John is determined to boost his credit score and make intelligent investment decisions. He understands the significance of a good credit score in accessing favorable financial opportunities. By monitoring his credit report, paying bills on time, and keeping credit utilization low, he aims to improve his creditworthiness.

Alongside improving his credit score, John focuses on investing wisely. Seeking advice from financial advisors and diversifying his portfolio across various asset classes, he aims for long-term growth. With a disciplined approach and a focus on fundamental analysis, he sets himself up for financial security in the future.

Unexpected Errors on His Credit Report Leading to Frustration

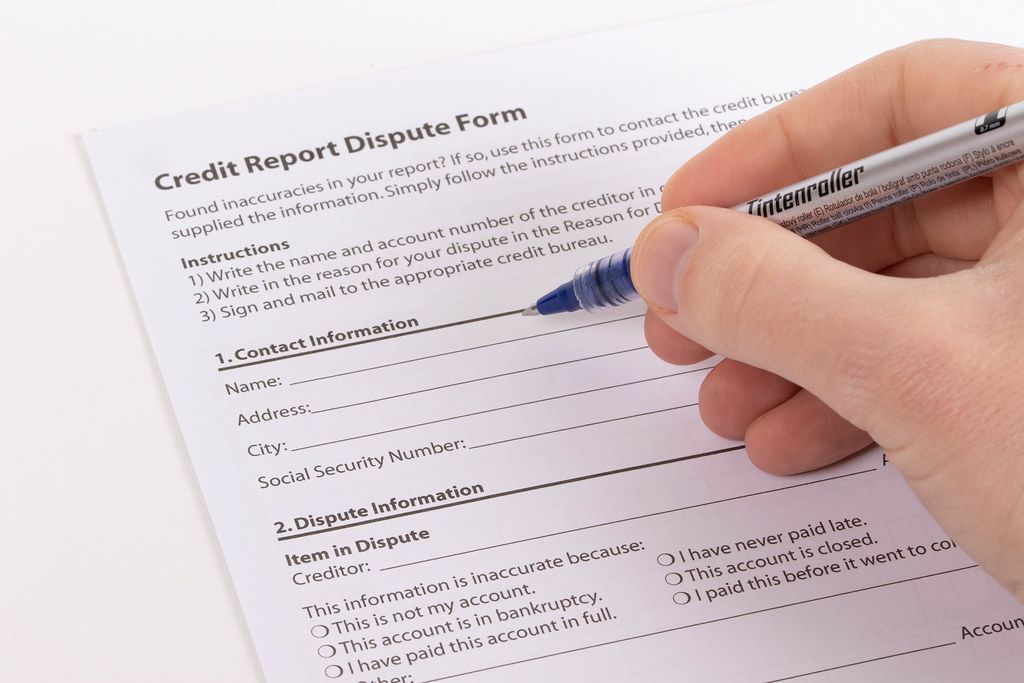

John’s frustration grew as he discovered unexpected errors on his credit report. Inaccurate information, such as accounts he never opened and late payments he never made, left him concerned about the impact on his financial stability. He promptly disputed the errors but faced a slow and frustrating process.

Weeks turned into months as he navigated through bureaucracy, submitted paperwork, and chased updates. The lack of transparency and communication from the credit bureaus only added to his mounting frustration.

These errors not only consumed his time but also cast uncertainty over his ability to secure loans or negotiate favorable terms in the future, leaving him feeling powerless against an industry that significantly influenced his financial well-being.

Regularly reviewing one’s credit report and advocating for accuracy is crucial in avoiding such frustrations.

The Search for a Solution and Credit Dispute Cloud Reviews

When dealing with credit disputes, finding a solution is essential. In this search, individuals often come across credit dispute cloud reviews. These reviews provide valuable insights into various online platforms that offer credit dispute resolution services.

Credit disputes arise when people believe there are errors in their credit reports affecting their finances. To address these issues, many turn to the internet for guidance. During their search, they encounter credit dispute cloud reviews – comprehensive evaluations of different platforms.

These reviews offer information on the effectiveness, reliability, and customer experiences associated with specific credit dispute resolution services. By reading them, individuals can make informed decisions about which platform best suits their needs.

Credit dispute cloud reviews empower users by sharing real-life experiences from others who have faced similar challenges. Armed with this knowledge, individuals can confidently resolve their own credit disputes while making informed choices along the way.

Definition of Credit Disputes and Their Role in Improving Credit Scores

Credit disputes are essential for improving credit scores by allowing individuals to correct errors and resolve disputes on their credit reports. When someone identifies an inaccuracy or unauthorized entry, they can initiate a formal dispute process with the credit reporting agencies (CRAs).

The CRAs then investigate the disputed items and contact the data furnishers associated with them. If the information cannot be verified or is proven inaccurate, it must be removed from the individual’s credit report.

This correction can lead to an improved credit score, providing better financial opportunities such as favorable loan terms and lower interest rates. Regularly reviewing credit reports, identifying discrepancies promptly, and taking action to dispute and correct them is crucial for maintaining a healthy credit profile.

How Errors on Credit Reports Can Harm Individuals’ Financial Goals

Errors on credit reports can seriously hinder individuals’ financial goals. Inaccurate information can lead to difficulties obtaining credit, higher interest rates, and unfair denials. It can also damage credit scores, affecting insurance premiums, rental applications, and job prospects.

These errors make it harder for individuals to rebuild their credit and achieve important milestones. Discovering such mistakes can be emotionally distressing, making it crucial to regularly monitor credit reports and take prompt action to rectify any inaccuracies.

In summary, errors on credit reports have far-reaching consequences for individuals striving to achieve their financial objectives. From limited access to credit and damaged credit scores to delayed progress and emotional distress, these inaccuracies pose significant risks.

Vigilant monitoring and swift correction are vital in safeguarding financial well-being and pursuing financial aspirations confidently.

The Significance of Addressing Inaccuracies Through Credit Disputes

Addressing inaccuracies through credit disputes is crucial for maintaining a good credit score. By challenging discrepancies on credit reports, individuals can rectify inaccurate information that may harm their financial well-being.

Using credit dispute cloud services offers convenience, allowing easy access to credit reports and initiating dispute resolutions online. This empowers individuals to take control of their financial reputation and promotes fairness within the system.

Successfully resolving inaccuracies leads to better loan terms, lower interest rates, and improved financial opportunities. Taking charge of one’s creditworthiness paves the way for greater financial security and a brighter future.

Introduction to Credit Dispute Cloud Services and Their Features

Credit dispute cloud services have transformed the way individuals and businesses handle credit report inaccuracies. These platforms offer convenient access to credit reports, streamline the dispute process, provide real-time tracking, and offer educational resources.

Collaboration functionality ensures all parties involved are working towards resolution. With credit dispute cloud services, users can take control of their financial reputation efficiently and effectively.

Streamlining the process: How these services simplify credit disputes

Credit dispute cloud platforms offer a streamlined approach to resolving credit disputes. These platforms provide easy access to credit reports, automate dispute filing with relevant documentation, and enable efficient tracking and monitoring of the progress.

With these platforms, users can quickly access their credit reports online, simplifying error identification. The automated dispute filing feature generates customized letters and eliminates the need for manual preparation. Additionally, users can easily track and monitor the progress of their disputes in one centralized location.

By using credit dispute cloud platforms, individuals can simplify and expedite the process of addressing inaccuracies on their credit reports. These services provide convenience, efficiency, and peace of mind as individuals work towards improving their credit profiles.

[lyte id=’3s0uGw3mnY0′]