Investing in commodities can be a lucrative venture, but it requires a deep understanding of the market and its underlying dynamics. One tool that can greatly assist investors in navigating the complex world of commodities is a commodity supercycles newsletter.

In this article, we will explore the basics of commodity supercycles, their significance for investors, and how newsletters provide valuable insights and analysis to help maximize investment opportunities.

The Basics of Commodity Supercycles

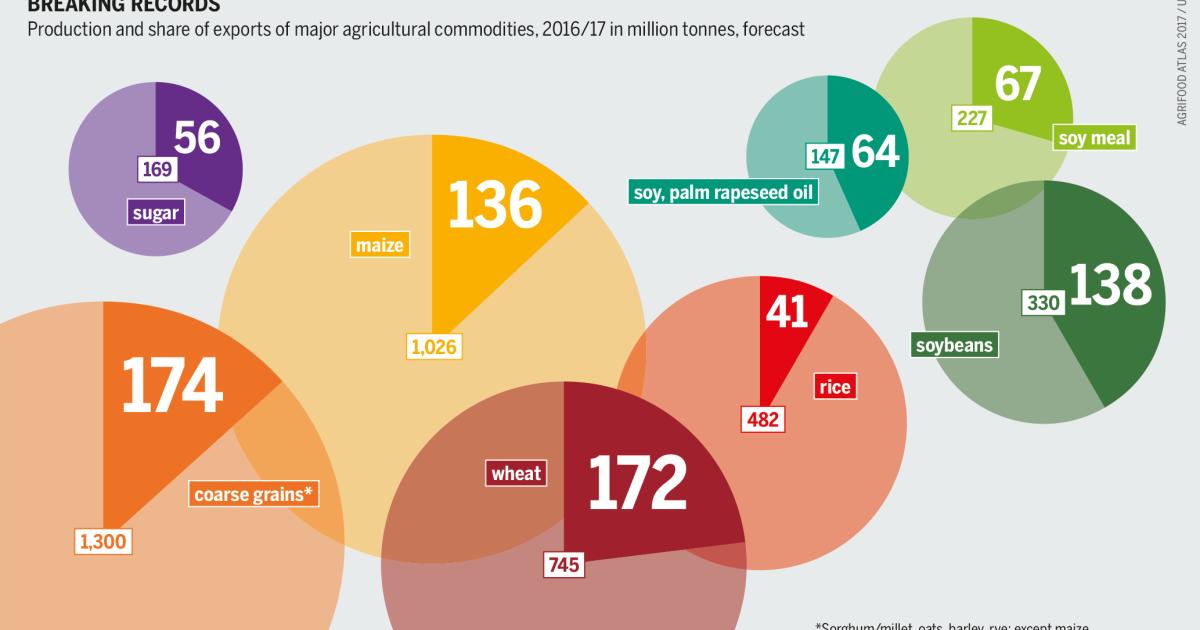

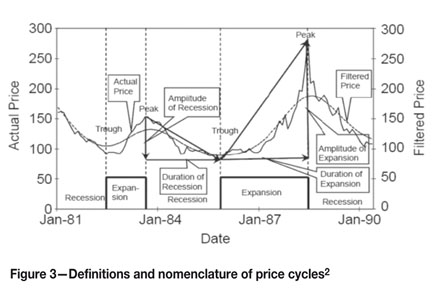

Commodity supercycles are prolonged periods of fluctuation in commodity prices, lasting for several years or even decades. These cycles are influenced by supply and demand dynamics, geopolitical events, and global economic trends.

For example, the oil supercycle from 2002 to 2014 saw prices skyrocket due to increased global demand, followed by a sharp decline as supply caught up. Understanding these cycles is crucial for investors looking to profit from them.

Factors such as supply and demand imbalances, geopolitical events, and economic trends all play a role in shaping commodity supercycles. By closely monitoring these factors, investors can make more informed decisions during these cycles.

The Significance of Commodity Supercycles for Investors

Commodity supercycles greatly impact industries and the economy. Sectors relying on specific commodities are vulnerable to price fluctuations, such as energy companies affected by oil price changes. Mining firms extracting precious metals also feel the effects of commodity price shifts.

These supercycles hold global significance, influencing inflation rates, interest rates, and monetary policies set by central banks. Financial markets react to commodity prices as they serve as underlying assets for investment products like futures contracts or ETFs.

Investors must recognize the opportunities and risks associated with commodity supercycles. They can profit from rising prices during boom periods but should be cautious during bust periods when prices decline sharply.

