Investing in emerging technologies can offer exciting opportunities for investors looking to diversify their portfolios and capitalize on market trends. One such technology that has been gaining traction in recent years is autonomous vehicles.

As the demand for self-driving cars continues to grow, companies like Cruise are at the forefront of this revolution. In this article, we will explore the potential of investing in Cruise Autonomous Vehicle Stock and delve into the factors that make it an attractive option for investors.

Introduction to Cruise Stock

Cruise Autonomous Vehicle Stock, or Cruise stock, refers to shares in Cruise, a leading autonomous vehicle company based in San Francisco. Since its establishment in 2013, Cruise has become a prominent player in the industry, attracting investors and industry experts alike.

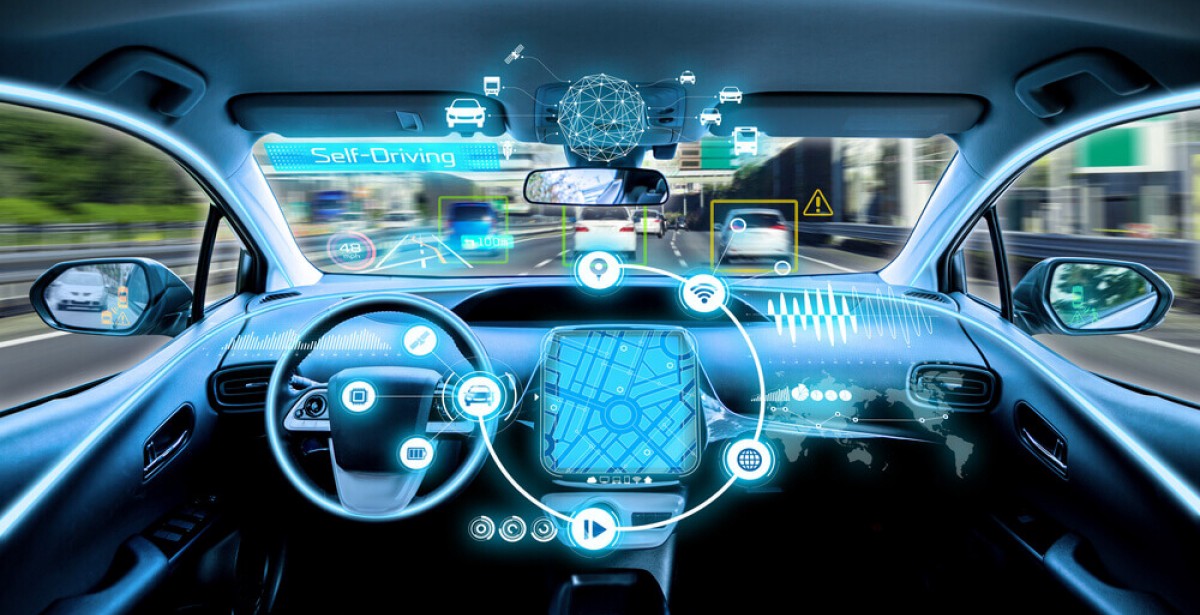

With its cutting-edge technology and focus on safety, Cruise aims to revolutionize transportation through self-driving cars powered by artificial intelligence and machine learning. Investing in Cruise stock provides an opportunity to be part of this pioneering company’s growth and contribute to shaping the future of autonomous vehicles.

About Cruise Stock

Cruise is a leading autonomous vehicle company that stands out in the industry due to its advanced technology and strategic partnerships. With a mission to create safer and more accessible transportation options, Cruise has positioned itself as a key player in the rapidly evolving autonomous vehicle space.

The popularity of autonomous vehicles has surged in recent years, driven by improved safety features, reduced traffic congestion, and environmental benefits. As consumers become more comfortable with self-driving technology, the demand for autonomous vehicles is expected to soar.

This increased interest has also led to the growth of Cruise stock, attracting investors who recognize the potential for profitability in this expanding market.

Cruise’s strategic partnerships with industry giants like General Motors (GM) and Honda provide valuable resources and manufacturing capabilities necessary for scaling autonomous vehicle production.

Additionally, Cruise’s advanced technology, including state-of-the-art sensors and artificial intelligence algorithms, gives it a competitive advantage in navigating complex environments while prioritizing passenger safety.

As consumer confidence in autonomous vehicles continues to grow, Cruise is well-positioned to capitalize on this trend. With its innovative technology and commitment to safety, Cruise stock represents an exciting opportunity for investors looking to be part of the future of transportation.

Investors’ Perspective on Cruise Stock

Investors are drawn to Cruise stock for its potential high returns. As the global market for autonomous vehicles expands, companies like Cruise have a significant opportunity to benefit. By investing in Cruise, investors can capitalize on the growing demand for self-driving cars and the disruption of traditional transportation models.

