DNA sequencing, once a niche field within the realm of genetics and research, has now become a powerful tool that is revolutionizing numerous industries. As a result, DNA sequencing companies are experiencing significant growth and attracting the attention of investors.

In this article, we will explore the concept and importance of DNA sequencing, introduce some prominent companies in the field, discuss the potential for high returns on investment, evaluate risks associated with investing in DNA sequencing companies stock, highlight key factors to consider before making an investment decision, and provide tips for successful investing in this sector.

Explaining the Concept and Importance of DNA Sequencing

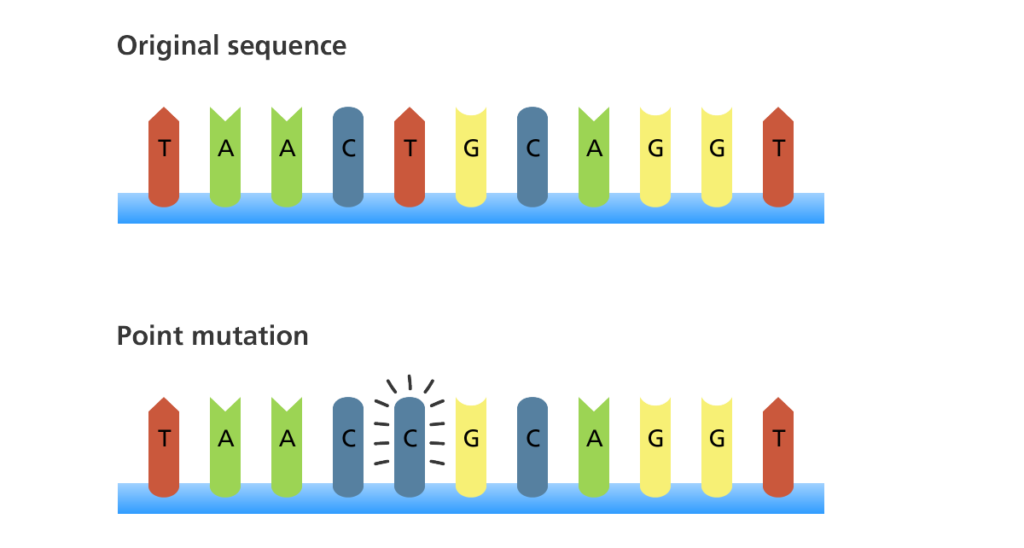

DNA sequencing is a game-changing process that determines the order of nucleotides in a DNA molecule. It provides valuable insights into an organism’s genetic makeup and has revolutionized fields like medical research, personalized medicine, agriculture, conservation biology, and forensic science.

In medical research, DNA sequencing helps identify genetic variations associated with inherited diseases and enables tailored treatments. It also aids in drug development by understanding how specific genetic variations impact disease progression.

In agriculture and conservation biology, DNA sequencing enhances crop yield, develops disease-resistant varieties, and preserves endangered species’ genetic diversity.

In forensic science, DNA sequencing assists in solving crimes by analyzing biological evidence and accurately identifying individuals through their unique genetic profiles.

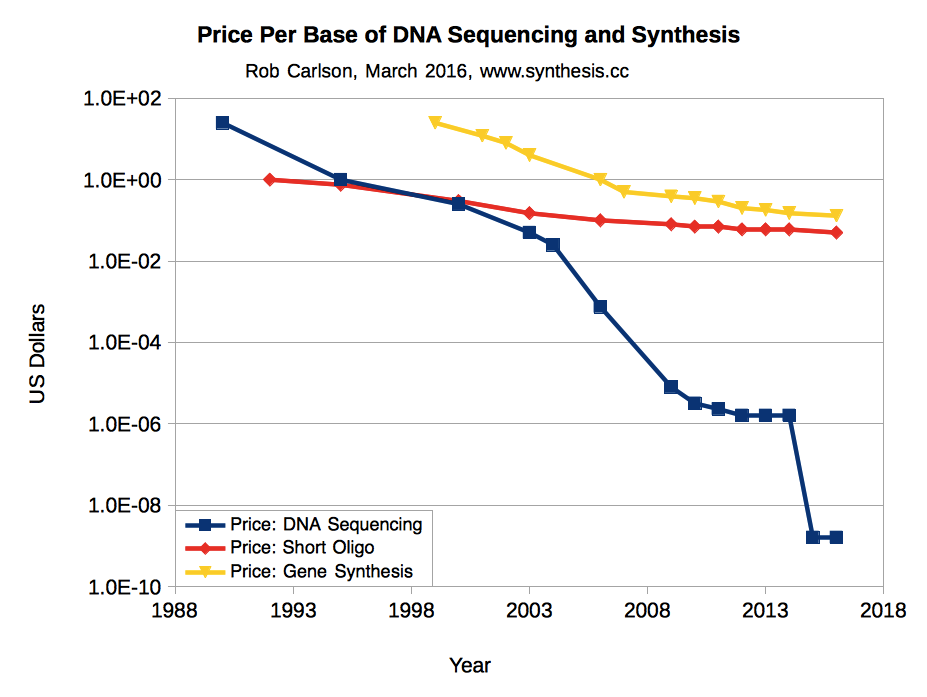

Advancements in technology have made DNA sequencing more accessible and cost-effective, enabling personalized medicine based on an individual’s genomic information.

