Investing in the right asset can be a game-changer for your financial future. While traditional investment options like stocks and real estate may seem like obvious choices, there’s a hidden gem that has been quietly gaining traction in the investment world – cell tower ownership.

With the ever-increasing demand for reliable network coverage, cell towers have become an essential part of our modern infrastructure. In this article, we’ll explore the lucrative world of cell tower ownership and provide valuable insights to help you make informed investment decisions.

Understanding the Growing Importance of Cell Towers

Cell towers play a vital role in ensuring seamless communication and internet access. In today’s digital age, uninterrupted connectivity has become paramount in our day-to-day lives. As more people rely on their smartphones for communication, entertainment, and business purposes, the need for strong network coverage has skyrocketed.

The evolution of telecommunications technology has also contributed to the growing importance of cell towers. With advancements in mobile devices and wireless technology, our reliance on cellular networks has only increased. Cell towers provide the necessary infrastructure for mobile networks to deliver consistent and high-quality service.

Investors have recognized the significant opportunity presented by the growing importance of cell towers. With more people relying on their smartphones for various aspects of their lives, investing in cell tower infrastructure can be highly lucrative.

As we continue to rely heavily on our mobile devices, cell towers ensure that we stay connected in an increasingly digital and mobile-driven society.

Unveiling the Lucrative World of Cell Tower Ownership

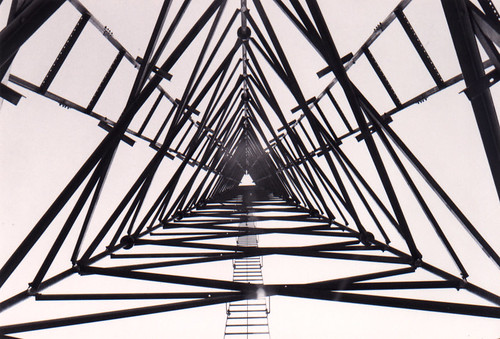

Cell tower ownership is a fascinating and potentially profitable venture that involves owning or leasing land where cell towers are erected. As a cell tower owner, your role is crucial in facilitating seamless communication by providing space for wireless carriers to install their equipment and antennas on your property.

One of the primary responsibilities of a cell tower owner is to maintain the structural integrity of the tower. This includes regular inspections and necessary repairs to ensure that the tower remains safe and reliable.

Additionally, you must comply with various regulations imposed by local authorities and industry standards to guarantee the smooth functioning of the cell tower.

Negotiating lease agreements with wireless carriers is another crucial aspect of being a cell tower owner. These agreements typically span several years, during which the carrier pays rent to the tower owner for using their land and equipment space. This steady stream of rental income forms the backbone of a cell tower investment’s profitability.

The revenue model for cell tower ownership revolves around these lease agreements and rent payments. The financial potential can be highly lucrative, especially considering that multiple carriers may utilize your property simultaneously. Each carrier pays rent based on factors such as location, demand, and coverage area.

To maximize profitability, it’s essential to understand market trends and negotiate favorable terms in lease agreements. As technology advances, wireless carriers constantly seek new locations for their towers, presenting opportunities for owners to capitalize on increasing demand.

Becoming a Savvy Investor: Factors to Consider Before Diving In

Investing in cell tower ownership requires careful consideration of market research, trends analysis, and risk evaluation. Thoroughly researching high-demand locations for new tower installations will guide your investment decisions. Analyzing current market trends and future projections helps you stay ahead of the curve and maximize returns.

Evaluating potential risks such as regulatory hurdles and competition is essential before committing to this investment opportunity. By considering these factors, you can become a savvy investor in cell tower ownership.

Taking the Plunge: How to Start Investing in Cell Towers

Investing in cell towers can be a lucrative venture, but it’s important to understand the fundamentals before diving in. There are two primary strategies: buying existing cell tower leases or purchasing land for new tower construction. Each has its pros and cons, so careful consideration is necessary.

Seeking guidance from industry experts, such as real estate agents and attorneys familiar with wireless communications law, is crucial for making informed decisions. By evaluating your goals and risk tolerance and getting professional advice, you can confidently enter this profitable industry.

Learning from Success Stories: Inspiring Case Studies

Real-life success stories in cell tower ownership provide valuable insights into the potential rewards and strategies employed by individuals in this industry. For instance, John, an astute investor, overcame zoning challenges and regulatory approvals to successfully erect a tower on his land.

His leasing arrangements with wireless carriers generated significant financial rewards. On the other hand, Mary opted to purchase existing cell tower leases and negotiate favorable agreements, resulting in consistent rental income and portfolio expansion.

These case studies demonstrate that dedication, perseverance, and informed decision-making can lead to success in the cell tower industry.

The Future of Cell Tower Ownership: Trends and Opportunities

The future of cell tower ownership looks promising as technology advances. Two key trends to watch are the adoption of 5G technology and the rise of small cells and distributed antenna systems (DAS). These trends offer new opportunities for investors who can adapt to changing market dynamics.

With 5G technology, cell tower demand will surge as telecommunication companies strive to provide fast and seamless coverage. Owners will need to upgrade infrastructure or strategically build new towers to optimize network performance.

Small cells and DAS are reshaping the landscape by enhancing network capacity in crowded areas like stadiums and city centers. Investing in these technologies allows owners to tap into revenue-sharing agreements with telecom operators and diversify their assets.

Overview of Top Cell Tower Companies in the United States

In the United States, a few dominant companies lead the cell tower industry. American Tower, Crown Castle, and SBA Communications are among the top players in this rapidly expanding sector.

American Tower boasts an extensive portfolio of over 40,000 towers across all 50 states, providing essential infrastructure for wireless communication. Crown Castle focuses on urban areas, capitalizing on the increasing demand for connectivity in densely populated regions.

With around 30,000 towers nationwide, SBA Communications serves both rural and urban areas efficiently.

These companies not only own traditional cell towers but also invest in digital infrastructure such as small cells, distributed antenna systems (DAS), and fiber optic networks. This diversification allows them to meet evolving communication needs and stay ahead technologically.

With their broad networks and investments in digital infrastructure, American Tower, Crown Castle, and SBA Communications are key players shaping the future of telecommunications in the United States.

[lyte id=’bJCG2BdPq48′]