As an income investor, I’m always looking for opportunities to invest in companies who are growing their dividend rate.

Because when a company raises its dividend, it’s giving investors a raise and that’s always a good thing.

Who leaves a company when they keep getting raises?

Spoiler Alert: No one.

Several years ago, I began looking at how company stock prices move in relation to its dividend. (I must have been really bored that day.)

What I found wasn’t surprising.

As you can imagine, if a company reduces its dividend or cuts it altogether, it’s disastrous for the stock.

Two recent examples of this are General Electric (GE) and Government Properties Income Trust (GOV), now Office Properties Income Trust (OPI) after a merger.

Here’s GOV/OPI.

You can see the exact place on the chart where the dividend was cut and how the share price moved in tandem.

And here’s GE.

Same deal except the share price checked itself before it really wrecked itself after the drastic cut to a $0.01 dividend. Thanks value investors!

But how does the stock price react when the opposite occurs?

When a company increases its dividend and the stock price is still lagging?

That my friend is what we call a Dividend Magnet.

What’s a Dividend Magnet?

Dividends attract investors.

Specifically income investors who are looking for total returns – capital gains AND dividends.

I tell my students that the first question we must ask ourselves before investing in any dividend stock is “is the dividend sustainable?”

Meaning can the company afford to pay us this income AND give us periodic raises along the way.

To answer that we look to the dividend growth rate.

The dividend growth rate tells us if the company has a history of raising (or reducing) its dividend.

In finance (and life), historic behavior is one of the best predictors of future behavior.

“Once a cheater, always a cheater” type of thing.

So, I look for stocks that have a history of growing their dividend and an additional indicator that can predict with remarkable accuracy when a stock is ready to pop.

It’s a gap that I look for that occurs when share price lags dividend growth.

When that happens, we have an income stock that has a gap to be filled with capital gains.

I love to buy stocks when share price lags dividend growth because it means capital gains are just waiting to happen.

And that means that my total return will be pretty awesome.

So, I’ll walk you through how I uncover these dividend magnets and show you a few current examples.

How to Screen for a Dividend Magnet

What you’re looking for are stocks that…

- Pay a dividend

- Have a positive 3 and/or 5 year dividend growth rate

Then you go through the list and take a look at the fundamentals to determine if that’s a stock you want to own.

If the answer is yes, then you look to the technicals to determine when you should buy and at what price.

I use yCharts.com but it’s an easy screener to set up on any stock screening service.

Once you have a list of stocks that pay a dividend and have a positive growth rate, overlay them both on a chart – normalized for a percentage change instead of just the numbers.

Here are a few I uncovered today with a gap between the share price and the dividend…

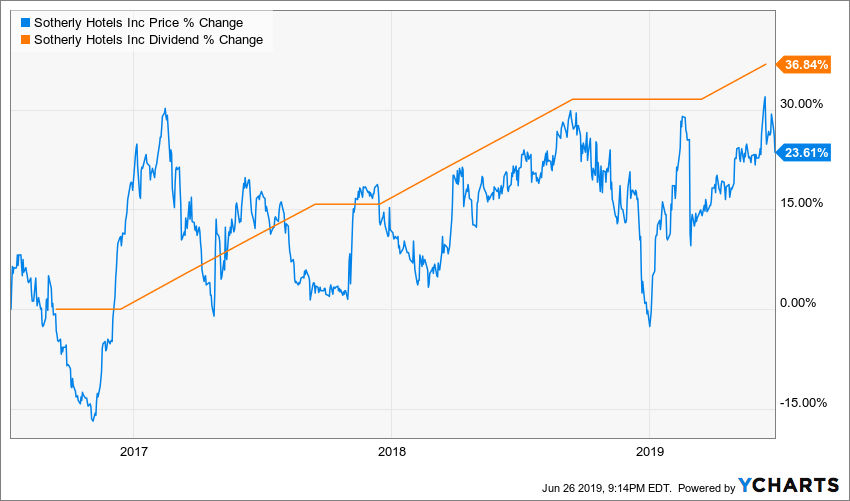

Sotherly Hotels Inc (SOHO)

KeyCorp (KEY)

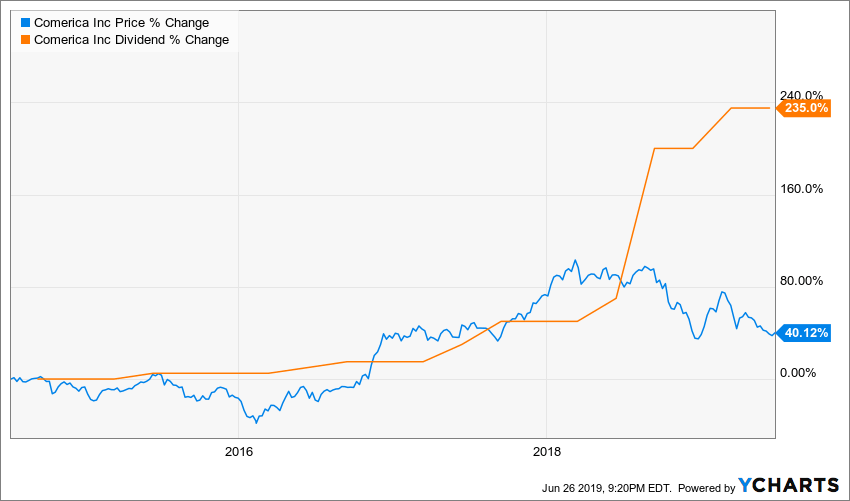

Comerica Inc (CMA)

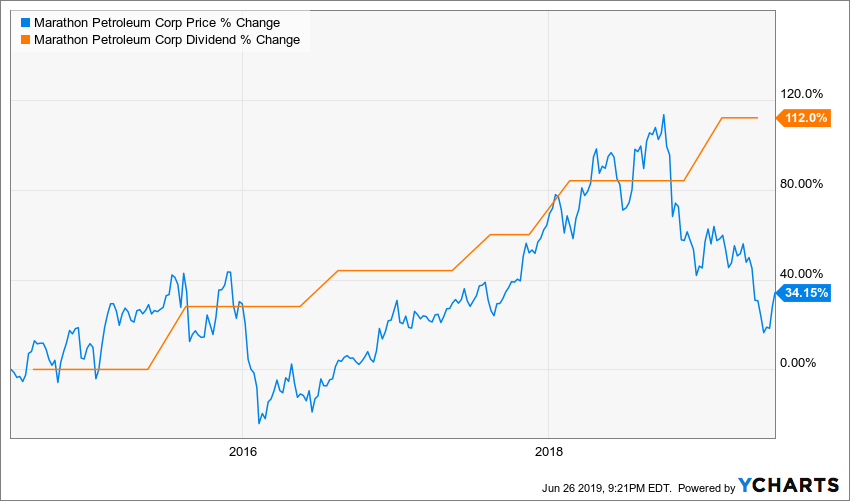

Marathon Petroleum Corp (MPC)

AbbVie Inc (ABBV)

What Do These Charts Have In Common?

As you can see each of these charts shows share price lagging dividend growth leaving a gap to be filled with capital gains.

And that is an underpriced stock, my friends.

If you’re looking for some dividend producing income investments, uncover some Dividend Magnets for yourself and set yourself up for recession-proof gains and long-term profits.

Like this article?

You should join Income Investors Academy where I post two fully-researched income investment ideas each month along with weekly coaching calls, special reports, and investing tutorials. All designed to build a portfolio that generates passive income for you now and for many years to come.