To navigate through these cycles successfully, investors need to understand market trends, supply and demand dynamics, geopolitical factors, and environmental regulations impacting commodities. By staying informed, they can make more informed investment decisions.

In summary, commodity supercycles have far-reaching consequences for industries and the economy. Investors must remain vigilant, seizing opportunities while mitigating risks to maximize their chances for success in volatile market conditions.

Navigating Commodity Supercycles: The Role of Newsletters and Expert Analysis

Commodity supercycle newsletters provide invaluable resources for investors navigating these complex cycles. They offer expert analysis and insights on market trends, helping investors make informed decisions.

Subscribers gain access to comprehensive analysis of various commodities, timely updates on performance and predictions for future price trends. Additionally, tailored investment strategies and recommendations are provided, guiding investors on when to buy or sell and how to manage risk effectively.

By leveraging the expertise offered by these newsletters, investors can navigate commodity supercycles with confidence.

Key Components of a Commodity Supercycle Newsletter

Commodity supercycle newsletters provide investors with vital information to make informed decisions. Key components include:

Newsletters analyze individual commodities, offering insights into their current state and future potential.

Discussion on supply-demand dynamics helps investors anticipate price fluctuations and profitability.

Newsletters explore how geopolitical events impact commodity prices, such as trade policies or regulatory changes.

Assessing relevant economic data helps investors gauge market conditions accurately.

Commodity supercycle newsletters cover these components to assist investors in navigating the complexities of commodity markets.

Case Study: Successful Investments Using Commodity Supercycle Newsletters

Real-life examples demonstrate the effectiveness of commodity supercycle newsletters in guiding investment decisions. During the 2000s supercycle, newsletters accurately predicted the surge in copper demand due to infrastructure development in emerging economies like China.

Investors who acted on these predictions saw significant returns by investing in copper-related industries or trading copper futures contracts.

By staying informed through reliable commodity supercycle newsletters, investors can capitalize on market trends and make well-informed investment choices. These newsletters provide valuable insights into emerging trends and help investors identify lucrative opportunities within commodities markets.

Successful investments during previous commodity supercycles highlight the importance of using reputable sources like commodity supercycle newsletters to stay ahead of market developments. Subscribing to these newsletters and leveraging their expert analysis can position investors advantageously and potentially generate significant returns.

In summary, commodity supercycle newsletters have proven to be a valuable tool for guiding investment decisions. They offer accurate predictions about emerging trends and help investors strategically navigate commodities markets for profitable outcomes.

Tips for Choosing a Reliable Commodity Supercycle Newsletter

When choosing a commodity supercycle newsletter, consider the provider’s reputation within the investment community. Look for recommendations and endorsements from respected individuals or organizations. Additionally, review their track record of accurate predictions during past supercycles to gain confidence in their analysis.

Transparency is crucial, so ensure they are open about their methodology and data sources. Consider the range of commodities covered by the newsletter and evaluate the level of customer support provided. These tips will help you select a reliable source of information for making informed investment decisions in the commodities market.

Additional Resources for Learning About Commodity Supercycles

To enhance your understanding of commodity supercycles, explore additional resources such as books, websites, or podcasts dedicated to this topic. Recommended resources include “The Super Cycle: Profit from the Coming Inflation Tidal Wave” by David Skarica and “Commodity Investing 101” by Adam Dunsby.

These books provide practical strategies and insights for profiting from commodity supercycles. Additionally, websites like Bloomberg Commodities, Investing.com’s Commodities section, and CommodityHQ.com offer expert analysis and market updates.

Podcasts such as “The Commodity Supercycle Podcast” hosted by Jordan Roy-Byrne feature discussions with industry experts, providing valuable information for informed decision-making in the commodities market. Expand your knowledge and stay informed with these valuable resources.

Embracing Opportunities in Commodity Supercycles

Understanding commodity supercycles is crucial for investors seeking to maximize their returns in the commodities market. Subscribing to a reliable commodity supercycle newsletter provides access to expert analysis, timely updates, and tailored investment strategies.

By embracing the power of expert analysis and making informed decisions, investors can position themselves advantageously during different phases of these cycles, capitalizing on opportunities while managing risks. Choosing a reputable newsletter that offers unbiased insights from industry experts is essential.

Real-life examples and historical data can further enhance understanding and predict market movements. Embrace the potential of commodity supercycles by staying informed and making strategic investment choices.

[lyte id=’asV4Y6xvZwI’]