Investing is a way to grow our wealth and secure our financial future. While traditional investment avenues like stocks and real estate are well-known, there are lesser-known options worth exploring. One such avenue that often goes under the radar is investing in cheap royalties.

In this article, we will delve into the world of cheap royalties and explore how they can be a lucrative investment opportunity.

Defining Royalties and Their Importance in Investing

Royalties are payments made to the owner of intellectual property or assets for their use or sale. They can come from sources like music, books, patents, and mineral rights. Buying cheap royalties allows investors to acquire income streams at a discounted price. This strategy offers diversification, long-term income potential, and scalability.

By investing in royalties, individuals can tap into alternative revenue streams and enjoy stable cash flows over time. It’s a smart move for those looking to enhance their portfolios and unlock new opportunities for financial growth.

Highlighting the Benefits of Investing in Cheap Royalties

Investing in cheap royalties offers several advantages. Firstly, it provides an opportunity for high returns on investment. If a royalty asset turns out to be successful or experiences unexpected growth, investors can reap significant profits.

Secondly, cheap royalties often generate passive income, allowing investors to earn money without actively managing the asset themselves.

Additionally, investing in cheap royalties allows for portfolio diversification, reducing risks associated with concentrating investments in one area. These assets also tend to provide stability and security compared to other forms of investment, as they are often derived from established revenue streams.

Moreover, investing in cheap royalties allows individuals to support and participate in creative industries they believe in while potentially benefiting financially. This form of investment is accessible to individuals with varying levels of experience and expertise, making it an enticing option for expanding investment horizons.

In summary, investing in cheap royalties presents a range of advantages including potential for high returns, passive income generation, diversification opportunities, stability, security, and support for creative industries.

Exploring the Potential for High Returns on Investment

Investing in cheap royalties offers the potential for significant returns. By purchasing undervalued royalty assets, investors position themselves for growth and success if the asset performs well in its market.

For example, buying a music royalty from an up-and-coming artist who later becomes a chart-topping sensation could result in substantial returns. Cheap royalties also provide diversification opportunities, spreading risk across different markets and revenue streams.

However, thorough research and due diligence are crucial when evaluating potential opportunities within this space. Overall, exploring the potential for high returns through cheap royalties can be a promising investment strategy.

Discussing the Passive Income Generated by Royalties

Investing in cheap royalties offers the advantage of generating passive income, allowing investors to receive regular payments without actively managing their assets. This passive income stream provides financial stability and freedom, freeing up time for other pursuits.

Additionally, investing in cheap royalties allows for diversification and scalability, spreading risk across different industries. With the potential for long-term growth, investing in cheap royalties presents an attractive opportunity to enhance one’s financial well-being.

Researching Online Marketplaces for Royalty Sales

Investors seeking affordable royalty investments can explore online marketplaces that facilitate buying and selling these assets. Popular platforms like Royalty Exchange, SongVest, and The Rights Marketplace offer advantages and drawbacks worth researching.

Royalty Exchange provides a wide range of royalty assets across industries with auction bidding capabilities. SongVest focuses on music royalties from renowned artists, while The Rights Marketplace specializes in intellectual property rights for books, movies, and more.

Thoroughly comparing these platforms is essential before making an informed investment decision.

