Investing in battery technology has become an increasingly popular choice for investors looking to capitalize on the growing demand for clean energy solutions. As the world moves towards a more sustainable future, batteries are playing a crucial role in powering electric vehicles, storing renewable energy, and revolutionizing consumer electronics.

In this article, we will explore the potential of battery technology investments, the key factors driving this trend, and the leading companies at the forefront of this industry. We will also discuss emerging players worth watching and provide key considerations for investors interested in this sector.

Finally, we will examine the risks and rewards associated with investing in battery technology and share our thoughts on the future prospects of this exciting field.

The Rise of Battery Technology: A Game-Changer for Investors

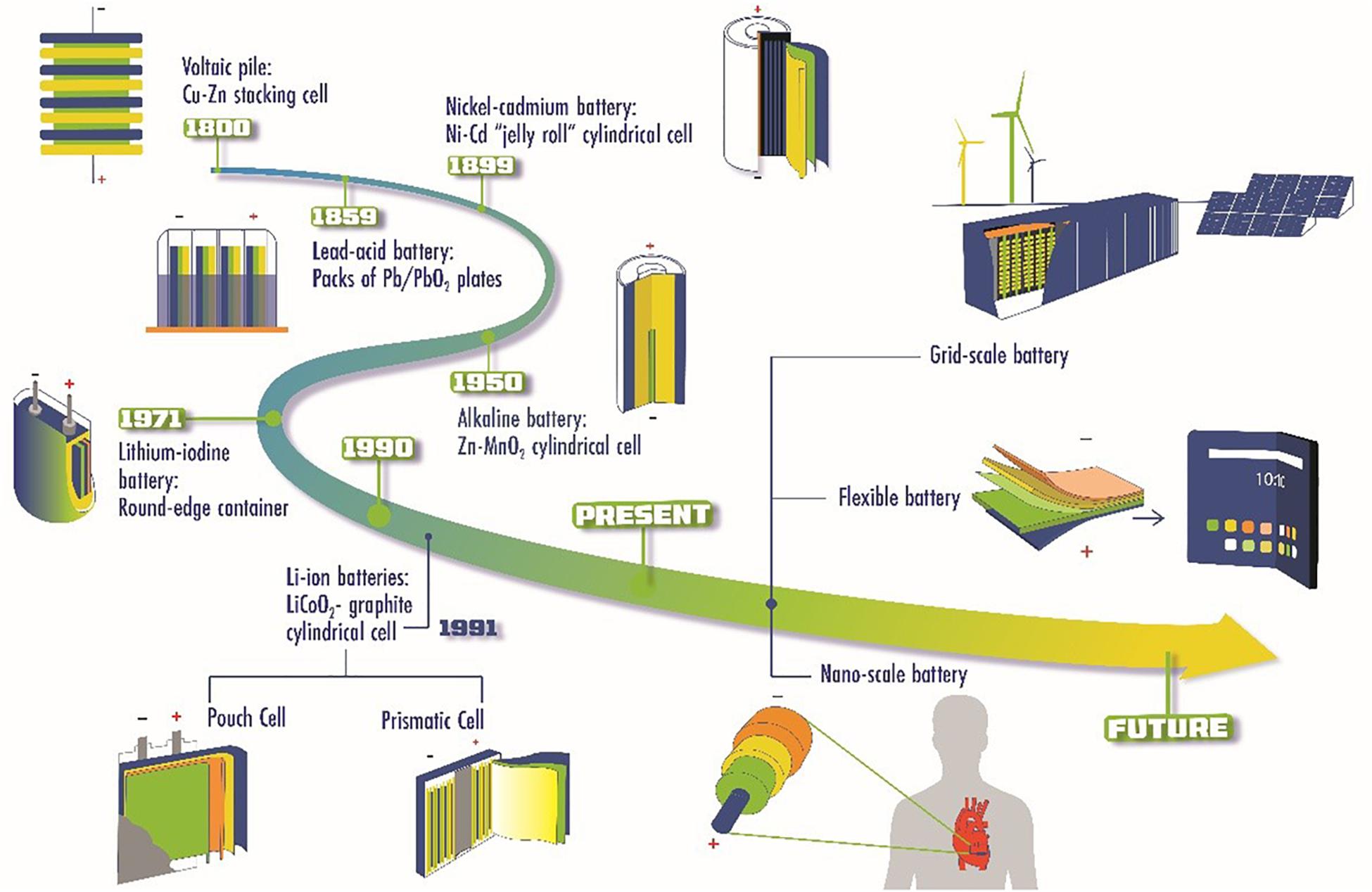

Battery technology is revolutionizing industries, transforming how we power devices and promoting sustainability. With advancements in performance and decreasing costs, batteries are now used for storing renewable energy and powering electric vehicles.

Companies like Tesla lead the way with cutting-edge batteries offering longer ranges and faster charging times. Energy storage providers like Enphase Energy and Sunrun harness batteries to store excess solar energy.

This technology extends beyond transportation and energy sectors, finding applications in consumer electronics, aerospace, telecommunications, and defense. Investors recognize the growth potential in this field, as battery technology reshapes industries and paves the way for a greener future.

