Investing in the stock market can be a daunting task, especially for those who are new to the game. With so many variables to consider and countless investment strategies available, it’s easy to feel overwhelmed.

However, with the advent of technology, investors now have access to powerful tools that can help them make informed decisions based on data-driven insights.

One such tool is Chaikin Analytics, a revolutionary platform that has been transforming the way investors approach their investment decisions. In this article, we will explore the various features and benefits of Chaikin Analytics and how it can empower investors to succeed in the world of investing.

Understanding the Limitations of Traditional Investing Approaches

Traditional investing approaches, relying on subjective analysis and gut feelings, are no longer sufficient in today’s data-driven world. Investors need reliable and objective information to make sound decisions.

Emotional biases, lack of systematic frameworks, and the inability to leverage vast amounts of available data are some of the main limitations. To overcome these challenges, investors should embrace more sophisticated strategies that integrate quantitative analysis with human expertise.

By combining data-driven insights with human judgment, better-informed investment decisions can be made for improved outcomes.

Chaikin Analytics: Empowering Investors with Data-Driven Insights

Chaikin Analytics is a game-changing tool that provides investors with accurate and actionable insights into stocks and markets. With its cutting-edge data analytics capabilities, this platform empowers investors to make smarter investment choices based on quantitative analysis.

The user-friendly platform of Chaikin Analytics is designed for both beginners and experienced traders. Here are some steps to get started:

- Sign up for an account: Create an account on the Chaikin Analytics website to access their powerful tools.

- Define your investment goals: Clearly identify your objectives, whether it’s long-term growth or short-term gains.

- Explore stock rankings: Utilize the stock ranking system to quickly identify potentially promising stocks.

- Dive into advanced analytics: Dig deeper into performance metrics using Chaikin’s advanced analytics tools.

- Stay informed with alerts and updates: Receive real-time alerts and updates on stocks in your portfolio or watchlist.

Chaikin Analytics revolutionizes the way investors approach stock analysis by providing accurate data-driven insights. This user-friendly tool levels the playing field, making it a must-have resource for any investor looking to make smarter decisions based on reliable information.

Don’t settle for traditional approaches when you can harness the power of data-driven insights with Chaikin Analytics!

Take control of your investments today!

Signing up and setting up your account on the Chaikin Analytics website

To access all the features and resources offered by Chaikin Analytics, you first need to sign up for an account on their website. The sign-up process is simple and straightforward, requiring only basic information such as your name and email address.

Once you’ve created an account, you can customize your profile settings to tailor the platform to your specific needs.

Chaikin Analytics provides a user-friendly interface, making it easy to navigate through different sections of their website. Their platform caters to investors of all skill levels and offers real-time data on thousands of stocks, including stock ratings, fundamental analysis reports, and news updates.

You can also download their mobile app for on-the-go access.

Signing up with Chaikin Analytics opens up a world of possibilities for enhancing your trading strategies. Take advantage of their intuitive interface and comprehensive resources to elevate your investment journey and stay ahead in the market.