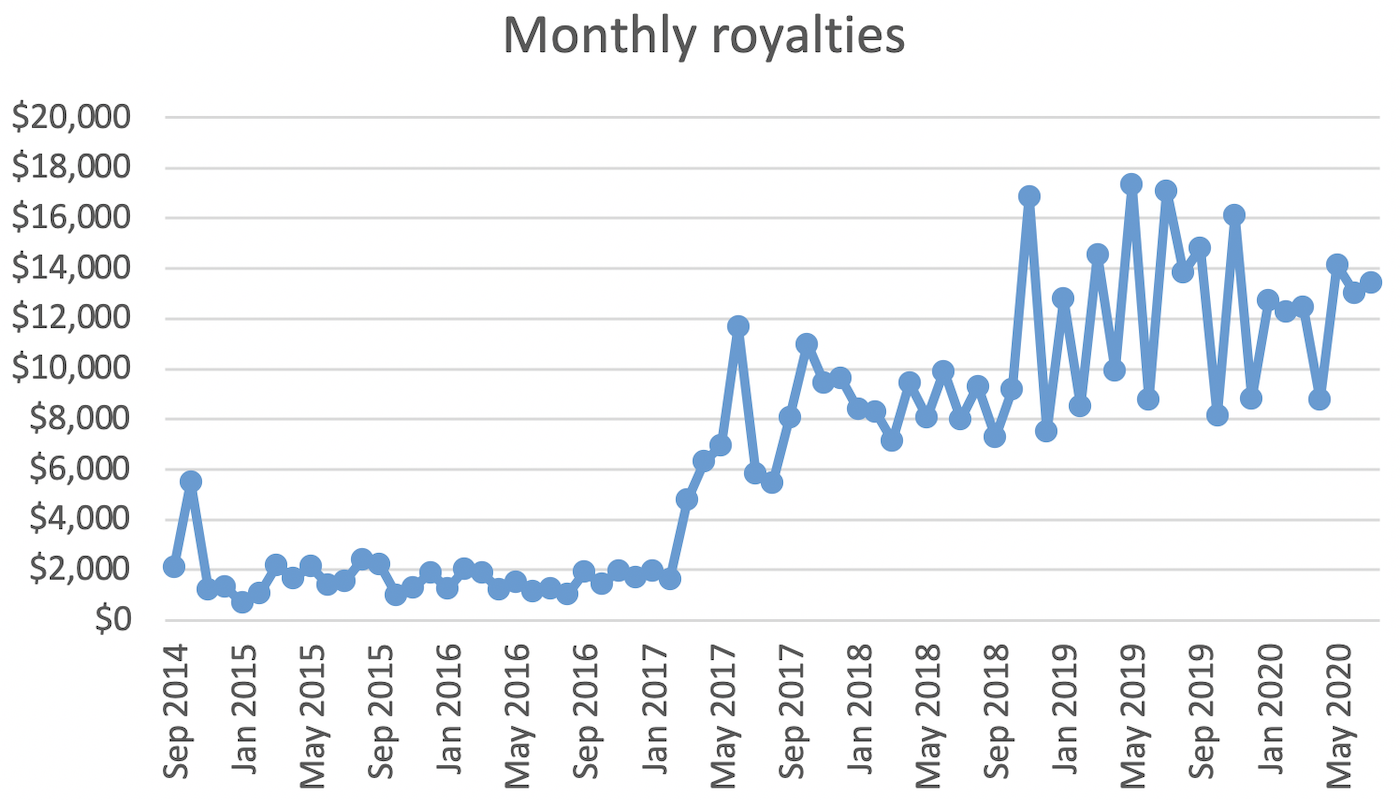

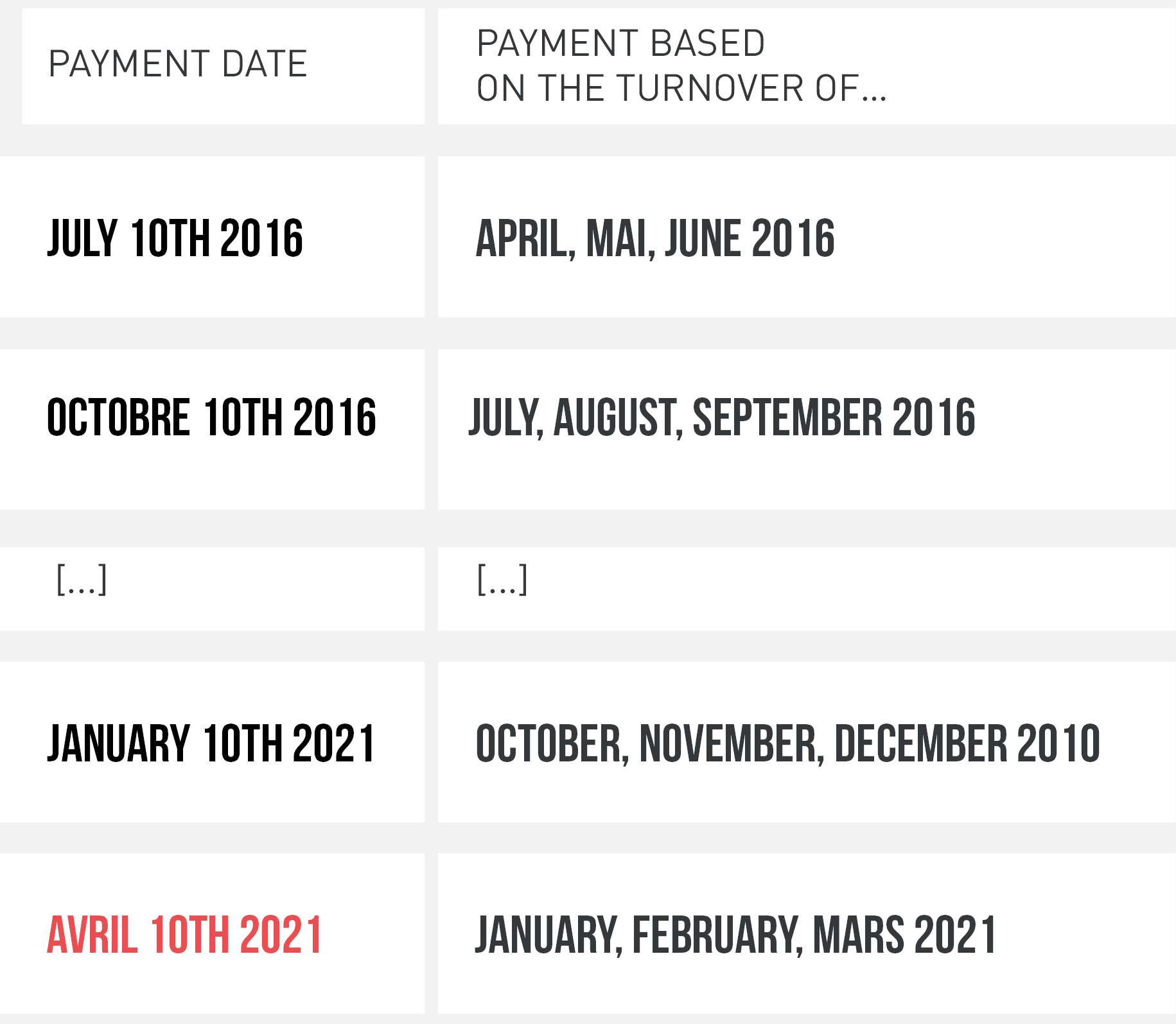

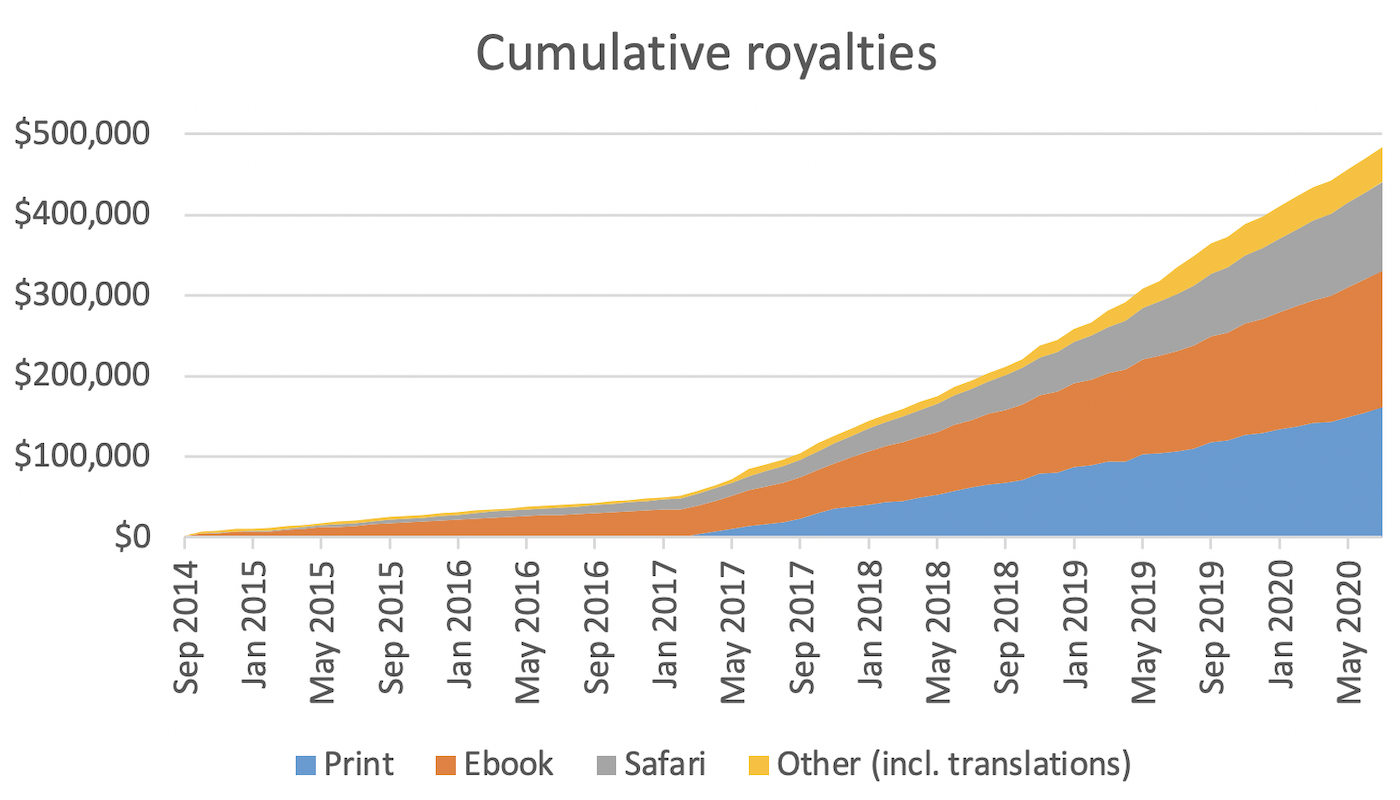

Analyzing Historical Revenue and Growth Trends

When evaluating cheap royalties as potential investments, analyzing their historical revenue and growth trends is crucial. This analysis provides valuable insights into the asset’s earning potential and future prospects.

By studying past performance, investors can identify patterns or trends that indicate opportunities or risks associated with the asset’s future performance.

Factors to consider include consistent revenue growth, a diverse range of income streams, and indications of increasing demand for the underlying intellectual property. These factors suggest higher returns and stability in generating income.

Analyzing historical revenue and growth trends helps investors make informed decisions about cheap royalties by understanding their past performance and assessing their potential for future success.