Exploring the Potential of Battery Technology Investments

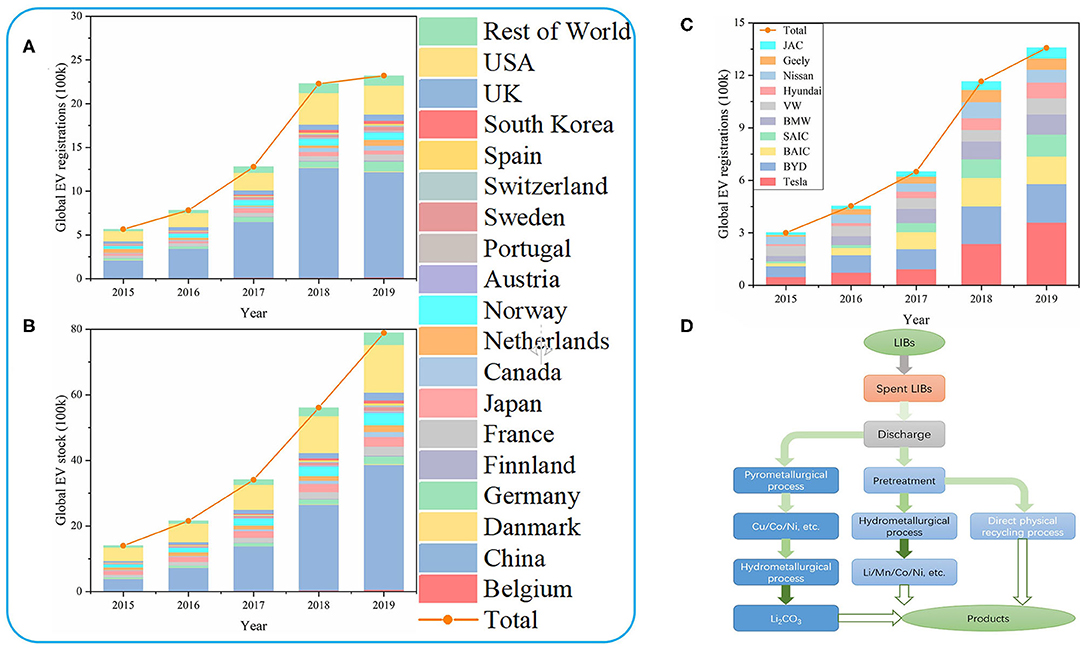

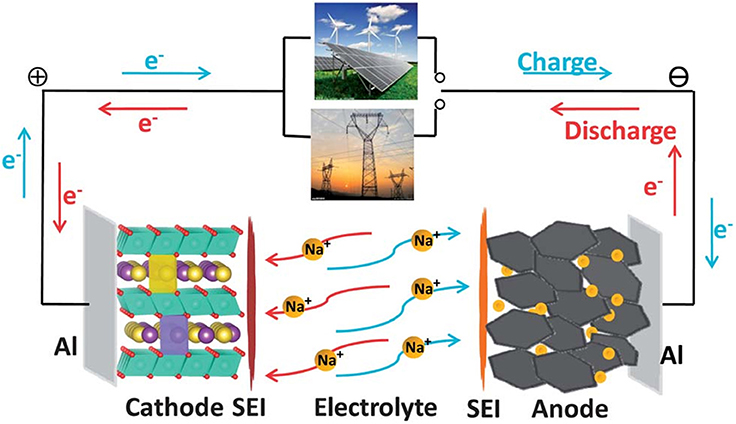

Battery technology investments have immense potential across various industries. Electric vehicles are driving significant growth in this sector as countries commit to reducing greenhouse gas emissions. Batteries power these vehicles, making investing in electric vehicle manufacturing and battery production lucrative.

Renewable energy storage is another promising area for battery technology investment. Batteries play a critical role in storing excess energy generated by solar and wind sources during low demand periods. Investing in energy storage companies can provide exposure to this rapidly growing market.

Battery technology also fuels consumer electronics and smart devices, where demand for longer-lasting batteries is increasing. Companies at the forefront of battery innovations stand to benefit from this trend, making them attractive investment options.

