Investing in robotics stocks has become an increasingly popular option for those looking to diversify their investment portfolios and capitalize on the advancements in technology. As we look towards 2023, the potential of robotics stocks is expected to soar even higher, presenting investors with exciting opportunities.

In this article, we will explore the top robotics stocks to consider for investment, analyze their growth prospects, assess key performance metrics, discuss diversification strategies, and provide tips for successful investing in this dynamic sector.

Introduction to the Potential of Robotics Stocks in 2023

The field of robotics has advanced significantly, transforming industries such as healthcare, manufacturing, and transportation. In 2023, investing in robotics stocks holds immense potential for substantial returns. This is driven by technological breakthroughs, increased adoption across sectors, and supportive regulatory environments.

Technological advancements in AI, machine learning, and sensors have made robots more intelligent and efficient. Industries are embracing automation to improve productivity and reduce costs.

The widespread adoption of robots in healthcare, manufacturing, and transportation contributes to the potential for substantial returns. Robots perform precise surgeries, automate tasks on assembly lines, and power autonomous vehicles.

Supportive regulatory environments worldwide encourage the adoption of robotic automation. Stable policies provide a framework for companies to thrive and attract investors seeking long-term growth potential.

Investing in robotics stocks offers an exciting opportunity for growth and innovation in portfolios. With technological advancements and increasing adoption across sectors, the potential for substantial returns is undeniable in 2023.

Overview of Top Robotics Stocks to Consider for Investment

Investing in robotics stocks can be a lucrative opportunity, given the rapid growth in technology and automation. Here are four top players worth considering:

-

Nvidia: A leader in AI and autonomous vehicles, Nvidia’s high-performance computing platforms have revolutionized various industries, including gaming and self-driving cars.

-

Intuitive Surgical: With its da Vinci Surgical System, Intuitive Surgical has made significant advancements in robotic surgery, catering to the rising demand for minimally invasive procedures.

-

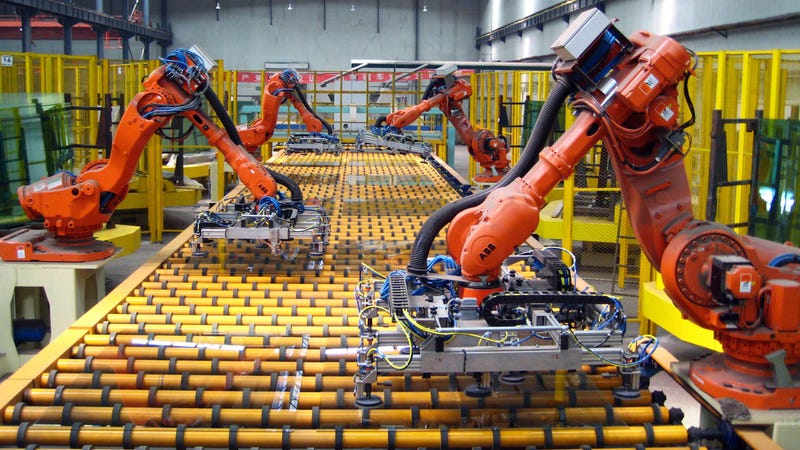

ABB: As a global leader in industrial automation, ABB offers advanced robotics solutions that enhance productivity and efficiency across manufacturing processes.

-

Rockwell Automation: Specializing in industrial robotics and automation solutions, Rockwell Automation serves diverse industries like automotive and pharmaceuticals, making it a key player in streamlining operations.

Consider these top robotics stocks when exploring investment opportunities within the sector. Each company offers unique strengths and potential for growth as technology continues to shape our world.

Evaluating the Potential of Robotics Stocks in 2023

The potential for investing in robotics stocks in 2023 is significant. Market trends indicate that the robotics sector will experience substantial growth, driven by increasing demand across industries such as healthcare, manufacturing, logistics, and defense.

Technological advancements, including AI and collaborative robots (cobots), are revolutionizing the industry and opening up new opportunities for automation. Governments are also implementing supportive policies to encourage innovation and adoption. Investing in robotics stocks presents promising opportunities for long-term growth potential.

Assessing the Performance Metrics of Robotics Stocks

When investing in robotics, it’s important to evaluate performance metrics. Key indicators to consider include revenue growth rate, profitability metrics like gross margin and net margin, and return on investment (ROI). These metrics provide insights into a company’s financial health and growth potential.

Comparing these metrics with industry benchmarks helps investors assess performance relative to peers. By analyzing these factors, investors can make more informed decisions about which robotic stocks have strong growth potential.

Diversification Strategies for Robotics Investments

To mitigate risks and maximize returns in robotics investments, diversification is crucial. By spreading investments across different sectors within robotics, investors can reduce exposure to any single company or industry. Here are three sectors that offer diversification opportunities:

Investing in companies providing industrial automation solutions and manufacturing robots taps into the growing demand for automated production processes.

Investing in companies developing robotic solutions for healthcare offers long-term growth potential as robotics becomes more prevalent in surgical procedures, rehabilitation, and patient care.

Investing in companies involved in autonomous vehicle technology takes advantage of the transformative trend of self-driving cars, offering benefits such as enhanced safety, reduced traffic congestion, and improved fuel efficiency.

By diversifying across these sectors, investors can mitigate risks while positioning themselves to benefit from the continued growth of robotics technology.

Managing Risks and Challenges in Robotics Investing

Investing in robotics brings potential returns but also entails risks and challenges. Market volatility and economic uncertainties can affect stock prices, while technological obsolescence and competition require companies to constantly innovate. Regulatory changes and ethical concerns may impact operations.

To mitigate these risks, diversify your portfolio, stay informed about market trends, and regularly review and rebalance your investments. By being proactive and informed, investors can navigate the dynamic field of robotics with confidence.

Tips for Successful Investing in Robotics Stocks

When investing in robotics stocks, consider these key tips:

- Seek expert advice from professionals specializing in the robotics sector. They can provide valuable insights tailored to your investment goals.

- Stay updated on industry news, trends, and technological advancements to identify emerging opportunities.

- Regularly review and rebalance your robotic investment portfolio to ensure it aligns with your risk tolerance and capitalizes on new opportunities.

Following these tips can increase your chances of success when investing in robotics stocks.

Conclusion

[lyte id=’NIvHjiw6RNg’]