Investing in the stock market can often feel like navigating a complex maze, with countless strategies and approaches to consider. However, one approach that has consistently proven its worth is value investing. In this article, we will delve into the world of value investing and explore why it is highly regarded in the investment community.

Overview of Value Investing and its Principles

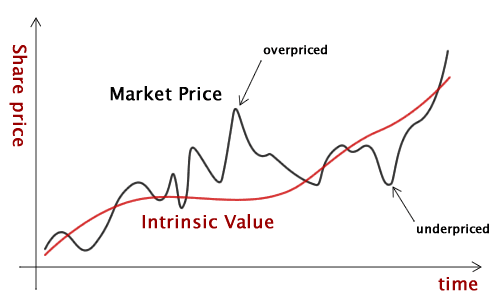

Value investing is an investment strategy that involves carefully analyzing stocks to identify undervalued opportunities. It takes a long-term perspective, focusing on stocks trading below their intrinsic value. By minimizing risk and maximizing returns, value investors aim to uncover hidden gems within the market.

This approach requires thorough research, a margin of safety, and a focus on fundamentals rather than short-term fluctuations. Ultimately, value investing offers the potential for significant growth and financial success in the stock market.

Why Value Investing is Highly Regarded in the Investment World

Value investing has gained immense popularity and is highly regarded in the investment world for a multitude of compelling reasons. This investment strategy aligns with the core principles of fundamental analysis, which involves evaluating various aspects of a company’s financial health, management team, competitive advantage, and growth prospects.

By focusing on these crucial factors, value investors aim to identify stocks that may have been overlooked or undervalued by the broader market.

One significant advantage of value investing is that it provides a margin of safety for investors. By purchasing stocks at a discount to their intrinsic value, investors build-in protection against unforeseen events or market downturns.

This conservative approach helps mitigate risks associated with volatile markets and provides a cushion during periods of economic uncertainty.

Moreover, value investing fosters a long-term mindset among investors. Instead of succumbing to short-term market fluctuations or chasing after hot trends, value investors prioritize the underlying fundamentals and long-term potential of companies.

This patient approach allows them to weather short-term turbulence while aiming for substantial gains over time.

Furthermore, value investing encourages thorough research and analysis. Investors who subscribe to this strategy meticulously study financial statements, industry trends, and competitive landscapes to identify opportunities that others may overlook.

This disciplined approach requires patience and diligence but can yield significant rewards for those who are willing to put in the effort.

Deep Value Investing

Deep value investing involves identifying stocks trading at a significant discount to their intrinsic value. It requires thorough research and analysis, focusing on companies with strong assets or potential catalysts for future growth.

One approach within deep value investing is “net-net” investing, where investors target companies with current assets exceeding liabilities. By purchasing these undervalued stocks, investors position themselves for potential substantial gains when the market recognizes their true worth.

Patience and discipline are key in this strategy as it may take time for the market to appreciate the value of these overlooked gems.

Contrarian Investing

Contrarian investing is a strategy that involves going against the prevailing market sentiment and taking positions that differ from popular opinion. By identifying opportunities where market expectations are excessively pessimistic or optimistic, contrarian investors can capitalize on mispriced securities.

This often involves buying stocks when others are selling in times of panic or distress, and selling when others are overly optimistic about a company’s prospects. Contrarian investing requires a contrarian mindset and a willingness to challenge conventional wisdom.

It is a strategy that involves defying the crowd and making informed decisions based on careful analysis.

Special Situation Investing

Special situation investing focuses on capitalizing on specific events or circumstances that create opportunities for above-average returns. These situations can include mergers and acquisitions, spin-offs, bankruptcies, or management changes.

Investors carefully evaluate the potential outcomes of these events and identify mispriced securities resulting from market overreactions or uncertainties surrounding these situations. By understanding the intricacies of such events, investors can position themselves for potentially lucrative returns.

The Role of Psychology in Investment Decision Making

Investment decisions are often influenced by emotions, cognitive biases, and heuristics. Understanding these psychological factors can help investors make more rational choices.

The fear of missing out (FOMO) can drive investors to chase after hot stocks or trends without proper analysis. Similarly, the fear of losses can lead to panic selling during market downturns, causing investors to miss out on potential gains.

Psychological biases like confirmation bias and anchoring bias also affect decision-making. Confirmation bias leads investors to seek information that supports their beliefs, while anchoring bias relies heavily on initial reference points for evaluation.

To counteract these influences, investors should strive for discipline and objectivity. Diversification, setting realistic goals, and maintaining a long-term perspective can help make informed decisions aligned with financial goals.

How Behavioral Biases Can Impact Investment Outcomes

Behavioral biases like confirmation bias, overconfidence, and anchoring can affect investment outcomes. Confirmation bias leads individuals to seek information that supports their beliefs while ignoring contradictory evidence. Overconfidence can lead to excessive risk-taking and an overestimation of one’s ability to consistently beat the market.

Anchoring causes individuals to rely too heavily on initial information when making subsequent judgments. Being aware of these biases and actively working to mitigate their influence is crucial for achieving optimal investment results.

Applying Behavioral Finance Principles to Value Investing Strategies

Value investors can leverage insights from behavioral finance to enhance their decision-making processes. By recognizing their own biases and understanding common pitfalls, they can strive for more objective analysis and disciplined investing.

For example, value investors may adopt a contrarian mindset when others succumb to herd mentality driven by emotional biases. They may also use quantitative models or checklists as decision-making tools that help overcome cognitive biases.

By combining fundamental analysis with an awareness of behavioral finance principles, value investors can make more informed decisions while avoiding common pitfalls associated with psychological biases in investing.

[lyte id=’-5SwWDPIML8′]