The fight against climate change has become a global priority, and one of the key strategies in reducing carbon emissions is through the use of carbon credits. These credits provide a financial incentive for companies to reduce their greenhouse gas emissions and invest in cleaner technologies.

But did you know that there is a growing market for investing in carbon credit royalties? In this article, we will explore the concept of carbon credits, the emergence of carbon credit royalty companies, and how investors can participate in this exciting new sector.

Understanding Carbon Credit Royalties

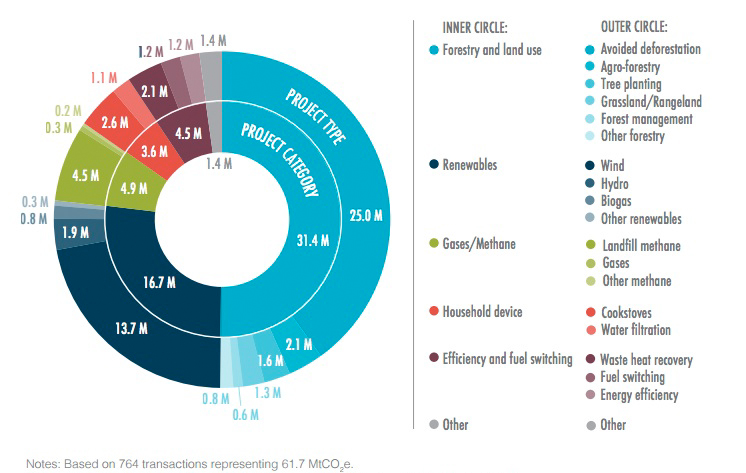

Carbon credit royalties act as intermediaries between investors and environmental projects in the market of carbon credits. These companies invest in projects that generate carbon credits, such as renewable energy initiatives or reforestation efforts, and receive a share of the revenue from selling these credits.

Investing in carbon credit royalties offers diversification for investors while supporting sustainable initiatives. Environmental projects benefit from funding, allowing them to continue reducing greenhouse gas emissions.

One case study involved financing a wind farm in a developing country, providing attractive returns for investors and contributing to clean energy generation. Overall, carbon credit royalties play a crucial role by connecting investors with projects that have positive environmental outcomes.

Investing in Carbon Credit Royalty Companies

Investing in carbon credit royalty companies requires thorough due diligence. Look for reputable companies with a track record of successful projects and a commitment to environmental sustainability. Assess the potential returns and risks associated with these investments.

Diversify your portfolio to spread risks across different projects and sectors. By investing in carbon credit royalties, you not only gain attractive financial returns but also contribute to the fight against climate change. Align your investments with global sustainability efforts for a more sustainable future.

Real-Life Success Stories from Investors

Investing in carbon credit royalties has proven to be a rewarding venture for environmentally conscious individuals. One investor, Jane Thompson, saw financial returns and witnessed the positive impact of reforestation efforts on biodiversity and carbon emissions reduction.

Another success story comes from Mark Davis, who supported renewable energy projects and benefited financially while contributing to combating climate change. These stories highlight how investing in carbon credit royalties aligns values with investment strategies, creating both personal fulfillment and financial prosperity.

However, thorough research and expert consultation are essential before embarking on such investments. These success stories inspire individuals to make a tangible difference in mitigating climate change and preserving our environment through their investment choices.

Navigating the Challenges of Carbon Credit Royalties

Investing in carbon credit royalties comes with its fair share of challenges. Ensuring transparency and credibility within the market can be a hurdle, as some projects may overstate their impact or fail to deliver on promises. Thorough due diligence is essential before making any investment decisions.

The complex regulatory landscape surrounding carbon credits adds another layer of difficulty. Different countries have varying regulations and standards for issuing and trading credits. Staying informed and working with reputable companies can help mitigate these challenges.

Finding reliable information about projects can be daunting, considering the multitude available. Evaluating project documentation, assessing developer credibility, and understanding credit calculation methodologies are crucial steps for investors.

Pricing volatility is also a challenge. Fluctuations in carbon credit values based on market demand, policy changes, and external factors require careful consideration for long-term trends.

Finally, liquidity challenges may arise when buying or selling credits due to limited participants or trading platforms.

To navigate these challenges successfully, gather detailed information about projects, stay updated on regulations, work with reputable companies, and assess risks diligently before investing in carbon credit royalties.

The Future Outlook for Carbon Credit Royalties

The future of carbon credit royalties looks promising as the world prioritizes sustainability and fights climate change. With a growing demand for carbon credits, this industry offers exciting opportunities for long-term investments.

Experts predict that the sector will continue to evolve with new technologies and projects emerging. As governments set stricter emission reduction targets and regulations, the demand for carbon credits is expected to skyrocket.

Advancements in technology, such as blockchain, are revolutionizing how carbon credits are generated and traded, making transactions more transparent and secure.

Investors can diversify their portfolios by supporting renewable energy development, forestry conservation initiatives, and sustainable agriculture practices. By investing in carbon credit royalties, they can make a positive impact while generating returns.

In summary, the future outlook for carbon credit royalties is bright due to increasing global awareness of the need to offset carbon footprints. Investing in this sector offers both financial rewards and the opportunity to contribute to a greener future.

How to Get Started with Carbon Credit Royalties

If you’re interested in exploring the world of carbon credit royalties, there are several essential steps you can take to begin your journey. It’s crucial to first educate yourself about the market and gain a solid understanding of the basics of carbon credits.

By doing thorough research, you can identify reputable companies that specialize in this sector and have a proven track record of successful projects.

To streamline the process, various platforms and resources exist that connect investors with reputable carbon credit royalty companies. These platforms provide transparency and facilitate due diligence before making any investment decisions.

It’s advisable to leverage these resources as they allow you to access detailed information about potential investments and assess their viability.

Another valuable approach is to collaborate with experienced professionals who specialize in the field of carbon credit royalties. Their expertise can provide you with valuable guidance and insights throughout your investment journey.

They understand the intricacies of this unique market and can help navigate any challenges or uncertainties that may arise.

As you embark on your exploration of carbon credit royalties, it’s important to keep in mind that this industry holds immense potential for both environmental impact and financial gain.

By investing in projects that reduce greenhouse gas emissions, you contribute to combating climate change while also potentially earning attractive returns on your investment.

In summary, getting started with carbon credit royalties involves educating yourself about the market, researching reputable companies, leveraging dedicated platforms for due diligence, and seeking guidance from experienced professionals.

Embracing this sustainable investment opportunity not only aligns with the environmental goals of reducing emissions but also opens avenues for financial growth.

Conclusion: Investing in a Greener Future

Investing in carbon credit royalties offers attractive returns while supporting environmental sustainability. By understanding carbon credits, diversifying your portfolio, and navigating challenges, you can participate in this emerging market.

[lyte id=’Y0MLefq_Dco’]