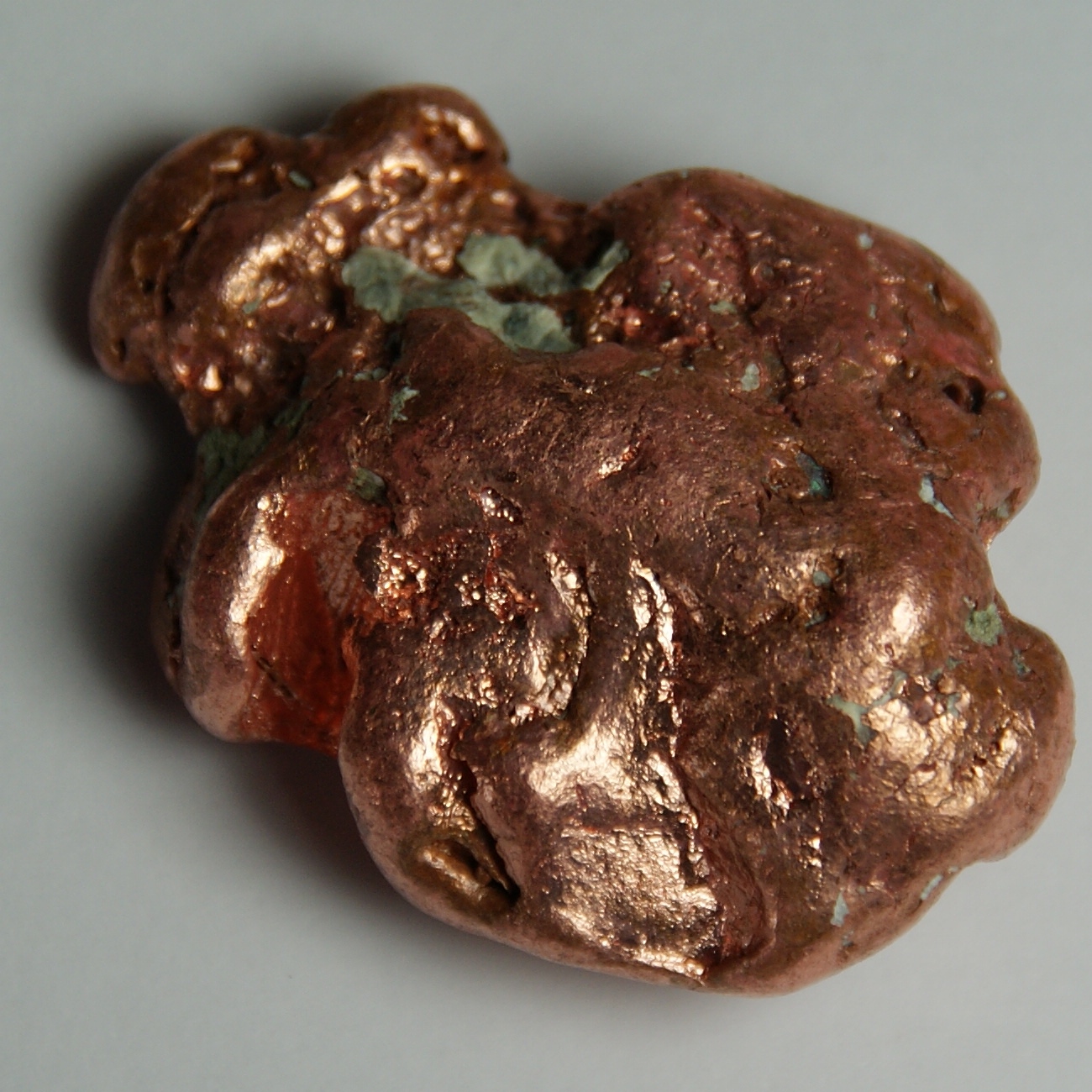

Investing in commodities has always been a popular choice for investors looking to diversify their portfolios and capitalize on global economic trends. While gold and silver have traditionally stolen the spotlight, another metal is starting to shine bright: copper.

With its versatile applications and growing demand, copper presents a compelling opportunity for investors seeking long-term growth.

