Investing in the stock market offers a multitude of opportunities, and one sector that has been generating significant buzz is the world of gene editing. One particular technology, CRISPR, has emerged as a game-changer in this field.

In this article, we will delve into the fascinating world of CRISPR stocks and explore the potential rewards and risks they present for investors.

The Discovery of CRISPR: A Game-Changing Technology

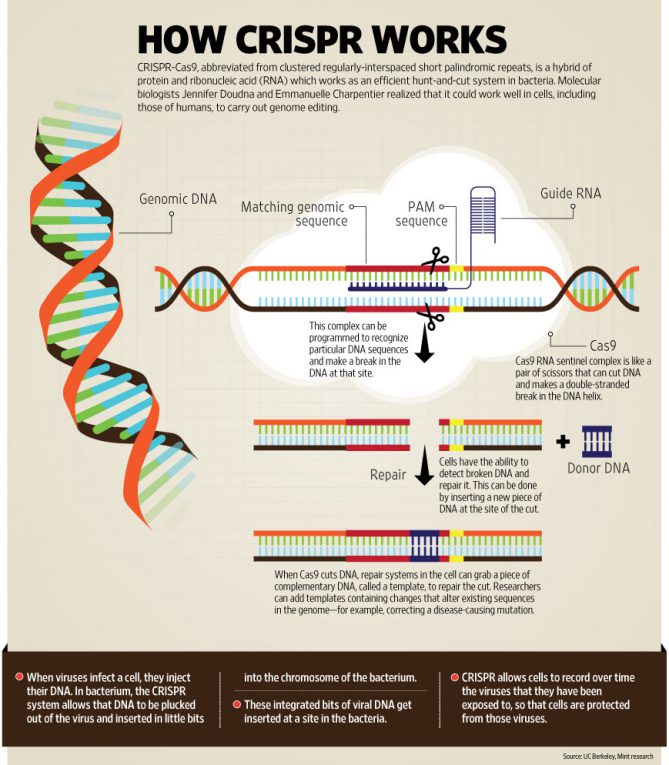

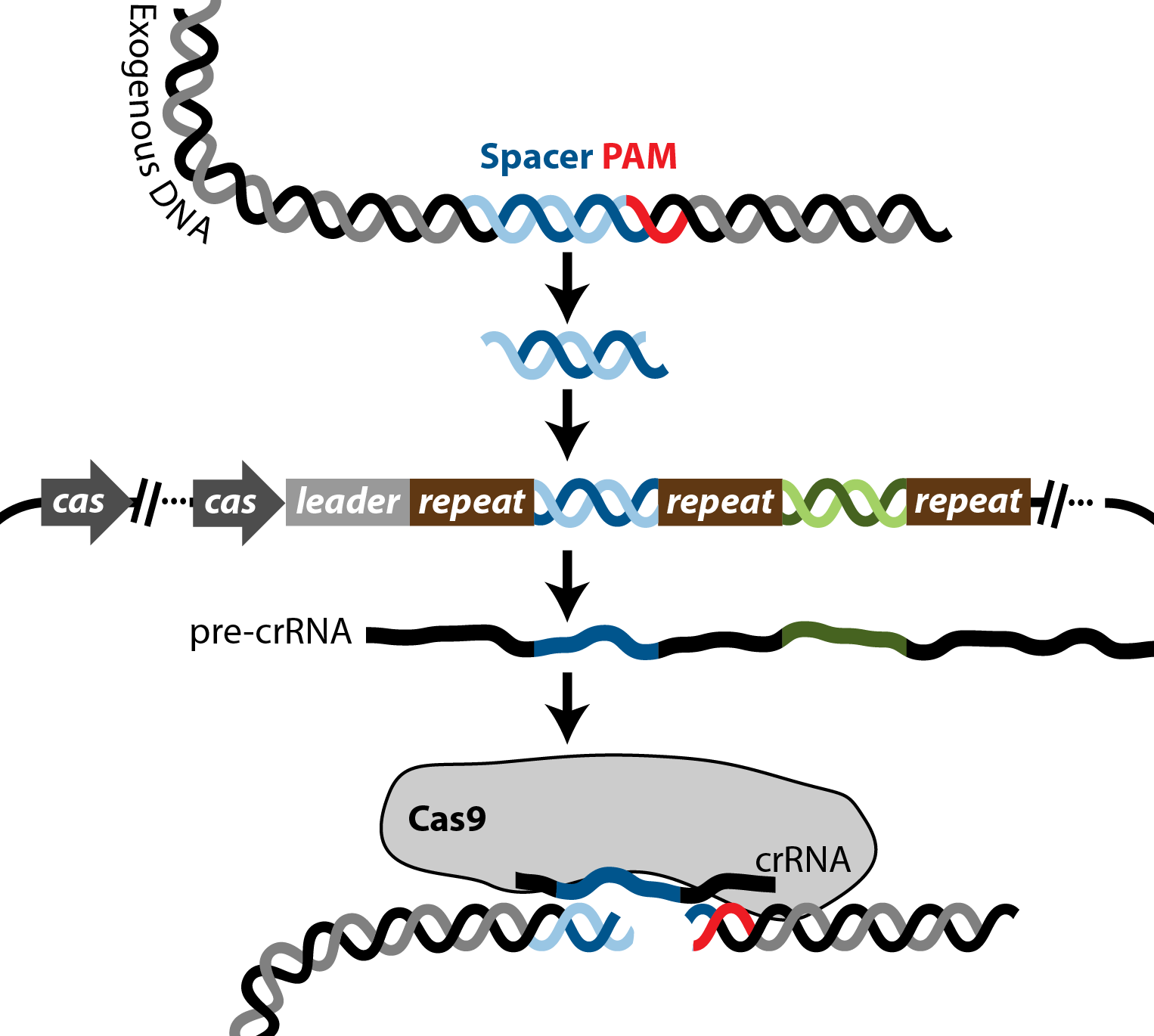

CRISPR (Clustered Regularly Interspaced Short Palindromic Repeats) is a revolutionary gene-editing tool that has transformed genetic research. Initially found in bacteria as a defense against viruses, CRISPR allows scientists to precisely modify DNA sequences.

Its discovery in 2012 by Jennifer Doudna and Emmanuelle Charpentier opened up possibilities for treating genetic disorders in healthcare. Furthermore, CRISPR holds promise for revolutionizing agriculture by enhancing crop traits and improving yields.

In biotechnology, it enables efficient investigation of genetic functions and the development of targeted therapies. With its versatility and precision, CRISPR has far-reaching implications across multiple industries, offering endless potential for addressing global challenges and improving quality of life.

CRISPR Stocks: An Overview

Investing in CRISPR stocks allows investors to tap into the growth potential of this revolutionary gene-editing technology. With companies continuously developing innovative approaches to gene editing, there is a growing interest from investors looking to capitalize on this exciting field.

