Investing in the stock market can be an exciting and rewarding endeavor. However, it’s important to approach it with a strategic mindset and consider various investment options. One such option is investing in defensive stocks.

In this article, we will explore what defensive stocks are, their benefits, top options in the UK market, sectors known for their defensive characteristics, international opportunities, risks associated with these investments, and how to build a strong defensive portfolio.

What are Defensive Stocks?

Defensive stocks are shares of companies that tend to perform well even during economic downturns. These stocks belong to industries that provide essential goods or services, like food, beverages, or pharmaceuticals. They demonstrate resilience when the economy is struggling, making them attractive options for risk-averse investors.

Differentiating between defensive and cyclical stocks is crucial for making informed investment decisions based on risk tolerance and objectives. By including defensive stocks in their portfolio mix, investors can achieve stability while mitigating market volatility risks.

The Benefits of Defensive Stocks

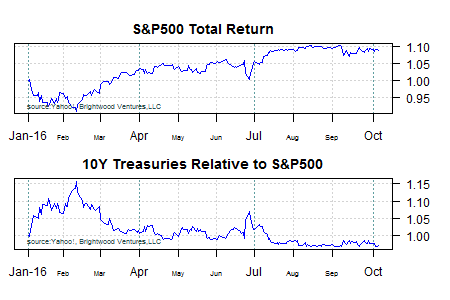

Investing in defensive stocks offers several advantages. These stocks provide stability and consistent returns over time, even during challenging market conditions. They tend to hold their value better than other investments.

Defensive stocks often pay regular dividends, making them appealing for those seeking a steady income stream from their investments. Compared to cyclical stocks, which can decline in value during economic slowdowns, defensive stocks typically outperform as people continue purchasing essential goods and services.

Additionally, investing in defensive stocks provides a sense of security. These stocks come from industries less affected by economic downturns, such as healthcare and consumer staples. They also exhibit lower volatility, providing a smoother investment experience.

In summary, investing in defensive stocks offers stability, consistent returns, regular dividends, resilience during economic downturns, and reduced volatility. By considering these benefits when constructing an investment portfolio, investors can enhance long-term financial success while minimizing risks associated with market fluctuations.

Top UK Defensive Stocks

Investing in defensive stocks is a strategy employed by many investors to mitigate risks during uncertain market conditions. In the UK market, some top defensive stocks worth considering are:

-

Unilever (ULVR): A multinational consumer goods company known for household brands like Dove, Knorr, and Ben & Jerry’s.

-

GlaxoSmithKline (GSK): A leading pharmaceutical giant that develops and manufactures medicines, vaccines, and healthcare products.

-

British American Tobacco (BATS): A global tobacco company with a diversified portfolio of brands.

-

National Grid (NG): An electricity and gas utility company providing essential services to millions of customers in the UK.

These companies have demonstrated resilience and stability over time, making them attractive options for long-term growth and consistent returns. However, thorough research and analysis are crucial before making any investment decisions.

By diversifying and considering a well-rounded portfolio of defensive stocks, investors can potentially weather market fluctuations and achieve their financial goals.

Top Defensive Sectors

During uncertain times, investors often seek stability in certain sectors known for their defensive characteristics. These sectors offer products or services that remain in demand regardless of economic conditions.

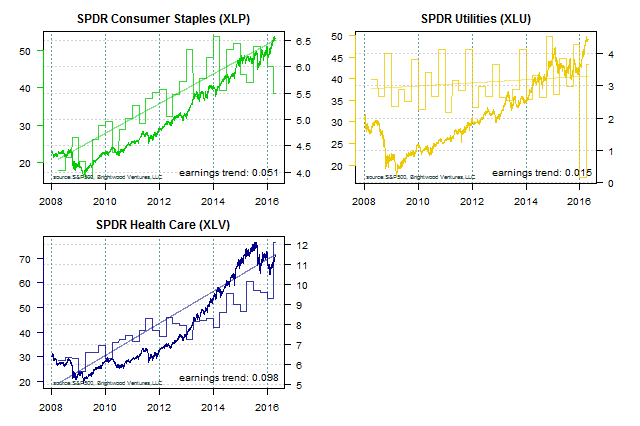

One such sector is consumer staples, which includes companies producing everyday necessities like food, beverages, household products, and personal care items.

