In the world of investing, understanding how credit works is crucial for financial success. One important concept that often comes up when discussing credit is the “credit 15/3 rule.” This rule has gained attention and sparked curiosity among investors and those looking to learn more about managing their finances.

In this article, we will dive deep into the credit 15/3 rule, debunk any myths surrounding it, and explore its role in maintaining a healthy credit score. So, let’s get started and unravel the secrets behind this intriguing concept.

Definition and Purpose of the Credit 15/3 Rule

The Credit 15/3 rule suggests keeping your credit utilization ratio below 15% on each credit card and maintaining an overall combined ratio below 30%. This rule aims to optimize your credit score by showing responsible credit use and avoiding excessive debt.

Adhering to this rule demonstrates financial discipline, improves creditworthiness, and can lead to better loan terms and interest rates. Monitoring balances regularly helps ensure compliance with the rule and promotes prudent management of multiple lines of credit.

By following the Credit 15/3 rule, individuals can enhance their credit scores and open up more favorable financial opportunities.

Importance of credit utilization in managing finances

Credit utilization is a vital factor in managing your finances and determining your creditworthiness. It represents the amount of credit you are currently using compared to your total available credit limit. Lenders consider this ratio when assessing your ability to handle debt responsibly.

By effectively managing your credit utilization, you can improve loan terms, interest rates, and borrowing limits. Maintaining a low ratio shows financial control and can positively impact your credit score.

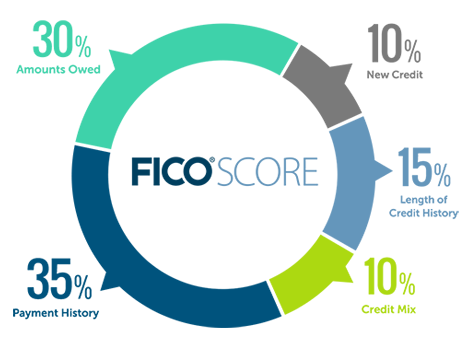

It’s important to note that credit utilization is just one aspect of overall creditworthiness, so it should be managed along with other factors like payment history and account diversity.

[lyte id=’GlpZmmRVmSo’]