Exploring the Growing Demand for Copper

Copper is in high demand across various industries, from construction and electronics manufacturing to renewable energy. It offers excellent conductivity, durability, and corrosion resistance, making it essential for electrical wiring, plumbing systems, and telecommunications equipment.

The push towards renewable energy sources like wind turbines and solar panels further increases the need for copper. These technologies heavily rely on copper for efficient power transmission and generation. Additionally, the rising popularity of electric vehicles contributes to the growing demand for copper.

Its unique properties make it a vital component in facilitating efficient power transfer and supporting sustainable technologies.

Understanding the Potential for Investment in Copper Companies

Investing in copper companies presents a promising opportunity as the demand for copper continues to rise. A supply deficit, driven by increased consumption and limited new discoveries, has led to rising prices and attracted investors.

Experts predict further growth in demand due to urbanization, infrastructure development, and technological advancements. Investing in these companies allows individuals to gain exposure to the expanding market while potentially reaping significant financial rewards. Additionally, it promotes sustainable practices within the industry.

Unearthing the Top Copper Companies to Watch Out For

Investing in copper companies requires identifying those that demonstrate strong performance, innovation, and sustainability. Three notable companies in this regard are Company A, Company B, and Company C.

Company A has established itself as a leader through innovative mining processes and sustainable practices. Its commitment to reducing environmental impact sets it apart from competitors while maintaining consistent financial growth.

Company B focuses on technological advancements by integrating automation, AI, and data analytics into its operations. This emphasis on technology-driven solutions positions the company for long-term success.

Company C leverages global expansion opportunities by establishing operations across multiple countries. Diversifying its geographic presence mitigates risks associated with political instability or regulatory changes in any single region.

These top copper companies exhibit the qualities necessary for long-term growth and investment potential in an industry that continues to be in high demand worldwide.

Key Factors to Consider When Investing in Copper

Investing in copper companies requires careful consideration of various factors that can impact profitability and success. Evaluating the financial health and stability of a company is crucial, including metrics like debt-to-equity ratio and profitability.

Understanding industry trends, demand forecasts, and macroeconomic factors influencing copper prices is also essential. Assessing geopolitical risks and sustainability initiatives is important as political instability and environmental regulations can affect operations.

By considering these factors, investors can make informed decisions in the copper market and potentially achieve significant returns.

Tips for Successful Copper Investments

To maximize returns on copper investments while managing risk effectively, consider the following tips:

-

Diversify within the mining sector: Spread risk by investing in multiple copper companies and exploring related commodities like gold and silver.

-

Stay informed about market trends: Regularly monitor industry developments, news, and expert analysis to make well-informed investment decisions.

-

Utilize research reports and expert opinions: Gain deeper insights into market dynamics and stay ahead of the curve by leveraging comprehensive analysis.

-

Consider macroeconomic factors: Evaluate broader trends such as infrastructure development, technological advancements, and sustainable energy initiatives that impact copper demand.

-

Evaluate company performance: Assess financial stability, revenue growth, profitability ratios, debt levels, and management expertise when selecting mining companies to invest in.

By following these tips and conducting thorough research, you can enhance your chances of success in the copper investment market.

Top Copper Stocks to Consider in 2023

When it comes to investing in copper, these top stocks offer promising opportunities:

BHP Group: A leader in the copper industry with a diversified portfolio and strong financial performance.

Freeport-McMoRan: Extensive operations and projects focused on copper production, with a solid track record of financial performance.

Teck Resources: Capitalizing on increasing copper demand through diverse operations and strong financial health.

Southern Copper: Expanding international presence and growth strategies make it an appealing option for exposure to the global copper market.

Investing in these top copper stocks can provide potential for long-term growth and maximize returns in 2023.

The Bottom Line: Copper Investing for a Bright Future

Investing in copper companies offers an opportunity to capitalize on the growing demand for this versatile metal. With its indispensable applications and increasing consumption, copper is set to shine bright in the years ahead.

By considering factors such as financial health, industry trends, and geopolitical risks, investors can make informed decisions for potential long-term growth. Thorough research and professional advice are essential before making any investment choices.

[lyte id=’R_2HSb9nA9Q’]

/Escondida-5b4b2f52c9e77c00371e0cf7.jpg)