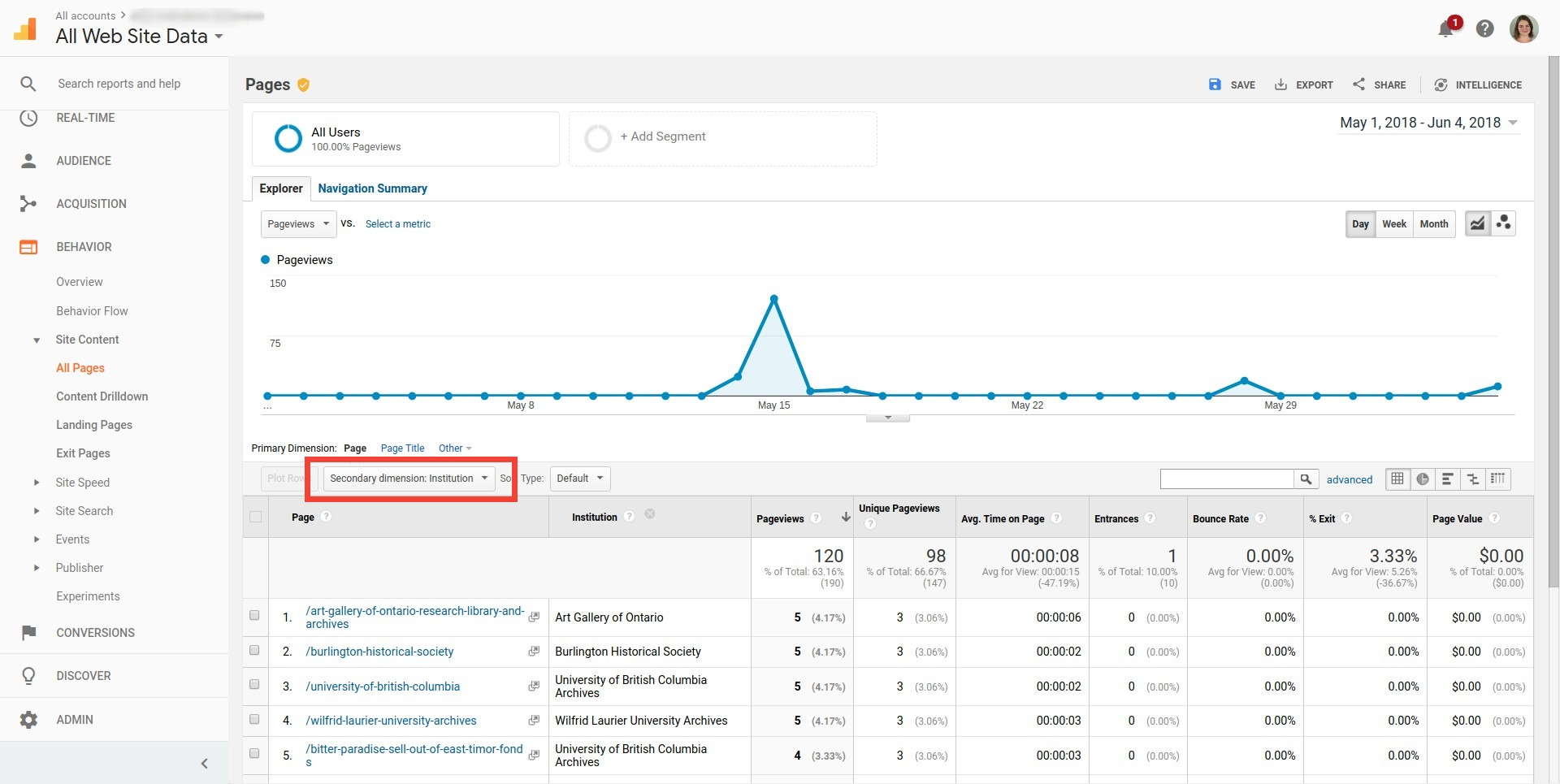

Exploring the Intuitive Interface and User-Friendly Features of the Platform

Once you set up your account on Chaikin Analytics, you’ll discover an intuitive interface with user-friendly features that make navigation a breeze. The platform is designed to be clean and organized, allowing you to easily access different tools and resources for investment analysis.

With its user-friendly design, Chaikin Analytics ensures that even beginners can quickly adapt and understand how to use the platform. Tabs and sections are strategically placed for easy access, whether you’re analyzing stocks, evaluating sectors, or tracking market trends.

One standout feature is the comprehensive toolset available within Chaikin Analytics. Customizable charts with technical indicators, real-time stock quotes, and news updates are all conveniently located in one place. This eliminates the need for multiple applications or websites, saving you time and streamlining your workflow.

Chaikin Analytics also offers educational resources such as webinars, tutorials, and market insights from experts in the field. Whether you’re a seasoned investor or just starting out, these resources provide valuable knowledge to support your decision-making.

Familiarizing Yourself with the Different Tools and Resources Available

Chaikin Analytics provides a wide range of tools and resources for investors at all levels. From educational materials to advanced technical analysis tools, there is something for everyone on this platform. Take the time to explore and familiarize yourself with each section to maximize your investment potential.

One notable feature of Chaikin Analytics is its Power Gauge rating system. This tool evaluates stocks based on multiple data points, providing valuable insights into their strength or weakness. Additionally, the platform offers technical analysis tools for in-depth stock chart analysis and trend identification.

By understanding and utilizing these resources within the Chaikin Analytics platform, you can make more informed investment decisions based on data analysis and increase your chances of success in the market. Explore all that Chaikin Analytics has to offer and unleash the power of informed investing.

Understanding the Power Gauge Rating System and its Significance in Stock Analysis

The Power Gauge rating system evaluates stocks based on fundamental, technical, and sentiment factors. This comprehensive approach provides investors with a well-rounded assessment of a stock’s potential performance. Fundamental analysis considers financial health indicators, while technical analysis examines price patterns.

Sentiment analysis gauges market participants’ opinions. The Power Gauge rating ranges from bullish to bearish, indicating potential outperformance or underperformance. This system is valuable for making informed investment decisions by considering multiple factors simultaneously.

Interpreting and Utilizing the Power Gauge for Informed Investment Decisions

The Power Gauge rating system is a valuable tool for making informed investment decisions. A bullish rating suggests a stock is likely to perform well, while a bearish rating indicates higher risk. By considering the Power Gauge alongside other factors, such as market trends and financials, investors can determine which stocks to buy or sell.

Continuous monitoring and adaptability are key to effectively utilizing this system in the dynamic stock market environment. Ultimately, combining the Power Gauge with comprehensive analysis helps investors make smart choices aligned with their goals and risk tolerance levels.

Exploring Additional Data Metrics and Indicators Provided by Chaikin Analytics

In addition to the Power Gauge rating, Chaikin Analytics offers a wide range of data metrics and indicators that enhance investment analysis. These include earnings estimates, insider trading activity, and various technical indicators. By exploring these metrics, investors gain deeper insights into stocks and make more informed decisions.

Earnings estimates help assess future profitability, while insider trading activity reveals confidence levels. Technical indicators aid in price trend analysis and trade signals. With access to this wealth of information, investors can refine their strategies and maximize their chances of success in the market.

[lyte id=’rOChU2rxf1s’]