Investing in dividend paying stocks can be a lucrative strategy for investors looking to generate a steady stream of income and potentially grow their wealth over time. However, finding cheap dividend paying stocks that offer both attractive dividends and potential for capital appreciation requires careful evaluation.

In this article, we will explore the allure of dividend paying stocks, discuss the benefits of investing in them, and provide insights on how to find cheap dividend paying stocks. We will also present three case studies of cheap dividend paying stocks worth considering.

Finally, we will highlight some risks, considerations, and tips for investing in these stocks.

The Allure of Dividend Paying Stocks

Dividend paying stocks are an appealing investment option for many reasons. These stocks offer a consistent income stream through regular dividend payouts, which can supplement other sources of earnings and help meet financial goals. Companies that pay dividends tend to be more stable and mature, providing stability during market downturns.

Reinvesting dividends can accelerate wealth growth through compounding, allowing investors to increase their overall position over time. Additionally, dividend payments have the potential to keep pace with inflation, ensuring that income maintains its purchasing power.

Overall, dividend paying stocks provide investors with a reliable source of income and the potential for long-term financial stability.

Finding Cheap Dividend Paying Stocks

When looking for cheap dividend paying stocks, it’s crucial to consider their valuation. Valuation involves determining a company’s stock value based on its financial performance and future prospects. By investing in undervalued stocks, you can potentially benefit from both capital appreciation and regular dividend income.

To evaluate dividend stocks for cheapness, consider these key factors:

-

Price-to-Earnings Ratio (P/E Ratio): This ratio compares a company’s stock price to its earnings per share (EPS). A low P/E ratio suggests an undervalued stock with potential for higher earnings.

-

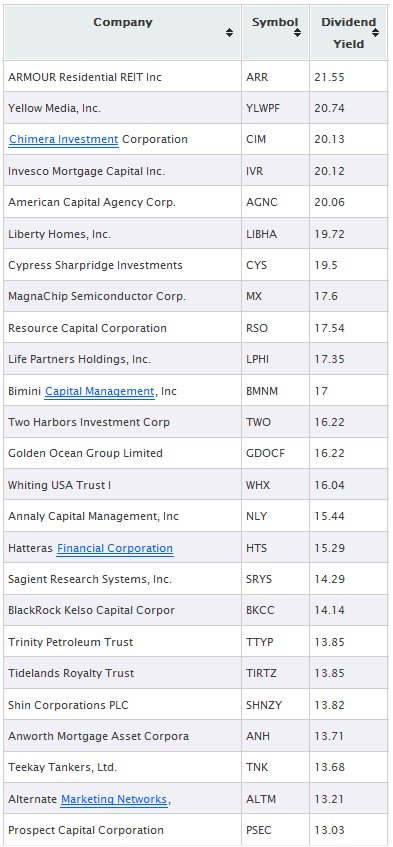

Dividend Yield: This is the annual dividend payment as a percentage of the stock’s current price. A higher dividend yield indicates a relatively cheaper stock in terms of dividends received.

-

Price-to-Book Ratio (P/B Ratio): This ratio compares the stock price to the company’s book value per share. A low P/B ratio suggests an undervalued stock relative to its assets.

-

Debt-to-Equity Ratio: This measures a company’s leverage by comparing total debt to shareholders’ equity. A lower ratio indicates less financial risk and can make a stock more attractive.

-

Free Cash Flow: It represents the cash generated by a company after deducting capital expenditures from operating cash flow. Positive free cash flow is essential for supporting dividends and growth opportunities.

By considering these factors, investors can identify cheap dividend paying stocks with good potential for long-term returns. Thorough research and analysis using these metrics will help make informed investment decisions.

Case Studies: Three Cheap Dividend Paying Stocks Worth Considering

When seeking investment opportunities, it is crucial to consider cheap dividend paying stocks that offer income and growth potential. Here are three examples:

Company X is a well-established technology company with a strong track record of consistently paying dividends, even during challenging market conditions. It has a low P/E ratio compared to its peers, indicating potential undervaluation. Its higher-than-average dividend yield makes it attractive for income-focused investors.

Operating in the healthcare sector, Company Y has promising prospects but remains relatively unknown to many investors. It has a moderate P/B ratio compared to competitors, suggesting potential undervaluation relative to its assets. With a low debt-to-equity ratio, it offers financial stability and lower risk.

Company Z faced temporary setbacks but has taken steps towards recovery, presenting an opportunity for investors to buy at bargain prices. Despite recent challenges, it maintains a reasonable P/E ratio compared to competitors, potentially indicating undervaluation.

Positive free cash flow and manageable debt-to-equity ratio position it well for future growth.

In summary, these three cheap dividend paying stocks—Company X’s consistency and potential undervaluation, Company Y’s overlooked status with high growth potential, and Company Z’s recovery prospects—offer compelling options for investors seeking income and long-term gains.

Thorough analysis of valuation metrics can help identify opportunities aligned with investment goals.

Risks, Considerations, and Tips for Investing in Cheap Dividend Paying Stocks

Investing in cheap dividend-paying stocks carries risks and considerations that should be carefully evaluated. Undervalued stocks can be volatile, so thorough research on financial health and management is essential. Diversifying the portfolio helps mitigate risk, while monitoring dividend sustainability is crucial.

Consulting a financial advisor can provide valuable guidance in navigating the complexities of this investment strategy. By considering these factors, investors can make informed decisions and increase their chances of success in cheap dividend-paying stocks.

Conclusion

[lyte id=’qFHBQOdIBIc’]