Overall, DNA sequencing has transformed our understanding of genetics and holds immense potential for scientific discovery and innovation across various disciplines.

Introduction to Prominent DNA Sequencing Companies

In the field of DNA sequencing, several companies have emerged as leaders, driving innovation and advancing technology. Illumina Inc. is renowned for its high-throughput sequencing platforms, while Pacific Biosciences (PacBio) excels in long-read sequencing.

Oxford Nanopore Technologies offers portable sequencers based on nanopore technology, and Thermo Fisher Scientific provides powerful solutions for both Sanger and next-generation sequencing (NGS). BGI Genomics has contributed significantly to large-scale sequencing projects.

Together, these companies have revolutionized genetic research and continue to shape the future of DNA sequencing.

Investing in DNA Sequencing Companies Stock

Investing in DNA sequencing companies’ stocks offers the potential for high returns as the demand for DNA sequencing services continues to grow. Industries such as healthcare and agriculture are incorporating genomics into their operations, creating a market for sequencing products and services. However, investing in this sector comes with risks.

The biotech industry is volatile, with market fluctuations and regulatory challenges impacting stock prices. Setbacks in clinical trials or delays in product approvals can also affect company performance. Thorough research is essential to mitigate these risks and make informed investment decisions.

| Heading 1 | Heading 2 |

|---|---|

| Potential for High Returns on Investment | – Growing market for DNA sequencing products and services – Healthcare providers using genetic testing for personalized medicine – Agricultural companies utilizing genetic data for crop improvement |

| Risks Associated with Investing in DNA Sequencing Companies Stock | – Volatile biotech industry – Market fluctuations and regulatory challenges impacting stock prices – Setbacks in clinical trials or delays in product approvals affecting company performance |

Key Factors to Consider Before Investing

Investing in DNA sequencing companies requires careful evaluation of key factors that can impact the success and profitability of your investment. Two crucial aspects to consider are technology and competitive advantage, as well as financial health and performance.

Assessing a company’s technology is vital. Look for innovative approaches and proprietary technologies that give them a competitive edge. Companies with advanced methods or unique tools are more likely to stay ahead and drive long-term growth.

Financial health is equally important. Analyze revenue growth, profitability, and debt levels to gauge stability and potential success. Steady revenue growth indicates market demand, while profitability demonstrates efficient resource utilization. Manageable debt levels ensure room for investment and expansion.

Considering these factors before investing in DNA sequencing companies will help make informed decisions and capitalize on opportunities in this rapidly evolving field.

Promising DNA Sequencing Companies to Watch Out For

Two companies are leading the way in revolutionizing personalized medicine and agricultural genomics through DNA sequencing.

Company A has developed groundbreaking techniques for highly accurate and comprehensive DNA sequencing. Their technology has the potential to revolutionize personalized medicine by enabling precise diagnosis, targeted therapies, and improved patient outcomes.

Company B applies DNA sequencing to agricultural genomics, helping farmers improve crop yields, develop disease-resistant plants, and promote sustainable farming practices. By harnessing genetic data, they contribute to advancements in agriculture that benefit both farmers and consumers.

Both Company A and Company B are promising DNA sequencing companies worth watching out for as they pioneer innovative solutions in their respective fields.

Tips for Successful Investing in DNA Sequencing Companies Stock

When investing in DNA sequencing companies, it is important to take a long-term perspective and consider sustained growth potential. Diversify your investment portfolio within the biotech sector to mitigate risks and maximize returns.

Stay updated on industry trends and news, research individual companies thoroughly, and analyze financial statements and management expertise. By adopting these strategies, investors can position themselves for success in this rapidly evolving field.

Real-Life Success Stories: Investors Who Struck Gold with DNA Sequencing Stocks

In the world of biotechnology, there are success stories of investors who recognized the potential of DNA sequencing companies early on and reaped substantial financial rewards. These investors conducted thorough research, understood the industry, and made informed investment decisions.

One such success story is John Masters, an experienced investor who analyzed various DNA sequencing companies and identified promising stocks with great growth potential. Similarly, Sarah Thompson, a former scientist turned financial analyst, leveraged her expertise in genomics to invest confidently in select DNA sequencing companies.

These success stories emphasize the importance of due diligence when investing in DNA sequencing stocks. Understanding industry trends and each company’s competitive advantages is crucial for making informed decisions.

While there are risks involved, the potential for revolutionizing healthcare and personalized medicine makes these investments intriguing.

By researching potential companies and staying informed about technological advancements, investors can position themselves for significant financial gains. However, caution and portfolio diversification are essential in this rapidly evolving sector.

Common Mistakes to Avoid When Investing in DNA Sequencing Companies Stock

Investing in DNA sequencing companies’ stock can be challenging. To make smart investment decisions, it is important to avoid some common mistakes. First, don’t fall for hype without thorough research. Evaluate each company’s fundamentals and competitive position before investing. Second, don’t be swayed by short-term market fluctuations.

Focus on long-term prospects and the company’s underlying value instead. Lastly, diversify your investments within the DNA sequencing industry to spread risk and maximize growth opportunities. By avoiding these mistakes, you can navigate this exciting field with confidence.

[lyte id=’OJaF0gz1JUg’]