Investing in the stock market can be a thrilling endeavor, especially when it comes to the world of technology. The rapid pace of innovation and the potential for explosive growth make tech stocks an attractive option for many investors.

But what about cheap tech stocks?

Can they offer the same level of excitement and profit potential?

In this article, we will explore the story behind cheap tech stocks, identify how to spot potential winners, discuss some top contenders worth considering, share a success story with a cheap tech stock investment, delve into strategies for investing in these stocks, highlight associated risks, and wrap up with some final thoughts.

The Story Behind Cheap Tech Stocks

Tech companies are known for their innovation and disruptive potential, making them attractive to investors. While high-flying tech giants grab attention, there is value in cheaper alternatives. Cheap tech stocks provide opportunities for affordable entry or portfolio diversification.

These undervalued gems offer significant upside potential if identified correctly. Thorough research and analysis are essential to navigate risks and find promising investment prospects within this sector.

Identifying Potential Cheap Tech Stocks

To identify potential cheap tech stocks, thorough research and analysis are crucial. Two commonly used approaches in this process are fundamental analysis and technical analysis.

Fundamental analysis involves evaluating a company’s financial statements, management team, competitive position, industry trends, and overall business outlook. By examining key metrics like revenue growth, profitability ratios, and debt levels, investors can gain insights into a company’s underlying value.

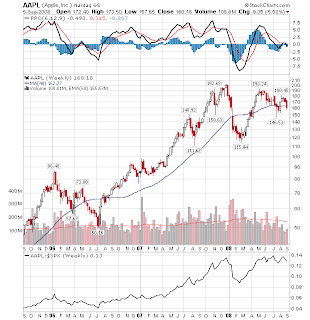

On the other hand, technical analysis focuses on studying historical price patterns and market trends to predict future stock movements. Technical analysts use charts, indicators, and other tools to identify buy and sell signals based on patterns in the stock’s price and volume.

When evaluating cheap tech stocks, factors to consider include market trends and demand for the company’s products/services. Assessing the company’s position within its industry and understanding the demand for its offerings is crucial.

Financial health and stability of the company should also be examined by looking at indicators such as solid revenue growth, manageable debt levels, consistent profitability, and healthy cash flows.

Analyzing a company’s competitive landscape and potential for growth is essential as well. Factors like barriers to entry, intellectual property rights, strategic partnerships, and adaptability to changing market conditions should be considered.

By considering these factors in combination with thorough research techniques in fundamental and technical analysis, investors can identify potential cheap tech stocks that may offer attractive investment opportunities.

Top Cheap Tech Stocks Worth Considering

When seeking potential investment opportunities in the tech sector, it’s important to consider affordable stocks that offer value. Two such options are Lumen Technologies and Applied Materials.

Lumen Technologies, formerly CenturyLink, operates a vast fiber-optic network in North America and provides communication services to businesses of all sizes. With a focus on expanding its cloud capabilities and digital transformation offerings, Lumen is well-positioned to meet the growing demand for high-speed internet connectivity.

The company appears undervalued compared to its industry peers, making it an attractive investment option.

Applied Materials is a leading global provider of materials engineering solutions for the semiconductor industry. They design and manufacture equipment used in semiconductor production, flat panel displays, and solar cells.

With a diverse product portfolio and strong customer relationships, Applied Materials plays a crucial role in enabling advancements in technologies like AI, 5G networks, and electric vehicles.

Investors should be aware of potential risks associated with these stocks. The cyclical nature of the semiconductor industry can lead to fluctuations in demand and profitability for Applied Materials. Additionally, factors such as supply chain disruptions and regulatory challenges should be monitored closely.

By considering these factors, investors can make informed decisions when evaluating cheap tech stocks like Lumen Technologies and Applied Materials. These companies offer growth potential while minimizing investment risk.

Success Story with a Cheap Tech Stock Investment

In this case study, we explore a success story of investing in a cheap tech stock. Through meticulous research, recognizing growth potential, and maintaining a long-term investment mindset, the investor achieved remarkable results.

Thorough research on company fundamentals and market trends played a pivotal role in their success. By identifying promising opportunities and understanding industry trends, they positioned themselves for exponential growth.

Additionally, their patient approach and ability to weather market fluctuations were crucial factors. They focused on long-term goals instead of short-term gains, capitalizing on the inherent volatility of tech stocks.

This case study demonstrates the potential rewards of investing in cheap tech stocks with diligence and strategic thinking. By learning from this success story, investors can uncover new possibilities within the ever-evolving tech industry.

Strategies for Investing in Cheap Tech Stocks

Investing in cheap tech stocks requires strategic approaches to mitigate risks and maximize returns. One effective strategy is dollar-cost averaging, which involves investing a fixed amount regularly regardless of the stock’s price.

This allows investors to buy more shares when prices are low and fewer shares when prices are high, reducing the impact of market volatility. Additionally, it is crucial to set realistic expectations and take a long-term perspective when investing in these stocks.

Avoid being swayed by short-term fluctuations and focus on fundamental aspects such as company financials and industry trends. By implementing these strategies, investors can position themselves for success in the dynamic world of cheap tech stock investments.

Risks Associated with Cheap Tech Stocks

Investing in cheap tech stocks can be appealing for maximizing returns, but it’s crucial to understand the risks involved. The technology sector is known for its volatility, with stock prices experiencing significant swings in short periods. This volatility stems from fast-paced technological advancements and intense competition.

Cheap tech stocks also carry company-specific risks such as poor management decisions, disruptive technologies from competitors, regulatory challenges, or financial instability. Thorough research and understanding of these risks are essential before making any investment decisions.

Diversifying portfolios and analyzing a company’s financials and competitive position can help mitigate potential losses.

Conclusion

Investing in cheap tech stocks can be a lucrative endeavor for investors who are willing to put in the necessary effort and research.

By conducting thorough due diligence, employing techniques such as fundamental and technical analysis, and evaluating key factors like market trends and financial health, individuals can identify potential winners in the tech sector.

Two notable contenders worth considering are Lumen Technologies and Applied Materials. These companies have shown promise in terms of their financial performance and growth prospects.

However, it is important to note that this article does not constitute financial advice, and investors should always seek professional guidance before making any investment decisions.

One strategy that can be employed when investing in cheap tech stocks is dollar-cost averaging. This approach involves consistently investing a fixed amount of money over regular intervals, regardless of the stock’s current price.

By doing so, investors can mitigate the impact of short-term market volatility and potentially accumulate more shares as prices fluctuate.

While cheap tech stocks present attractive investment opportunities, it is crucial to acknowledge the associated risks. The tech industry is highly competitive and subject to rapid changes in technology advancements and consumer preferences.

Therefore, investors should be prepared for potential fluctuations in stock prices and exercise caution when allocating their funds.

In conclusion, by conducting personal research, seeking professional advice, and maintaining a long-term perspective, investors can harness the potential rewards offered by cheap tech stocks. However, it is essential to remember that investment decisions should be based on individual circumstances and risk tolerance.

Cheap tech stocks can indeed be a valuable addition to an investment portfolio if approached with careful consideration and informed decision-making.

| Heading 1 | Heading 2 |

|---|---|

| Tech Stocks | Cheap Tech Stocks |

| Research Techniques | Fundamental Analysis Technical Analysis |

[lyte id=’QhLNAHuubK8′]