Exploring the potential of battery technology investments reveals opportunities in electric vehicles, renewable energy storage, and consumer electronics. By investing wisely in companies driving innovation within the battery sector, investors can contribute to a cleaner future while potentially reaping substantial rewards.

Key Factors Driving Investment in Battery Technology

Investment in battery technology is being driven by several key factors. Environmental concerns and the push for sustainability are compelling governments, businesses, and individuals to prioritize clean energy solutions like electric vehicles and renewable energy storage systems.

Governments worldwide are also offering incentives and subsidies to promote investments in batteries, while the increasing demand for electric vehicles and renewable energy sources further boosts the need for battery technology. Investors who recognize these trends can position themselves for significant returns as the market continues to grow.

Leading Companies Investing in Battery Technology

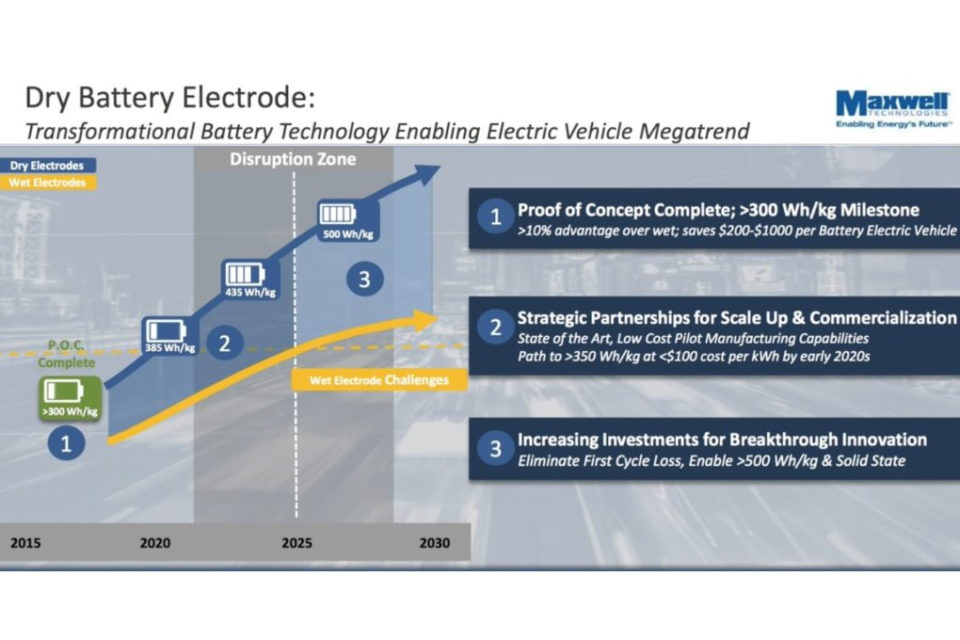

The battery technology sector is witnessing significant investment and innovation, with companies like Tesla and Panasonic leading the way.

