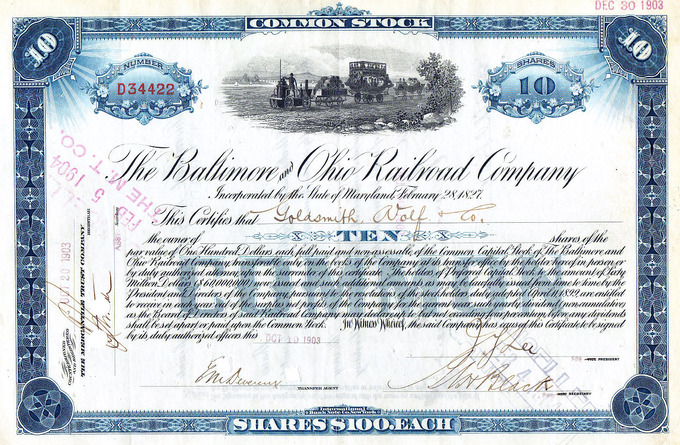

Investing is a complex and ever-changing field, with countless opportunities for those willing to dive into the market. While many investors focus on stocks, bonds, and real estate, there is another type of investment that often goes unnoticed: paper stocks.

In this article, we will explore the significance of paper stocks in investment portfolios and discuss the potential returns and risks associated with investing in them.

Understanding Different Types of Paper Stocks

Investing in paper stocks requires an understanding of the different types available. Bond paper is known for its durability and versatility, making it ideal for official documents. Card stock is thicker and sturdier, often used for business cards and invitations. Newsprint is a thin paper used for printing newspapers.

By knowing the characteristics and uses of each type, investors can make informed decisions that align with their goals.

Exploring the Pros and Cons of Investing in Bond Paper Stocks

Investing in bond paper stocks provides stability and reliable returns. These low-risk investments offer fixed returns over a set period, making them appealing for those seeking consistent income streams. One advantage is their ability to provide steady interest payments. They also tend to be less volatile during economic downturns.

However, bond prices can be affected by changes in interest rates or credit ratings, potentially leading to lower returns for investors. It’s important to consider these factors when deciding to invest in bond paper stocks.

The Appeal and Risks Associated with Card Stock Investments

Investing in card stock offers a unique appeal to those seeking diverse opportunities in the printing, packaging, and design industries. With potential for higher returns compared to bond paper stocks, investors can benefit from the growth of related sectors.

However, it’s important to be aware of the risks associated with investing in smaller or niche companies, including increased volatility and market fluctuations. Careful analysis of market conditions and diversification are key for successful card stock investments.

Newsprint: A High-Risk Investment Opportunity?

The world of newsprint investments can be a treacherous one, fraught with uncertainty and risk. As the demand for physical newspapers continues to decline in the face of the digital media revolution, this once-thriving industry has been forced to grapple with significant challenges.

Consequently, the value of newsprint stocks has taken a hit, leaving potential investors wondering whether the allure of this investment opportunity is worth the inherent risks involved.

One cannot deny that newsprint investments hold the promise of attractive returns if successful. However, it is crucial for prospective investors to approach these opportunities with caution and careful consideration. Market trends indicate a higher likelihood of loss, as the decline in physical newspaper consumption shows no signs of abating.

This sobering reality necessitates a thorough examination of both the potential rewards and pitfalls before taking the plunge into newsprint stocks.

To navigate this uncertain landscape effectively, investors interested in newsprint must stay vigilant and adapt their strategies accordingly. Close monitoring of industry developments becomes paramount in order to make informed decisions that align with market shifts.

By staying abreast of emerging trends and technological advancements, investors can position themselves more strategically to capitalize on any remaining opportunities within this struggling sector.

In conclusion, investing in newsprint is not for the faint-hearted or risk-averse investor. While there may still be pockets of growth amidst this industry’s turmoil, it is essential to approach such investments with eyes wide open.

Diligence, adaptability, and an unwavering focus on market dynamics are key ingredients for those who wish to explore this high-risk investment opportunity successfully.

| Pros | Cons |

|---|---|

| Attractive returns if successful | Higher likelihood of losses due to declining market demand |

| Potential growth opportunities despite industry challenges | Need for constant monitoring and adaptation |

Diversifying Your Portfolio with a Mix of Paper Stocks

Diversification is key when it comes to paper stocks. Including a mix of different types can spread out risk and maximize returns. Consider allocating a portion to stable bond paper stocks for income generation. Card stock investments provide growth opportunities and balance potential losses.

Approach newsprint investments cautiously, keeping them as a small portion of your portfolio. By carefully selecting and balancing these stocks, you can create a well-rounded investment strategy tailored to your goals.

Key Factors to Consider When Investing in Paper Stocks

Investing in paper stocks requires careful consideration of several key factors that can significantly impact investment decisions. Staying informed about industry trends is crucial for investors to navigate the ever-evolving paper industry successfully.

Keeping a finger on the pulse of technological advancements, consumer behavior shifts, and market demand allows investors to make informed choices.

Understanding the current state of the paper industry is paramount. This involves analyzing various aspects such as the overall market size, growth potential, and competitive landscape.

By staying updated on emerging technologies like digitalization and sustainable practices, investors can gauge how these developments might affect paper stocks’ long-term viability.

Evaluating company financials is another vital aspect of investing in paper stocks. Examining revenue streams, profit margins, debt levels, and cash flow helps determine a company’s financial health and stability. Furthermore, assessing a company’s management team and their strategic vision is essential for confidence in potential investments.

Diversification is key when investing in any sector, including paper stocks. Spreading investments across multiple companies within the paper industry can help mitigate risks associated with individual stock performance or industry-specific challenges.

Diversifying among different types of paper products such as packaging materials, specialty papers, or even related sectors like forestry can provide exposure to various segments while reducing vulnerability to specific market fluctuations.

Tips for Successful Paper Stock Investments

Successful paper stock investments require thorough research, monitoring market conditions, seeking expert guidance, diversification, and maintaining discipline. Analyze company financial statements, study market trends, and stay informed with industry news. Understand how factors like interest rates and global events impact paper stocks.

Consult financial experts to gain valuable insights. Diversify your portfolio across different companies or sectors to mitigate risk. Stay patient and disciplined for long-term success.

| Key Tips for Successful Paper Stock Investments |

|---|

| 1. Conduct thorough research |

| 2. Monitor market conditions |

| 3. Seek guidance from financial experts |

| 4. Consider diversification |

| 5. Stay patient and disciplined |

Glossary

This glossary section provides definitions for key terms related to different types of paper commonly used in various applications.

Bond Paper: High-quality paper used for official documents such as letterheads and legal papers.

Card Stock: Thick and sturdy paper used for business cards, invitations, and other printed materials that require durability.

Newsprint: Thin paper primarily used in newspaper printing due to its lightweight and absorbent properties.

By understanding these terms, you can make informed decisions when choosing the right paper for your specific needs.

[lyte id=’ET_dsK5a72g’]