However, before diving into CRISPR investments, it’s crucial to assess the associated risks and rewards. Regulatory challenges, ethical concerns, competition, and market volatility are factors that should be carefully considered when making investment decisions.

Governments are still determining how to regulate gene-editing technologies like CRISPR, while ethical considerations and public opinion may influence the future of its applications.

Despite these risks, investing in CRISPR stocks offers promising rewards. The potential for groundbreaking medical treatments and advancements in agriculture make this technology an enticing prospect for long-term investors seeking transformative opportunities.

The Top Players in the CRISPR Market

In the rapidly evolving field of CRISPR technology, several companies have emerged as leaders, driving groundbreaking advancements in various industries.

Company A pioneers the field with revolutionary breakthroughs, consistently pushing boundaries and leveraging strategic partnerships to accelerate innovation.

Company B focuses on medical breakthroughs, utilizing CRISPR to revolutionize disease treatment and prevention through gene editing therapies and ongoing clinical trials.

Company C aims to revolutionize agriculture by enhancing crop traits and increasing sustainability through genetic modification using CRISPR.

These top players are shaping the future of CRISPR applications, driving innovation and transforming industries such as healthcare and agriculture.

Crispr Therapeutics AG: Advancing Gene-Editing Cancer Treatment

Crispr Therapeutics AG is leading the charge in developing gene-editing therapies to revolutionize cancer treatment. Their pioneering approach has the potential to transform how we combat this deadly disease.