Tesla has revolutionized the electric vehicle industry with its cutting-edge batteries. Their Gigafactories produce high-performance lithium-ion batteries that offer longer ranges, faster charging times, and improved safety features.

Tesla’s advancements have not only propelled the electric vehicle market forward but also established them as a major player in the energy storage sector.

Panasonic, on the other hand, collaborates with Tesla to produce high-quality batteries at scale. This partnership allows both companies to leverage their expertise in battery technology and automotive manufacturing, resulting in superior performance and reliability.

Additionally, Panasonic is expanding into other industries such as energy storage solutions for homes and businesses.

Investors looking for opportunities within the battery technology space should closely monitor Tesla’s advancements and partnerships as well as consider Panasonic’s diversification efforts. These leading companies are shaping the future of battery technology and offer attractive investment prospects in this rapidly evolving industry.

Emerging Players in the Battery Industry Worth Watching

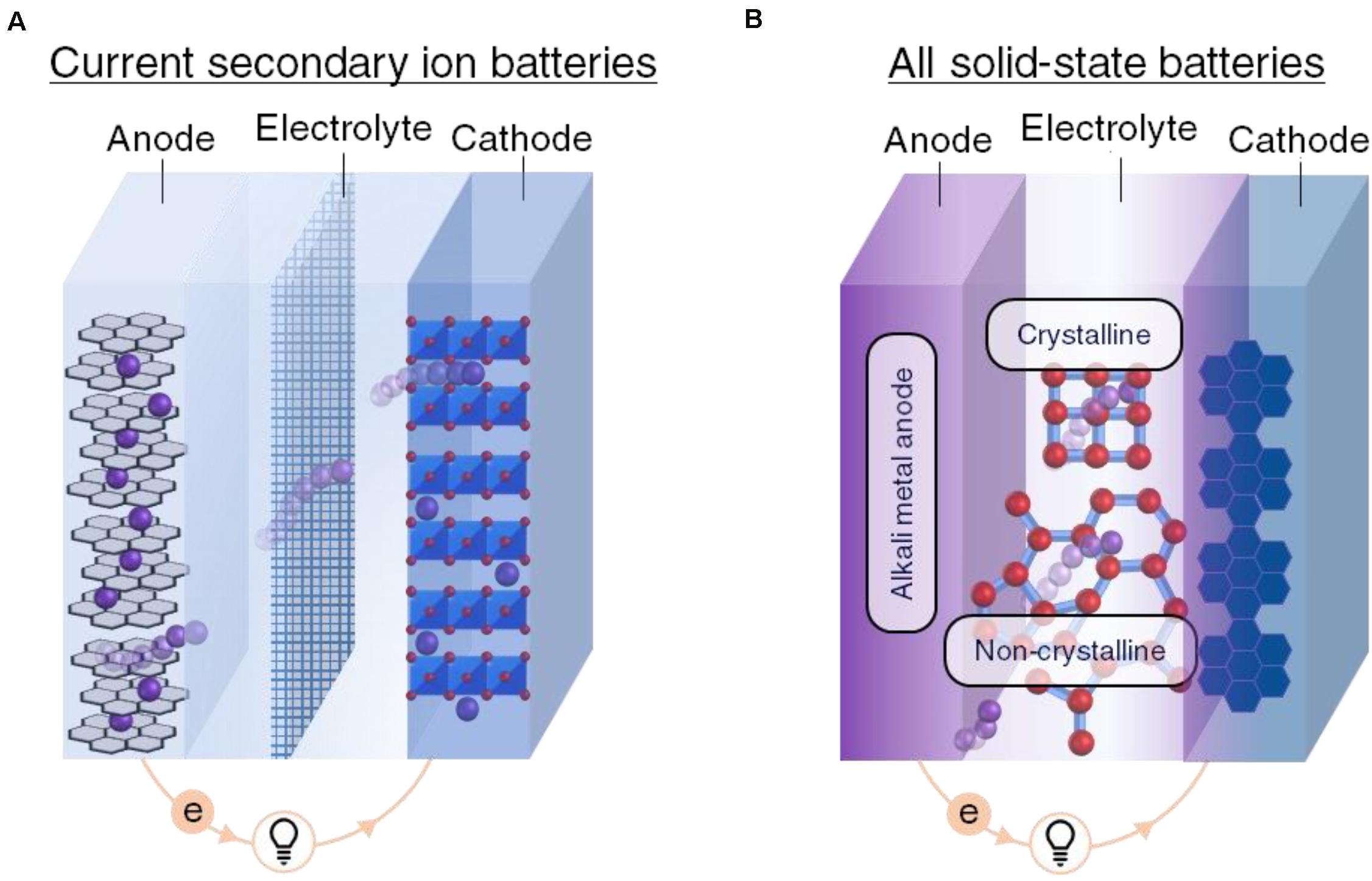

QuantumScape is an emerging player in the battery industry that is pioneering solid-state battery technology. Their batteries offer advantages such as higher energy density, faster charging capabilities, and enhanced safety features compared to traditional lithium-ion batteries.

Major automakers like Volkswagen have recognized the potential of QuantumScape’s innovative approach and invested heavily in advancing this technology. If successful, QuantumScape’s solid-state batteries could revolutionize electric vehicles by significantly increasing their range and reducing charging times.

Additionally, these advanced batteries could find applications in renewable energy storage systems for grid stabilization and improved efficiency. QuantumScape is a player worth watching as they continue to push boundaries and drive innovation in the battery industry.

Key Considerations for Investors Interested in Battery Technology

Investors interested in battery technology should carefully evaluate the financial health and stability of companies operating in this sector. Factors such as revenue growth, profitability, debt levels, research and development investments, and partnerships offer insights into a company’s prospects.

Analyzing market trends, growth potential, and competition is crucial for identifying investment opportunities. Understanding demand across industries, monitoring technological advancements, and evaluating the competitive landscape aid in making informed decisions.