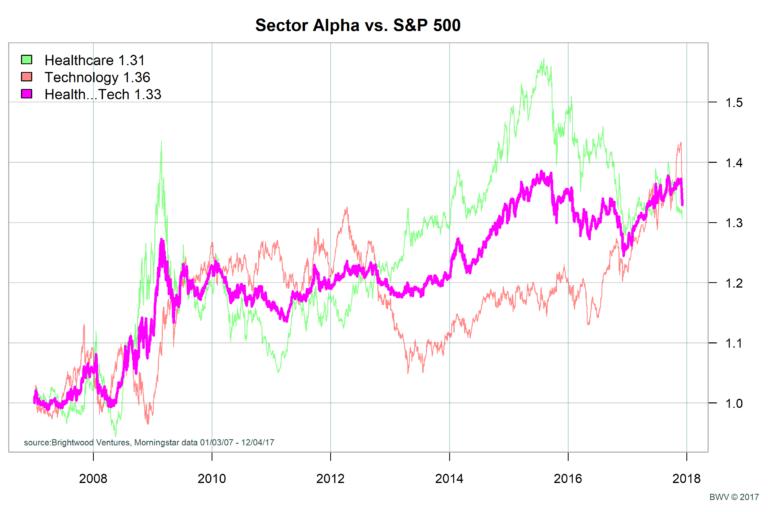

Healthcare is another defensive sector worth considering. As long as there is a need for medical treatments or medications, healthcare companies will continue to thrive. This sector encompasses pharmaceutical companies, medical device manufacturers, hospitals, and healthcare providers.

Utilities also fall into the category of defensive sectors. Electricity, water supply, and natural gas are essential services that people rely on every day. Utility companies usually operate under regulated environments with stable revenue streams.

By diversifying their portfolios and including investments in these defensive sectors alongside other assets aligned with their investment goals and risk tolerance levels, investors can create a well-balanced strategy designed to weather market fluctuations while still seeking potential returns on their investments.

Investing in International Defensive Stocks

Diversification is crucial for effective risk management in investing. While domestic investments have their benefits, exploring international opportunities can enhance a portfolio’s defensive characteristics.

Investing in international defensive stocks provides exposure to different economies, industries, and currencies. By diversifying holdings across countries like the United States, Germany, or Japan, investors can reduce their exposure to any single market and minimize risks.

However, thorough research on international markets and understanding regulatory frameworks is essential. Currency fluctuations should also be considered as they can impact returns when investing abroad.

Investing in international defensive stocks offers advantages beyond diversification. It taps into global growth potential while mitigating risks associated with solely relying on domestic investments.

Table: Benefits of Investing in International Defensive Stocks

| Benefit | Explanation |

|---|---|

| Exposure to Different Economies | Access diverse economies with varying growth prospects. |

| Industry Diversification | Gain exposure to different industries that perform differently based on market conditions. |

| Currency Hedge | Hedge against currency risk and exchange rate fluctuations through multi-currency investments. |

| Reduced Exposure to Single Market | Minimize vulnerability by diversifying across multiple countries’ markets. |

Consulting a financial advisor or expert is recommended before making investment decisions.

Risks and Considerations in Defensive Stock Investments

Defensive stocks, known for their stability and resilience, are not without risks. Investors must be mindful of potential challenges associated with these investments to make informed decisions.

One risk to consider is the possibility that defensive stocks may underperform during periods of economic growth or bull markets. As optimism about the economy’s prospects increases, investors may shift their focus towards cyclical stocks that offer higher growth potential.

Consequently, this shift in investor sentiment could result in temporary declines or slower growth for defensive stocks.

Another factor to bear in mind is that changes in consumer preferences or disruptive technologies can significantly impact the performance of specific defensive sectors.

Companies that fail to adapt or innovate accordingly may face considerable challenges, leading to a negative impact on their financial performance and ultimately on their stock prices.

To effectively manage these risks, it is vital for investors to maintain a diversified portfolio that includes a mix of defensive stocks as well as other types of investments. By spreading out their holdings across different sectors and industries, investors can mitigate the potential negative effects of any one sector facing difficulties.

Regular monitoring and analysis of individual company’s financial health and market trends are also crucial components of successful investment strategies.

By staying abreast of changes within the industry and keeping a keen eye on the financial performance of specific companies, investors can make more informed decisions regarding when to buy or sell certain defensive stocks.

In summary, while defensive stocks offer stability, it is important for investors to be aware of the risks involved.

By understanding these risks and taking proactive steps to manage them through diversification and diligent monitoring, investors can navigate the market more effectively and potentially achieve long-term success with their defensive stock investments.

Building a Strong Defensive Portfolio

Investors seeking stability and consistent returns, even in challenging economic conditions, should consider incorporating defensive stocks into their portfolio. These stocks belong to sectors such as utilities, healthcare, consumer staples, and telecommunications, which tend to perform well regardless of economic fluctuations.

Thorough research is essential to identify companies with stable earnings growth and reliable dividends in the UK market. Additionally, diversifying investments internationally can mitigate risks associated with local economic conditions. Managing risks effectively through ongoing analysis and adjustments is crucial.

Consulting with a financial advisor specializing in defensive investing can provide valuable insights tailored to individual goals and risk tolerance levels. By incorporating defensive stocks into their portfolio, investors can enhance resilience and work towards long-term financial goals.

Table: Key Considerations for Building a Strong Defensive Portfolio

| Key Considerations |

|---|

| Understand the characteristics of defensive stocks |

| Explore top options in the UK market |

| Identify sectors with defensive qualities |

| Consider international opportunities |

| Manage associated risks effectively |

Remember, building a strong defensive portfolio requires careful analysis, diversification, and strategic decision-making. With thorough research and effective risk management, investors can navigate market fluctuations successfully and achieve their financial objectives.

[lyte id=’R_K0AaVrVsM’]