The innovative strategy employed by Crispr Therapeutics AG involves harnessing the power of CRISPR technology to precisely target and modify cancer cells, opening up new possibilities for more effective and personalized treatments.

By leveraging this cutting-edge gene-editing tool, they aim to enhance the precision and accuracy of cancer therapies, ultimately improving patient outcomes.

One notable advancement in their research is their recent filing with the FDA for a sickle cell gene therapy. This significant milestone underscores their unwavering commitment to bringing life-changing treatments to patients and highlights their progress in obtaining regulatory approvals.

By focusing on diseases like sickle cell anemia, Crispr Therapeutics AG demonstrates their dedication to addressing critical medical needs and offering hope for those affected by these conditions.

The work being done by Crispr Therapeutics AG holds immense promise for the future of cancer treatment. Through their groundbreaking advancements in gene editing, they are pushing the boundaries of what is possible in the fight against this devastating disease.

With continued investment and support, Crispr Therapeutics AG has the potential to reshape how we approach cancer therapy, offering renewed hope for patients worldwide.

Biotech and Pharma Giants Place Bets on Caribou’s Gene-Edited Cancer Treatments

Caribou Biosciences has gained recognition from major biotech and pharma players for their expertise in developing gene-edited cancer treatments. With strategic partnerships and significant investments from industry giants, Caribou’s innovative gene-editing technologies have the potential to disrupt the market and transform cancer treatment.

By providing more targeted therapies, Caribou aims to improve patient outcomes and revolutionize the field of oncology. The confidence shown by these biotech and pharma leaders highlights the immense potential of Caribou’s advancements in gene editing.

Biotech and Pharma Giant Pfizer Takes Notice of Wall Street’s Interest

Pfizer, a prominent player in the biotech and pharmaceutical industry, is paying close attention to the growing interest from Wall Street in CRISPR technology. The advancements in gene editing through CRISPR have attracted significant investments and acquisitions within the sector.

Market response has been overwhelmingly positive, with investors recognizing the potential for substantial returns. Pfizer’s recognition of this trend reflects its commitment to staying at the forefront of scientific advancements and capitalizing on emerging opportunities.

This demonstrates the increasing importance of CRISPR technology in shaping the future of medicine.

Biotech and pharma giant Intellia’s investors are selling off their stocks following news of successful CRISPR gene-editing breakthroughs. This unexpected reaction highlights profit-taking, short-term market fluctuations, and concerns over competition in the CRISPR industry as key factors behind the stock dumping.

The impact on the overall CRISPR market is significant, showcasing cautionary aspects and opportunities for potential investors. Understanding these reasons provides valuable insights into investor sentiment towards CRISPR stocks and informs investment decisions in this rapidly evolving industry.

Evaluating the Financial Performance of CRISPR Stocks

Investors looking to capitalize on the potential of gene editing technology must carefully evaluate the financial performance of CRISPR stocks. This involves analyzing stock performance over time and considering various factors that can influence their future trajectory.

Understanding historical growth patterns is a crucial aspect of evaluating potential investments in CRISPR stocks. By examining past performance trends, investors gain valuable insights into how different companies within the CRISPR industry have fared historically.

This analysis helps gauge the stability and consistency of a company’s financial performance, allowing for informed investment decisions.

However, it is important not to rely solely on historical data when evaluating CRISPR stocks. Forecasting future projections based on these trends is equally vital. By projecting future performance, investors can assess the growth potential and profitability of different companies within the gene editing sector.

These projections help guide investment decisions by providing an outlook on potential returns.

When evaluating the financial performance of CRISPR stocks, it is also essential to consider external factors that could significantly impact their value. One crucial factor to examine is regulatory challenges. Gene editing technologies like CRISPR face ongoing scrutiny and regulation due to ethical concerns and potential risks.

Investors should carefully analyze each company’s regulatory landscape and evaluate how potential regulatory changes could impact their stock performance. Understanding and anticipating these challenges can help investors make more informed decisions based on a comprehensive assessment of risk.

[lyte id=’arujchJyeyM’]