Additionally, staying aware of regulatory factors and government policies that influence the sector is essential. Prioritizing sustainability aligns with long-term trends and can lead to positive outcomes.

| Factors to Consider | |

|---|---|

| Financial Health | Revenue growth, profitability, debt levels, research and development investments, partnerships |

| Market Analysis | Demand for batteries across industries, technological advancements, competitive landscape |

| Regulatory Factors | Changing regulations related to energy storage, transportation, and sustainability |

| Environmental Impact | Focus on sustainable practices |

Note: The table above provides a concise overview of the factors to consider when investing in battery technology.

The Risks and Rewards of Investing in Battery Technology

Investing in battery technology comes with risks as the industry rapidly evolves. Technological advancements can make existing technologies obsolete, leading to financial losses for slow-to-adapt investors. Intense competition from established players and emerging startups further adds challenges for companies in this space.

However, there are substantial rewards to be gained from investing in battery technology. With increasing demand across industries, companies at the forefront of technological advancements can experience significant revenue growth and market valuation.

The transition to clean energy and the rise of electric vehicles contribute to the growing demand for advanced battery solutions.

Despite the risks, understanding market dynamics and staying updated on technological advancements can help investors position themselves advantageously within the battery technology industry. By carefully assessing risks and identifying opportunities, investors can tap into the long-term potential of this evolving sector.

Conclusion: Harnessing the Power of Battery Technology Investments

Investing in battery technology presents tremendous opportunities for investors aligning financial goals with sustainability objectives. Batteries power electric vehicles, store renewable energy, and drive innovation in consumer electronics.

With exponential growth potential, understanding key investment factors and monitoring leading companies like Tesla and Panasonic, as well as emerging players like QuantumScape, positions investors advantageously within this dynamic industry.

While risks exist in a rapidly evolving sector, the potential rewards make battery technology investments attractive for those seeking financial returns and positive environmental impact. Electric vehicles are gaining popularity globally, driving demand for batteries.

Renewable energy storage benefits from batteries’ ability to store excess energy during peak periods. In consumer electronics, longer-lasting batteries enhance product appeal.

[lyte id=’fddC65Bo7uw’]