Conducting Thorough Due Diligence Before Making a Purchase

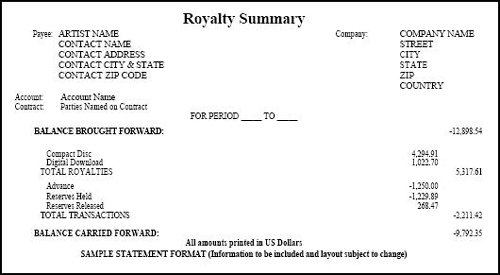

Before investing in cheap royalties, it’s crucial to conduct thorough due diligence to mitigate risks. This involves researching the legal documentation associated with the royalty, reviewing contracts and licenses to uncover any potential liabilities.

Seeking professional assistance from lawyers or financial advisors can also provide valuable guidance throughout the investment process, helping investors navigate complex legalities and assess the true value and risks of cheap royalties.

Success Stories: Real-Life Examples of Profitable Investments through Cheap Royalties

Exploring real-life success stories in investing in cheap royalties can offer insights into maximizing returns. By examining different strategies employed by successful individuals, investors can learn how to identify undervalued assets, negotiate favorable deals, and effectively manage royalty portfolios.

These examples highlight the importance of diligent research and careful analysis before making investment decisions, providing practical knowledge for navigating this potentially lucrative market.

A Story of a Profitable Investment in Undervalued Music Royalty

In the realm of music royalties, one investor stands out for their astute decision to purchase an undervalued asset that later became a chart-topping hit. Recognizing the potential in a relatively unknown artist’s music royalty, they acquired it for a bargain price.

To everyone’s surprise, the artist’s song skyrocketed in popularity worldwide, resulting in significant returns through substantial royalty payments. This success story serves as a testament to the rewards that can come from recognizing hidden opportunities and taking bold action in unconventional investment avenues within the music industry.

[lyte id=’CqyjeEd54rQ’]