Cruise’s competitive advantage lies in its cutting-edge technology, strong partnerships, and experienced management team. The company has made strides in developing robust autonomous driving systems and has forged strategic alliances with industry leaders like General Motors and Honda.

This positions Cruise favorably in a highly competitive market and enhances its potential for long-term success.

In summary, investing in Cruise stock offers the chance to be part of the transformative shift in transportation while potentially reaping significant financial rewards.

With its focus on innovation and its position as a frontrunner in the autonomous vehicle industry, Cruise represents an enticing opportunity for investors seeking high returns in a rapidly expanding market.

Funding History of Cruise

Cruise, a leader in the autonomous vehicle sector, has attracted substantial funding since its inception. In 2016, General Motors acquired Cruise for $1 billion, recognizing its potential. Since then, Cruise has secured investments from prestigious venture capital firms and strategic partners, solidifying its financial stability.

Notable investors include SoftBank Vision Fund, which invested $2.25 billion in 2018, and Honda Motor Co., Ltd., which invested $750 million in the same year. In 2020, Microsoft joined as an investor with a $2 billion investment at a valuation of $30 billion.

These investments have enabled Cruise to accelerate research and development efforts, expand its fleet of autonomous vehicles, and drive innovation in the industry.

Funding Highlights:

- 2016: General Motors acquires Cruise for $1 billion.

- 2018: SoftBank Vision Fund invests $2.25 billion.

- 2018: Honda Motor Co., Ltd. invests $750 million.

- 2020: Microsoft invests $2 billion.

Cruise’s strong financial backing positions it as a key player in shaping the future of transportation through autonomous vehicles.

Management of Cruise

Cruise, a leader in the autonomous vehicle industry, is guided by a talented management team. CEO Dan Ammann and co-founder Kyle Vogt bring extensive experience in technology, automotive engineering, and business development. Together with other key executives, they steer Cruise towards success in this rapidly evolving sector.

This cohesive team collaborates with partners from various sectors to stay at the forefront of technological advancements and navigate complex regulatory environments. Their collective expertise and strategic vision ensure that Cruise continues to innovate and revolutionize transportation through self-driving technology.

Risks and Challenges in Investing in Cruise Stock

Investing in Cruise stock comes with risks and challenges that should be carefully considered. Market volatility and uncertainties surrounding emerging technologies, like autonomous vehicles, pose significant hurdles. Regulatory changes and legal battles related to autonomous vehicles can impact Cruise’s prospects.

Investors must assess these factors before making investment decisions.

Expert Opinions on Investing in Cruise Stock

The future of autonomous vehicles has garnered significant attention from industry experts, who express optimism about their potential to revolutionize transportation. These experts believe that the advancements in autonomous vehicle technology will undoubtedly impact companies like Cruise and have a positive effect on their stock value.

Insights from these industry experts provide valuable perspectives on the growth trajectory of Cruise and its position within the market. They highlight how investing in Cruise stock can be a strategic move for investors seeking long-term gains.

With its focus on developing cutting-edge autonomous vehicle technology, Cruise is poised to capitalize on the growing demand for efficient and sustainable transportation solutions.

However, it’s crucial to consider the regulatory challenges that autonomous vehicles face when evaluating their impact on stock value. Experts weigh in on this aspect, emphasizing how regulatory hurdles could potentially hinder the growth prospects of companies operating in this sector.

Understanding these opinions is essential for investors as they navigate potential risks associated with investing in Cruise or similar companies.

By staying informed about regulatory developments and monitoring expert opinions, investors can make more informed decisions regarding their investments in Cruise stock. This knowledge equips them with insights into potential obstacles and opportunities within the autonomous vehicle market.

The Future Outlook for Cruise Stock

Cruise, a leader in the autonomous vehicle market, has a promising future ahead. With ongoing innovation, increasing public acceptance, and strategic partnerships, Cruise is well-positioned for long-term growth.

Advancements in technology continue to enhance the capabilities of autonomous vehicles, making them safer and more reliable. This increased reliability instills confidence in consumers and investors alike.

The growing acceptance of self-driving cars among the general public further fuels optimism for Cruise’s future. As people become more accustomed to this technology, demand for autonomous vehicles is expected to rise significantly.

Cruise’s partnerships with key players in the automotive industry provide valuable resources and opportunities for revenue growth. These collaborations bolster Cruise’s credibility and position it at the forefront of technological advancements.

Investors should closely monitor any potential impact that partnerships or acquisitions may have on Cruise’s stock value. Such developments can greatly influence investor sentiment and ultimately affect stock performance.

[lyte id=’3ibYtccMoSI’]