Investing in commodities can be a lucrative venture, especially when it comes to metals like copper. As one of the most widely used industrial metals, copper has a significant impact on various sectors of the economy.

If you’re interested in investing in copper but unsure where to start, this beginner’s guide will introduce you to the world of copper price ETFs (Exchange-Traded Funds) and provide valuable insights to help you make informed investment decisions.

Understanding the Basics of Copper Prices

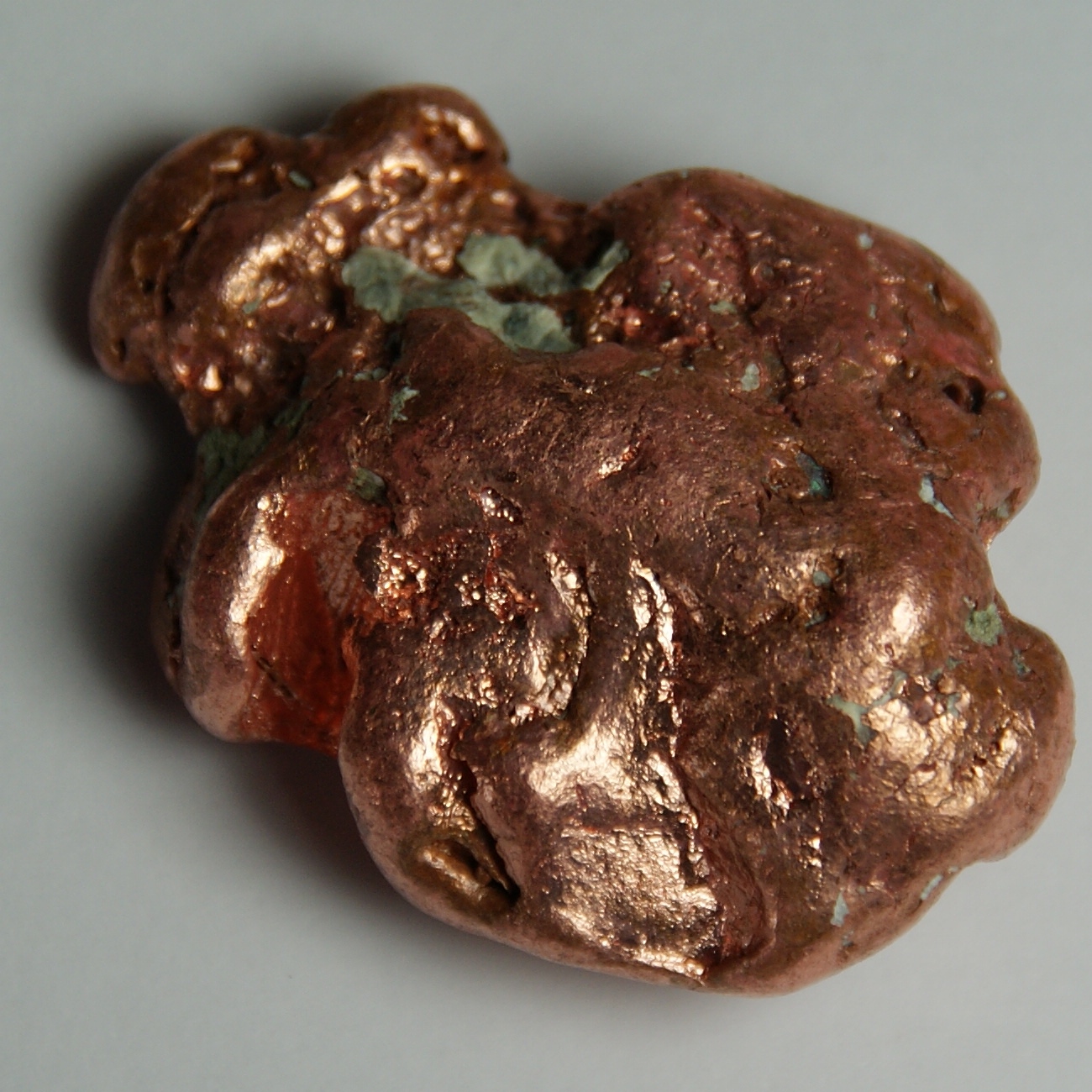

Copper, a versatile metal that holds immense importance in our daily lives, serves as a fundamental component across various industries. Its exceptional properties, including conductivity, malleability, and resistance to corrosion, make it highly sought after.

From electrical wiring and plumbing systems to renewable energy infrastructure and consumer electronics, copper plays a crucial role in powering our modern world.

The price of copper is influenced by several factors that shape its supply and demand dynamics. The balance between these two key elements serves as a primary driver of copper prices. When the demand for copper exceeds the available supply, scarcity drives prices higher.

Conversely, if the supply outpaces demand, prices tend to experience a decline.

In addition to supply and demand dynamics, economic indicators also significantly impact copper prices. Factors such as GDP growth rates, manufacturing activity levels, and construction spending reflect the overall health of the global economy.

These indicators directly influence the demand for copper as they determine the extent of its utilization in various sectors.

Furthermore, geopolitical factors hold considerable sway over copper prices. Events like trade disputes or political instability in major copper-producing countries can have significant ramifications on market conditions.

Changes in government policies or disruptions in mining operations can disrupt supply chains and subsequently lead to price fluctuations in the market.

Understanding these fundamental aspects is vital for anyone seeking to comprehend the complex nature of copper prices. By examining how supply and demand interact with economic indicators and geopolitical factors, one can gain valuable insights into this essential metal’s pricing trends and anticipate future fluctuations.

Table:

| Factors Influencing Copper Prices |

|---|

| Supply and demand dynamics |

| Economic indicators |

| Geopolitical factors |

Exploring the Benefits of Investing in Copper ETFs

Copper ETFs offer investors a convenient and cost-effective way to gain exposure to copper’s price movements without physically owning the metal. These funds provide instant diversification by including multiple copper-related assets, reducing risks associated with individual companies or industries.

Compared to purchasing physical copper or investing in mining companies, copper ETFs have lower costs and are accessible to individual investors who may not have extensive resources or expertise in commodities trading.

By considering copper ETFs as part of their investment strategy, individuals can capitalize on the potential gains associated with this versatile metal while managing risks effectively.

Introducing Copper Price ETFs: How They Work

Copper price ETFs offer investors a convenient way to gain exposure to the performance of copper without dealing with physical storage or trading futures contracts. Popular options include Global X Copper Miners ETF (COPX) and United States Copper Index Fund (CPER). These funds track major copper indices or mining companies.

Tracking methods used by these ETFs vary. Some hold physical copper in warehouses, while others use futures contracts to mirror price movements on commodity exchanges. This allows investors to benefit from rising copper prices without directly engaging in these activities themselves.

In Part II of this series, we will analyze the performance trends and future outlook for copper price ETFs, providing valuable insights for informed investment decisions. Stay tuned for more information on how these ETFs can diversify portfolios and capitalize on the global demand for this essential industrial metal.

[lyte id=’R_2HSb9nA9Q’]