average investors. While they may seem intimidating at first, with proper research and understanding, they can be accessible to a wide range of investors. Educating oneself and seeking professional advice can help navigate any complexities.

Conclusion: Is Double Leveraged Oil ETF Investing Right for You?

[lyte id=’4ZFulkQ9Kpc’]