Elliott Wave Theory, developed by Ralph Nelson Elliott in the 1930s, is a powerful tool used by investors and traders to analyze financial markets, including cryptocurrencies. This theory identifies repetitive patterns or waves in market prices, influenced by investor psychology.

By understanding these waves, investors can anticipate future market movements and make informed decisions. Elliott Wave Theory is relevant in financial markets as it helps identify trends, reversals, and corrections, providing valuable insights for trading strategies.

Overview of Bitcoin and Ethereum Market Analysis

Cryptocurrencies like Bitcoin and Ethereum have gained significant attention in recent years. To make informed investment decisions in these markets, understanding market analysis techniques is crucial.

Market analysis involves studying past price movements, volume trends, and other factors to predict future market behavior. In cryptocurrency trading, where volatility is high, market analysis plays a vital role in mitigating risks and maximizing profit potential.

As of [current date], both Bitcoin and Ethereum have experienced significant price fluctuations. Bitcoin has established itself as a store of value while Ethereum has gained traction for its smart contract capabilities.

Bitcoin’s market dominance remains high with a strong community following. Ethereum’s ecosystem continues to expand rapidly with various decentralized applications being built on its blockchain.

Both cryptocurrencies have shown resilience over time but can be influenced by news events or regulatory developments. Staying updated with the latest market analysis is crucial for successful trading in these dynamic markets.

Applying Elliott Wave Analysis to the Bitcoin Market

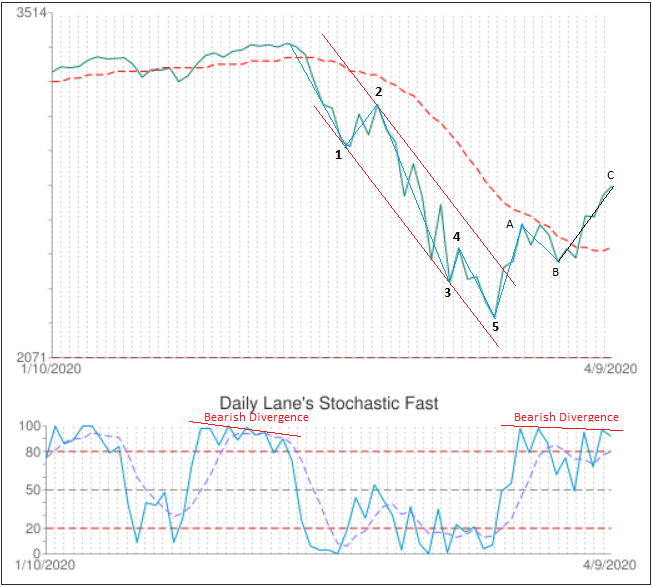

Elliott Wave Analysis is a powerful tool in analyzing Bitcoin’s price movements. By identifying wave patterns within its historical data, investors can anticipate potential future moves and adjust their trading strategies accordingly.

To apply this analysis, start by identifying major waves (impulse and corrective) within the price chart. Assess their characteristics, such as length and depth, to determine the current wave count.

Traders often use Fibonacci retracement levels to gauge potential support or resistance areas for Bitcoin, helping identify critical price zones where reversals may occur.

Bitcoin’s price history reveals multiple instances of Elliott Wave patterns. For example, a typical bullish cycle consists of five upward-moving waves (1-2-3-4-5), followed by three downward-moving waves (A-B-C). Recognizing these patterns in real-time data allows investors to anticipate turning points and adjust their trading strategies.

Applying Elliott Wave Analysis to the Bitcoin market provides valuable insights into potential price movements. By recognizing wave patterns and using tools like Fibonacci retracement levels, investors can make more informed decisions and improve their chances of success in cryptocurrency trading.

Applying Elliott Wave Analysis to the Ethereum Market

By applying Elliott Wave Analysis, investors can gain valuable insights into the price movements of Ethereum. Similar to Bitcoin, this analytical approach helps identify wave patterns and structures within the market.

It is important to consider Ethereum’s unique factors, such as network upgrades and developments in the decentralized finance ecosystem, when applying this analysis. By carefully examining price movements, investors can make informed trading decisions and potentially capitalize on profitable opportunities in the ever-changing cryptocurrency market.

Conclusion and Forecast for Bitcoin and Ethereum Prices

Elliott Wave Analysis provides valuable insights into the current state and potential future movements of Bitcoin and Ethereum markets. By understanding wave patterns, investors can anticipate trends, identify entry or exit points, and adjust trading strategies accordingly.

Considering broader market sentiment and news events is crucial as they impact cryptocurrency prices. While past performance doesn’t guarantee future results, applying Elliott Wave Theory helps navigate volatile markets with a more informed perspective.

It’s important to conduct thorough research and use Elliott Wave Analysis in conjunction with other technical tools for better decision-making. This combination enhances understanding of market dynamics and increases chances of success in the cryptocurrency world.

[lyte id=’qOdjpDArIcQ’]